[ad_1]

KEY POINTS:

Recommended by Zain Vawda

Get Your Free JPY Forecast

Most Read: Dollar and Risk Asset Reversals Throw Off Anticipation of Major Tend Developments

USD/JPY FUNDAMENTAL BACKDROP

USD/JPY continued its advance in the Asian session before a modest pullback as the European session began pushed the pair below the 137.00 handle. Yesterday saw the Dollar record its biggest daily gain against the Yen since June 17 as the Dollar index staged a recovery.

The US dollar index bounced yesterday as US ISM data beat estimates continuing a trend which seems to be at odds with the Federal Reserve’s recent dovish tilt. The recent batch of data out of the US suggests market participants may be premature in their assessment of a slowdown in inflation as well as rate hikes. Following yesterday’s data markets are once again pricing in a Fed funds peak rate above 5% for 2023.

Recommended by Zain Vawda

How to Trade USD/JPY

Bank of Japan Governor Kuroda didn’t help the Yen overnight with dovish comments regarding the prospect of a pivot from the countries ‘easy monetary policy’ stance. Governor Kuroda brushed aside any chance of a pivot stating that “the BoJ is seeking to sustainably and stably achieve its 2% inflation target accompanied by wage growth. Our view is that this will likely take more time.” The Governor has discussed wage growth in the past stating that he would like to see wage growth surpass inflation before he will be open to discuss a policy shift. Governor Kuroda’s comments no doubt end any hope of a policy pivot before his term ends in April.

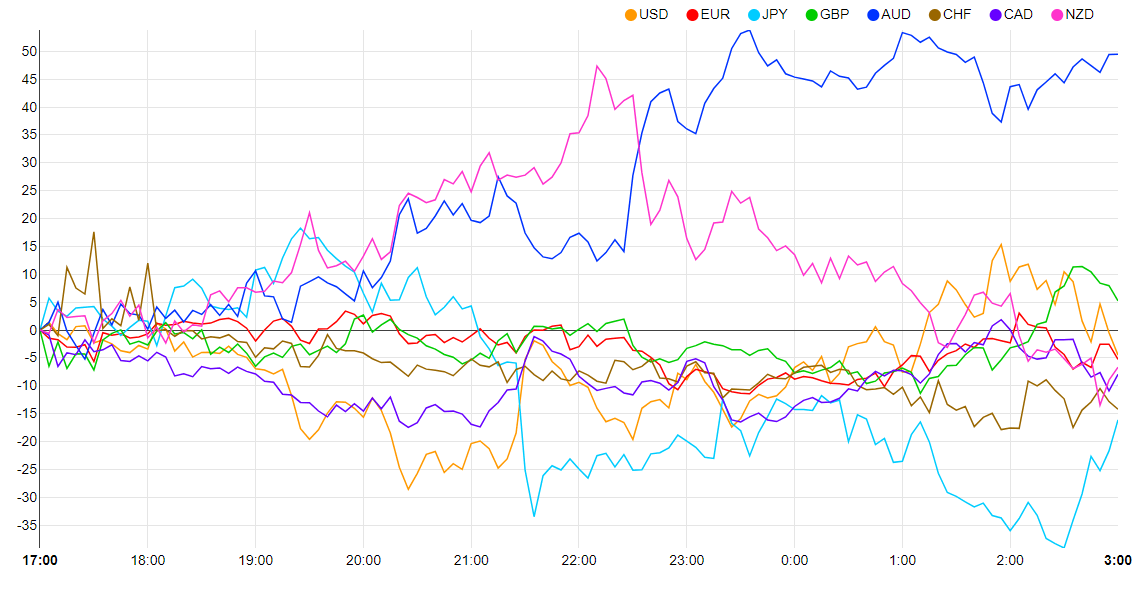

Currency Strength Chart

Source: FinancialJuice

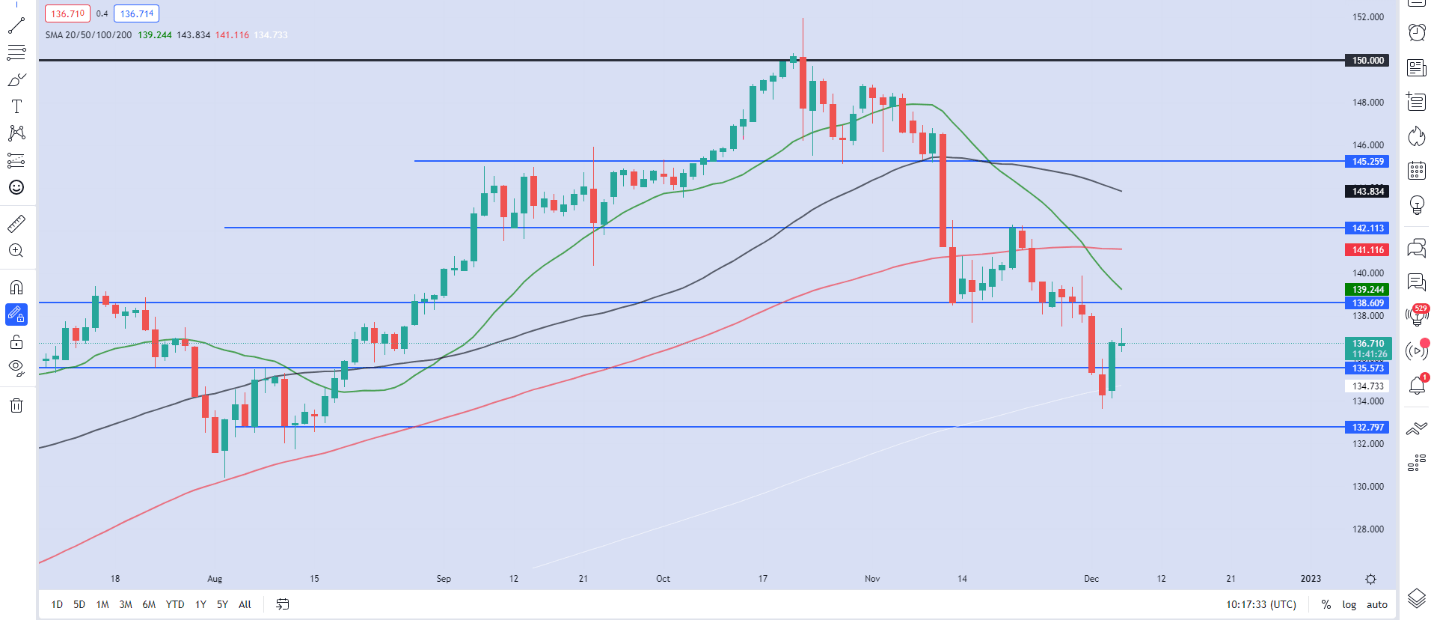

From a technical perspective, USD/JPY printed has printed a morning star candlestick pattern after bouncing off the 200-day MA hinting at further upside. Immediate resistance rests around the 138.50 area with a break above opening up a test of the psychological 140.00 level. A return of dollar weakness later in the day could result in a test of support around 135.50 before recent lows come into play at the 133.50 area. There remains a lack of significant data today, so any move is likely to be driven by the dollar index and its ability to sustain its recovery.

USD/JPY Daily Chart – December 6, 2022

Source: TradingView

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently SHORT on USD/JPY, with 54% of traders currently holding short positions. At DailyFX we typically take a contrarian view to crowd sentiment, and the fact that traders are short suggests that USD/JPY may continue rise.

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]