[ad_1]

GBP/USD – Prices, Charts, and Analysis

- US dollar strength is forcing GBP/USD back towards multi-month lows.

- UK data may empower the MPC doves, leaving Sterling vulnerable.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

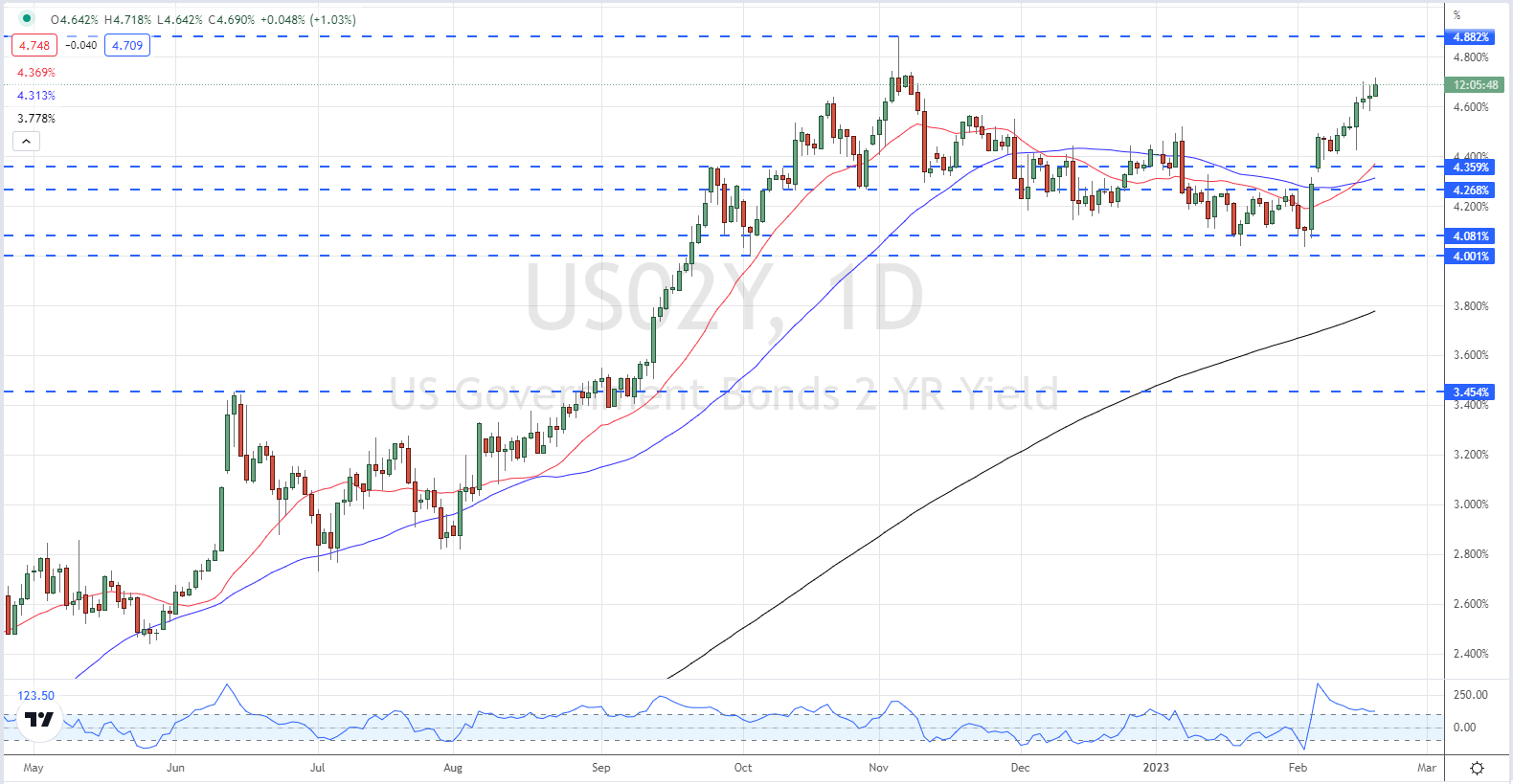

The US dollar continues to flex its muscles across a range of currency pairs, powered by further hawkish Fed rhetoric and rising US Treasury yields. Yesterday both St. Louis President James Bullard and Cleveland Fed President Loretta Mester said that a 50 basis point rate hike at the next FOMC meeting should not be taken off the table. Yesterday’s comments were the latest in a line of hawkish Fed commentary and underlined the Fed’s intent to battle inflation aggressively. US Treasury yields rose further, with the rate-sensitive 2-year printing a fresh multi-month high of 4.72%, while the latest Fed Fund terminal rate reading rose to 5.30%.

