[ad_1]

US DOLLAR FORECAST:

- U.S. dollar inches modestly higher after U.S. consumer price index data tops estimates

- January headline inflation clocks in at 6.4% y-o-y, core CPI at 5.6% y-o-y

- This article looks at EUR/USD and USD/JPY ‘s key technical levels to monitor in the near term

Recommended by Diego Colman

Get Your Free USD Forecast

Most Read: Which Way for S&P 500 and Nasdaq 100 Index After US CPI Data?

The U.S. dollar, as measured by the DXY Index, exhibited volatilty after U.S. inflation data crossed the wires, seeking direction as bulls and bears engaged in a hard-fought tug of war. While the greenback took a dive in a knee-jerk reaction, it ultimately managed to erase losses and climbed into positive territory as Treasury yields, especially those at the front end made a run higher (DXY up +0.10% to 103.41 at the time of writing.

WHAT’S BEHIND MARKET MOVES?

The U.S. Bureau of Labor Statistics (BLS) released this morning its latest inflation report. According to the agency, the consumer price index rose 0.5% on a seasonally adjusted basis, bringing the annual rate to 6.4% from 6.5%, two-tenths above consensus estimates. For its part, the core gauge, which excludes food and energy expenditures, clocked in at 0.5% m-o-m and 5.6% in the last 12 months, slightly above forecasts.

US INFLATION DATA AT A GLANCE

Source: DailyFX Calendar

While the upside surprise was disappointing and may embolden market hawks to push for more Fed hikes, it is important to note that not everything was negative this morning’s report. For instance, shelter, a lagging indicator, accounted for nearly half of the CPI gain, after jumping 0.7% m-o-m. If real-time numbers on housing metrics were included instead, this category would be in disinflation by now, suggesting that current figures may be misleading about price trends.

