[ad_1]

USD/JPY PRICES, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free JPY Forecast

Most Read: USD Breaking News: US Dollar Index (DXY) Retreats as Durable Goods Data Disappoints

USD/JPY FUNDAMENTAL BACKDROP

USD/JPY continued higher today printing a fresh high of 136.86 following signs yesterday that we may be in for a deeper retracement. Yesterday’s pause came about following a slight pullback in the dollar index facilitated by lackluster durable goods data out of the US.

Recent comments from the incoming BoJ Deputy Governor Shinichi Uchida as well as current frontrunner for the BoJ Governor post Kazuo Ueda both struck a dovish tone in testimony before the Japanese Parliament’s Upper House. Ueda confirmed his intention to stick to ‘Abenomics’ and defending the central bank’s monetary policy stance. The current Deputy BoJ Governor Masazumi Wakatabe recently said: “Central Banks must remain on guard against the potential dangers of secular stagnation, and low inflation as price rises driven by cost-push factors do not last long.” These comments have seemingly put an end to speculation that incoming BoJ leadership will alter the Central Banks policy while at the same time keeping the yen under pressure against the greenback.

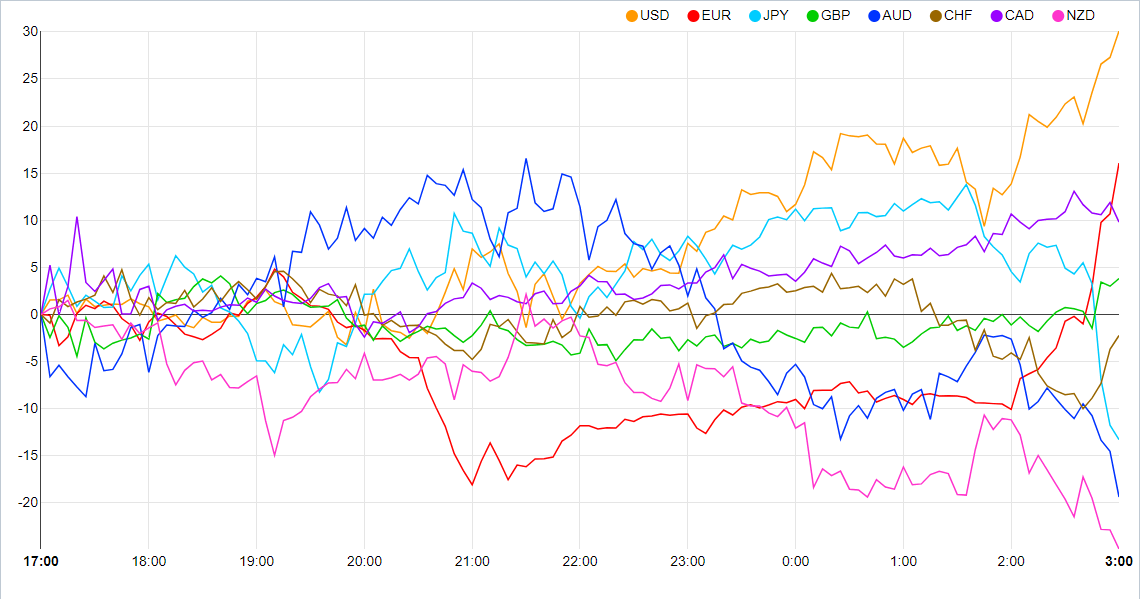

Currency Strength Chart

Source: FinancialJuice

Japanese data released overnight was mixed as we had industrial production come in weaker than expected while retail sales came in stronger. Industrial production posted its first decline in 3 months as production fell 4.9% MoM in January. Retail sales rose a solid 1.9% MoM with apparel and motor vehicles the biggest contributors. Production in Japan remains an area of concern moving forward, however consumption looks well and truly on track to recovery.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

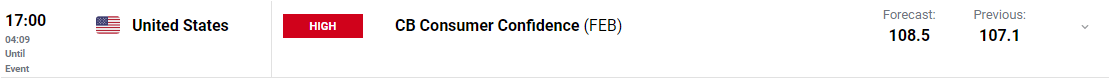

The US CB Consumer Confidence data is due out later today which could help the dollar consolidate recent gains should the print come in above the forecast of 108.5. Looking at the Dollar Index and the amount of repricing we have seen of late I’m not sure there is a lot of room left for appreciation. I do think Fridays ISM Non-Manufacturing PMI may give the dollar further impetus given that the US is a service driven economy and that would be good gauge of the recovery in the services sector.