US Treasury 2-Year Yield – February 17, 2023

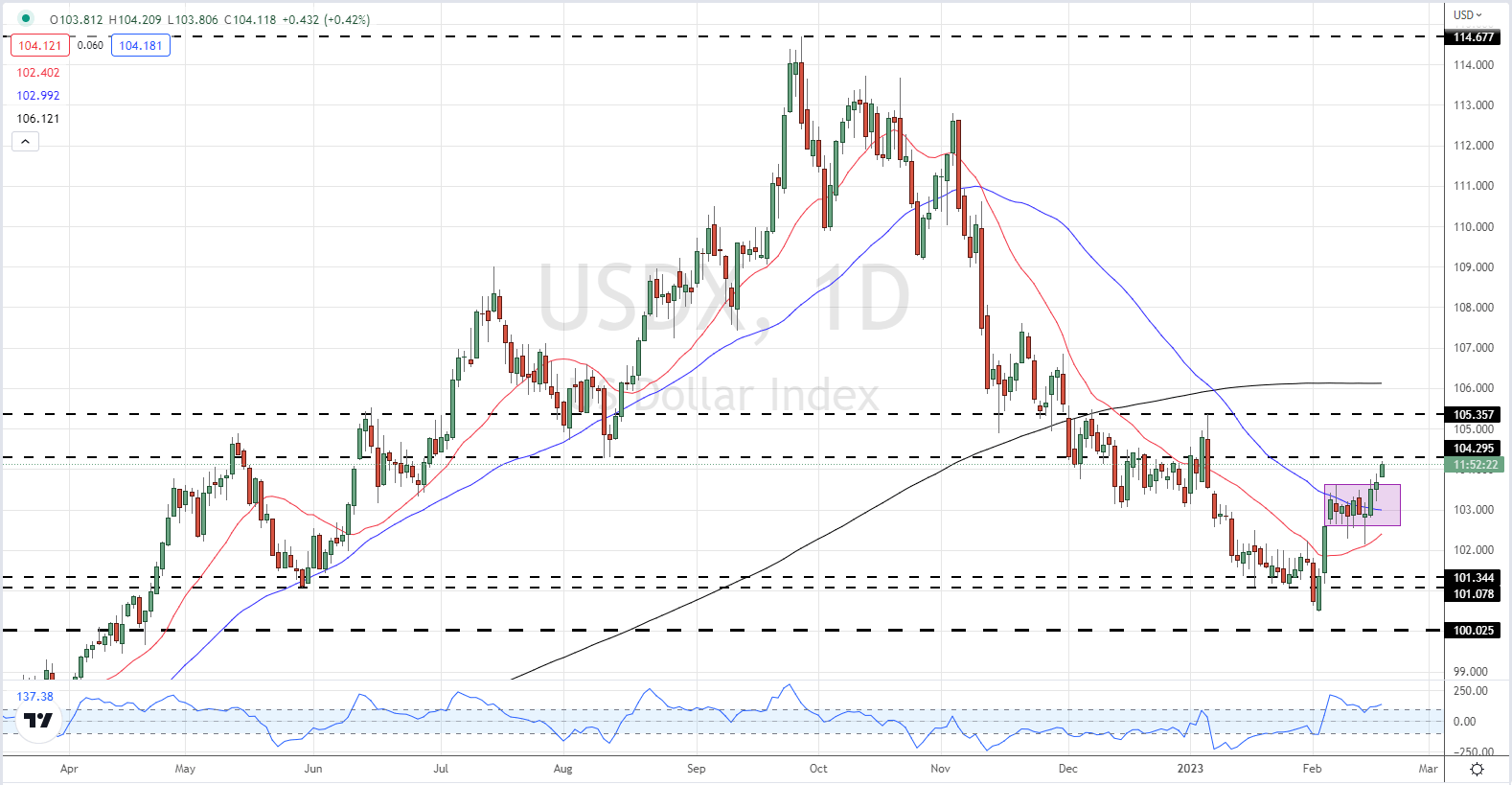

The US dollar index (DXY) moved higher in response to the latest round of hawkish Fed chatter and the ongoing re-pricing in the US bond market. The greenback is now posting fresh six-week highs and has broken the recent bullish flag set-up.