Recommended by Diego Colman

Trading Forex News: The Strategy

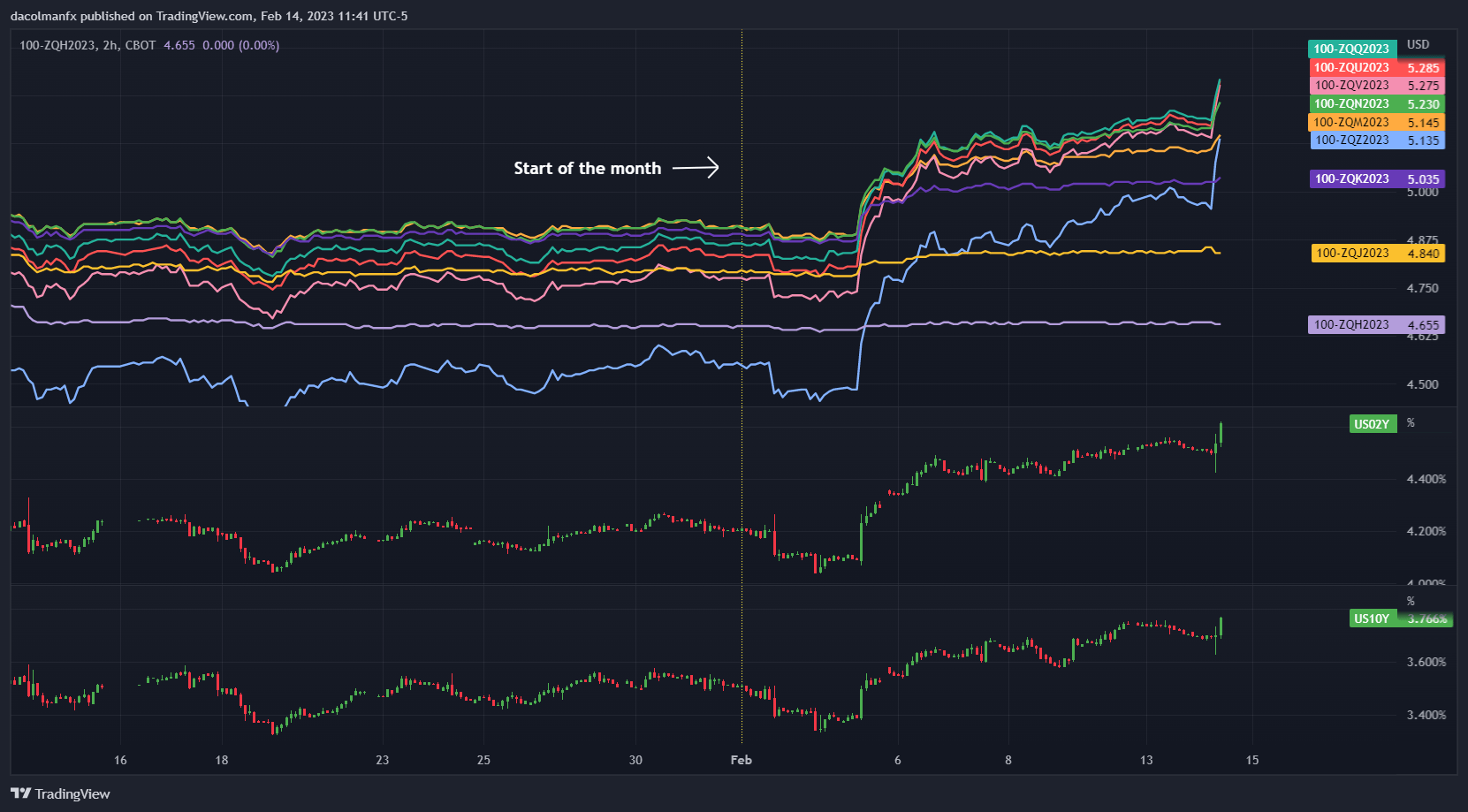

FED FUTURES IMPLIED YIELD AND US TREASURY RATES

Source: TradingView

Taken together, today’s data may be slightly bullish for the U.S. dollar, though probably insufficient to alter the risks around the Fed’s policy outlook or lead traders to reprice significantly higher the FOMC terminal rate on a sustained basis. That said, the U.S. currency may retain some support in the coming days but will need additional catalysts to extend its recovery over a longer-term horizon, especially if sentiment stays buoyant.