Customize and filter live economic data via our DailyFX economic calendar

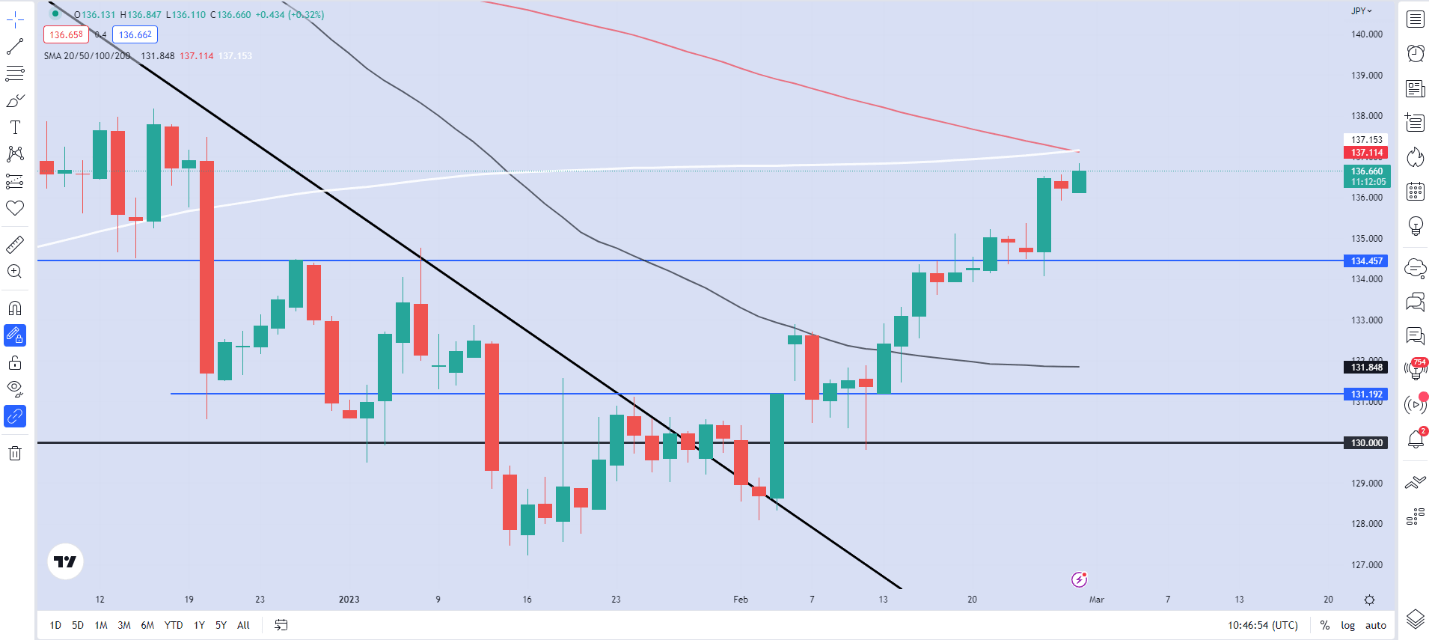

TECHNICAL OUTLOOK

From a technical perspective, USD/JPY is facing a big challenge at the 137.00 handle as we have the 100 and 200-day MA which have just formed a death cross. This coupled with my earlier comments that markets have already priced in recent changes in the Fed Funds peak rate hints that we could be in for some pause or retracement.

Yen gains will no doubt be capped by the dovish rhetoric from the BoJ with rangebound trading looking increasingly likely. The levels to keeo an eye on from an intraday perspective remain the 135.50 support and of course the 137.00 confluence area just above the current price.

USD/JPY Weekly Chart – February 28, 2022

Source: TradingView

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]