US Dollar Index (DXY) Daily Chart – February 17, 2023

Recommended by Nick Cawley

How to Trade GBP/USD

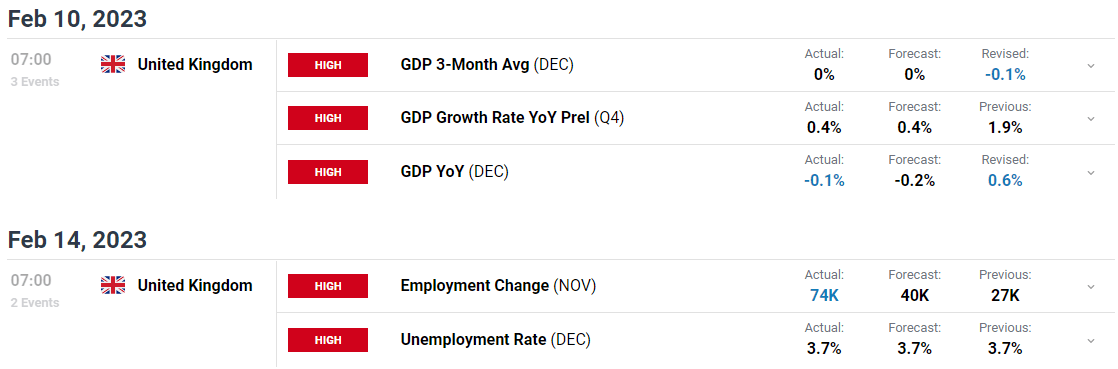

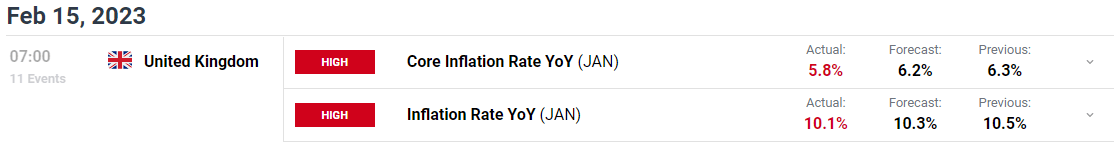

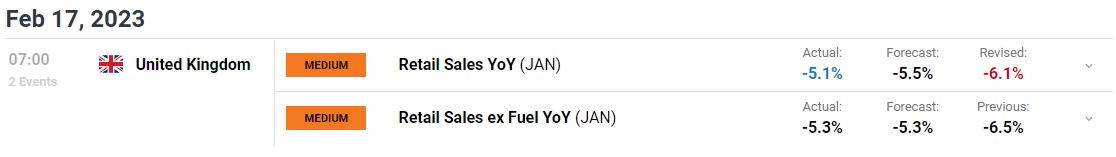

While the US dollar remains the primary driver of the move lower in GBP/USD, recent economic data suggests that the Bank of England (BoE) may become slightly less aggressive when deciding on the future path of UK interest rates. Growth in the UK has flatlined, the jobs market remains strong, retail sales remain poor but marginally better-than-forecast, while core inflation is falling. The BoE may decide that UK interest rates are starting to work and that they should be wary of making interest rates too restrictive. The UK Bank Rate, currently at 4%, is now seen topping out at 4.5% with a potential rate cut at the December meeting now starting to be priced in.

For all market-moving data releases and events, see the DailyFX Economic Calendar

The British Pound may get a marginal boost in the coming days if market talk of an impending Brexit deal proves correct. UK PM Rishi Sunak is said to be in talks with the EU over an imminent deal on the Northern Ireland protocol, although the role of the European Court of Justice remains a stumbling block.