Recommended by Diego Colman

Get Your Free EUR Forecast

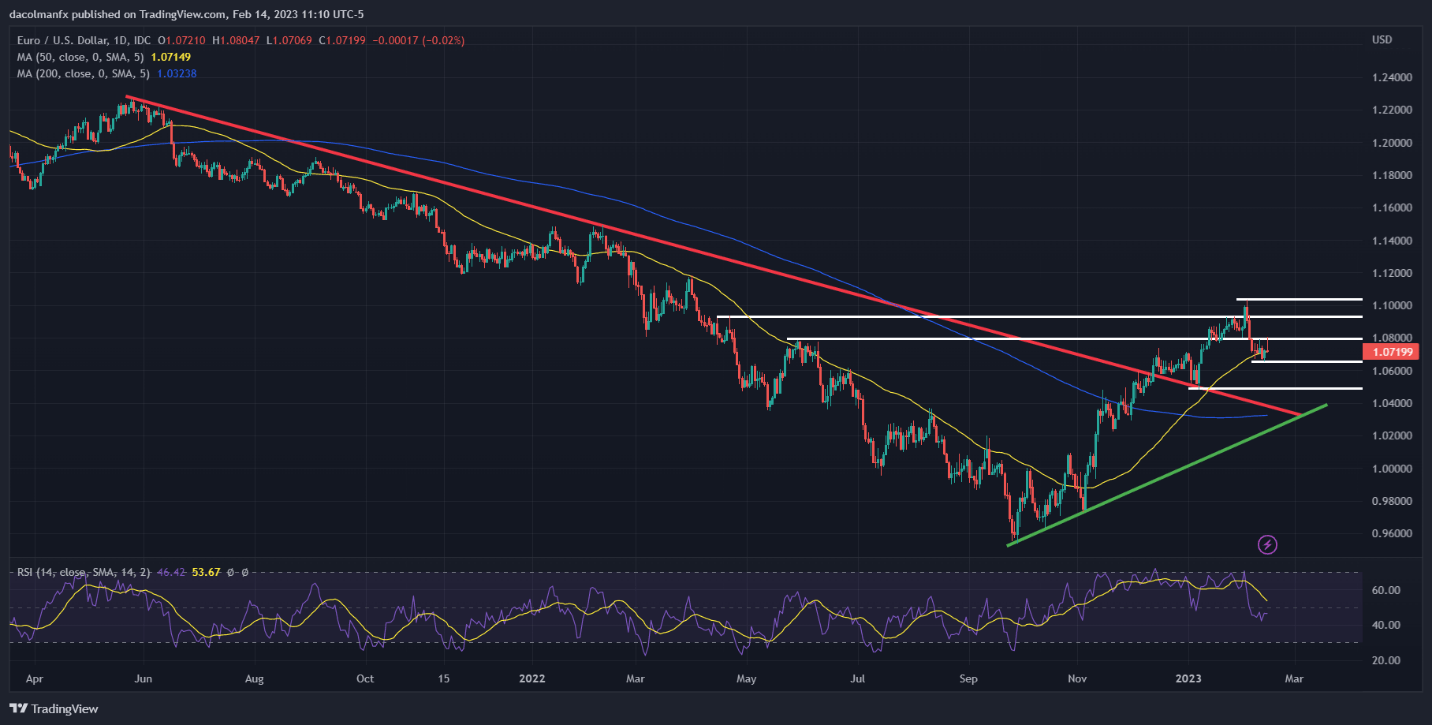

EUR/USD TECHNICAL ANALYSIS

EUR/USD is still in a consolidation phase, stuck between resistance at ~1.0800 and support at ~1.0650. For the pair to take a decisive directional cue, prices need to break out of this range. That said, if the consolidation resolves to the upside, we could see a move towards 1.0935, followed by a retest of the 2023 high. On the other hand, if technical support at 1.0650 is breached on the downside, the selling momentum could accelerate, paving the way for a fall towards 1.0495.

EUR/USD TECHNICAL CHART

EUR/USD Technical Chart Prepared Using TradingView

Recommended by Diego Colman

Get Your Free JPY Forecast

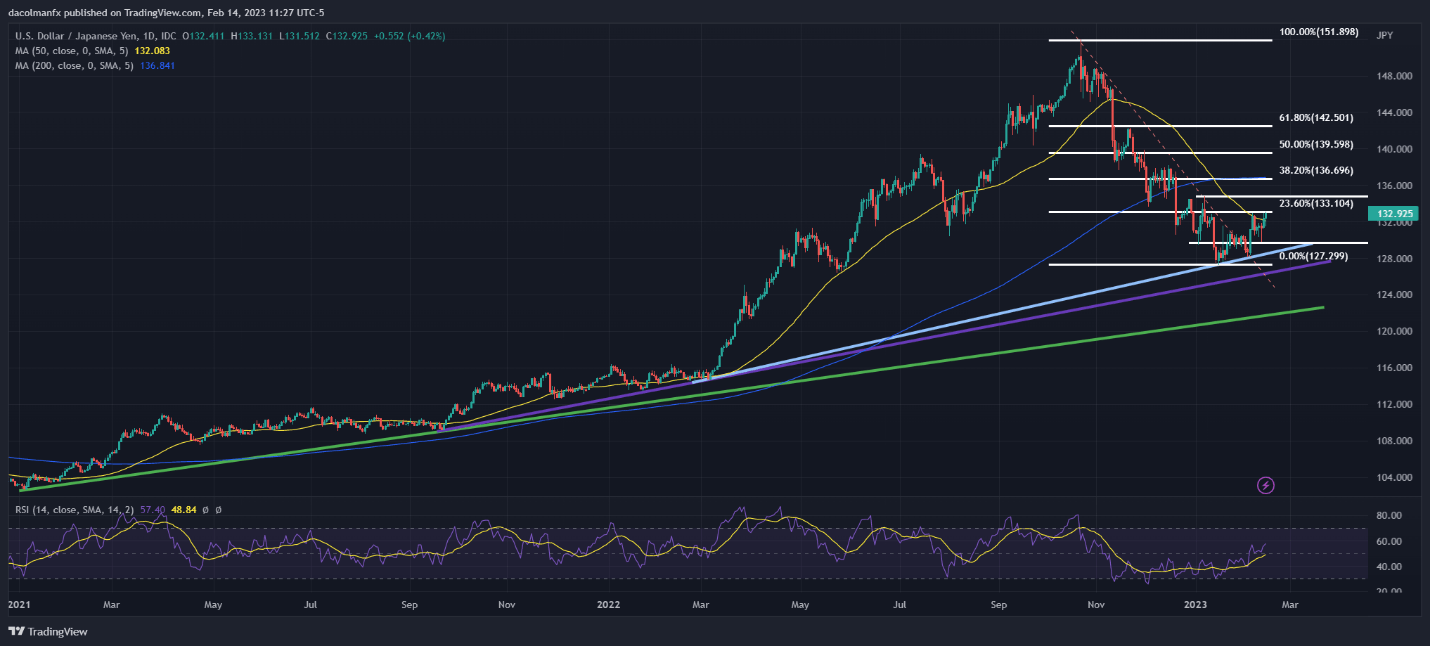

USD/JPY TECHNICAL ANALYSIS

After the recent bounce, USD/JPY is now approaching resistance near 133.10. If bulls manage to drive the exchange rate above this barrier, upside impetus could gather strength, allowing buyers to launch an attack on 134.90, followed by 136.70, the 38.2% retracement of the October 2022-January 2023 decline. Conversely, if sellers return and trigger a bearish pullback, initial support appears at 129.70 and then 128.50, a floor created by a short-term rising trendline in play since February 2022.

USD/JPY TECHNICAL CHART

[ad_2]