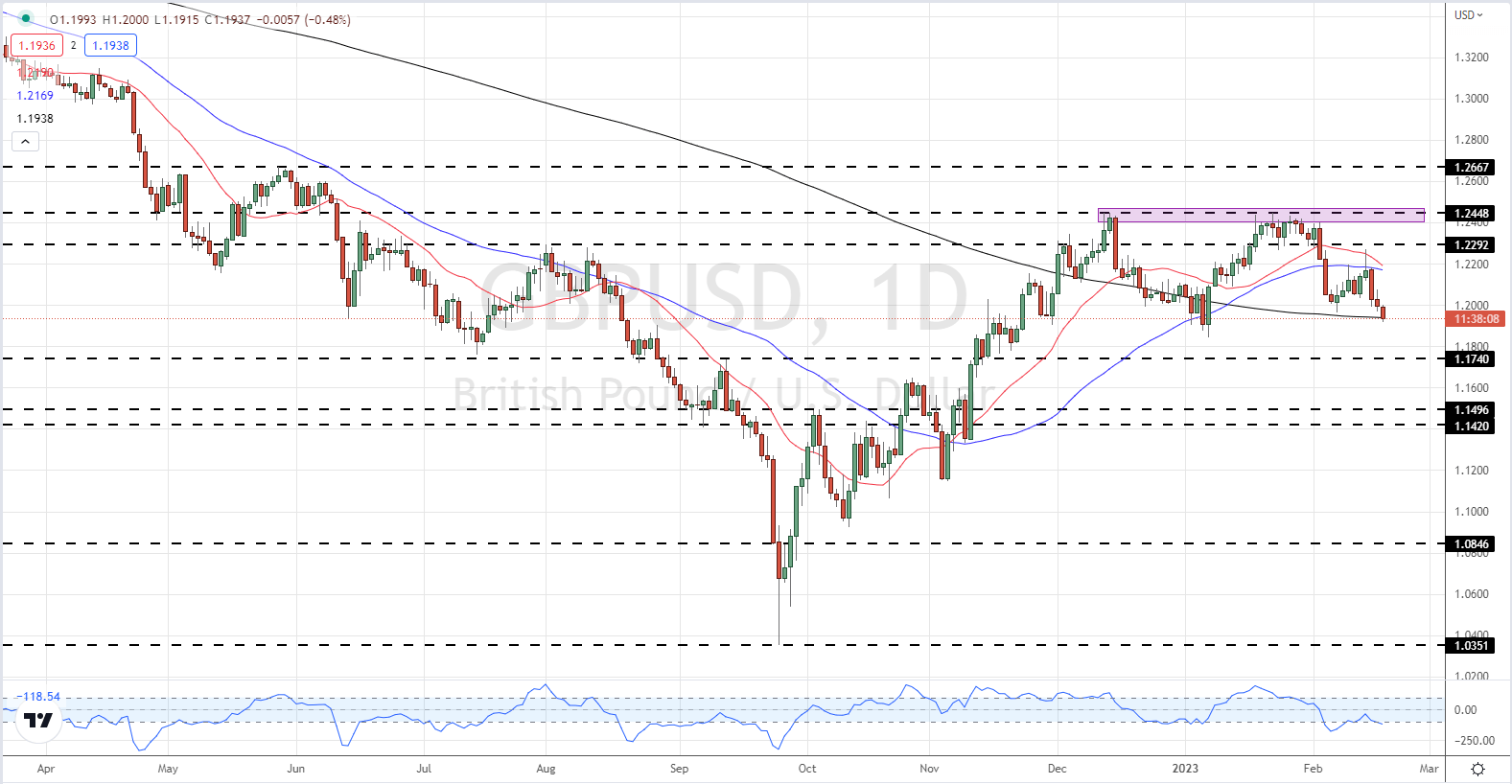

Cable remains weak and is currently at levels last seen in early January. The pair has broken below both the 20- and 50-day moving averages this week and are testing the longer-dated 200-dma. Big figure support at 1.1900 may soon be tested, leaving the January 6 low print at 1.1842 as the next target.

GBP/USD Daily Price Chart – February 17, 2023

All Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 7% | -7% | 1% |

| Weekly | 17% | -8% | 6% |

Retail Traders Increase Their Net Long Positions

Retail trader data show 61.23% of traders are net-long with the ratio of traders long to short at 1.58 to 1.The number of traders net-long is 3.03% higher than yesterday and 14.53% higher from last week, while the number of traders net-short is 4.13% lower than yesterday and 6.26% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]