Gold and Silver Outlook:

- Gold prices linger around technical support and resistance around $1,840.

- Silver prices shift lower after facing major resistance at $21.00

- USD strength and rising yields remain prominent threats to gold and silver strength.

Discover what kind of forex trader you are

Gold and Silver Fundamental Outlook:

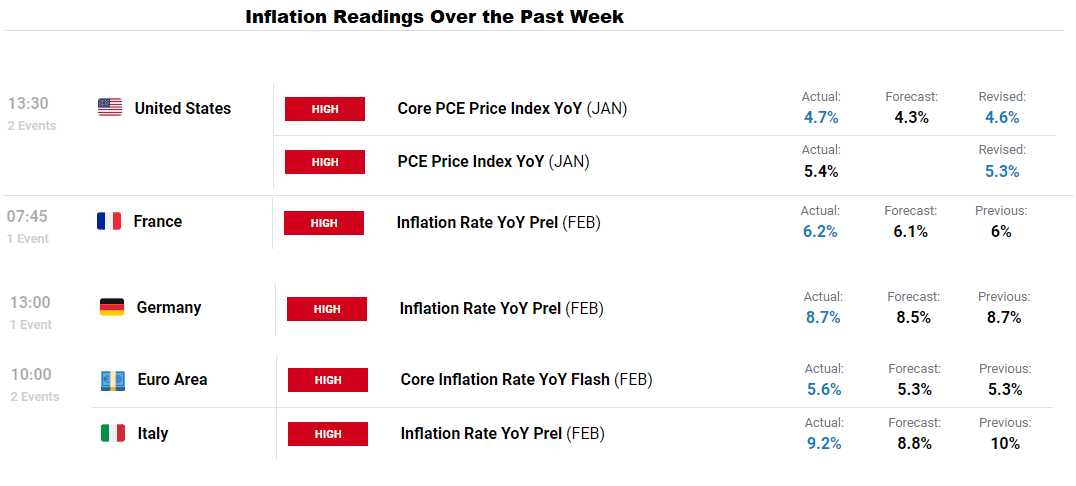

Gold and silver prices have benefited from the recent release of CPI data, that continues to highlight persistently high levels of inflation worldwide. This means that consumers are required to pay more for goods and services, reducing the amount of disposable income for households.

DailyFX Economic Calendar

While major central banks remain committed to taming rampant inflation through higher interest rates, this poses an additional threat to the non-yielding assets.

Recommended by Tammy Da Costa

Trading Forex News: The Strategy

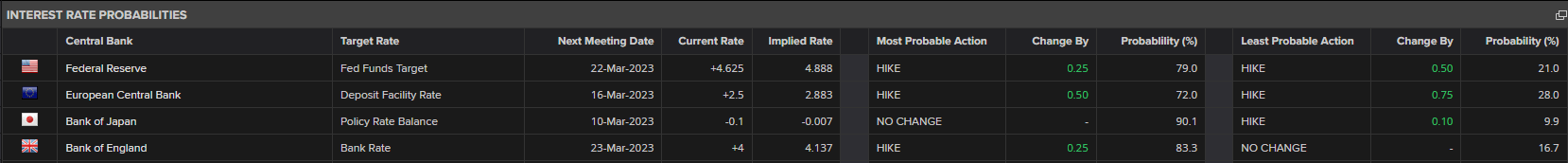

With the Federal Reserve, ECB (European Central Bank) and BoE (Bank of England) committed to drive inflation back to the 2% target, ‘sticky’ inflation has raised expectations that rates will remain elevated for longer.

Despite the aggressive pace of monetary tightening and rate hikes over the past year, robust economic data has provided policymakers with more ammunition to implement further rate hikes.

Source: Refinitiv

The readjustment in pricing has increased the probability for a 50-basis point rate hike at the next FOMC meeting, supporting rising yields and Dollar strength.

Because gold and silver are precious metals that do not generate additional income from rising rates, this environment does not bode well for the safe-haven commodities.

However, after shedding approximately 5.43% in February, costs of living continue to rise at a rapid pace, limiting further losses.

Gold (XAU/USD) Technical Outlook

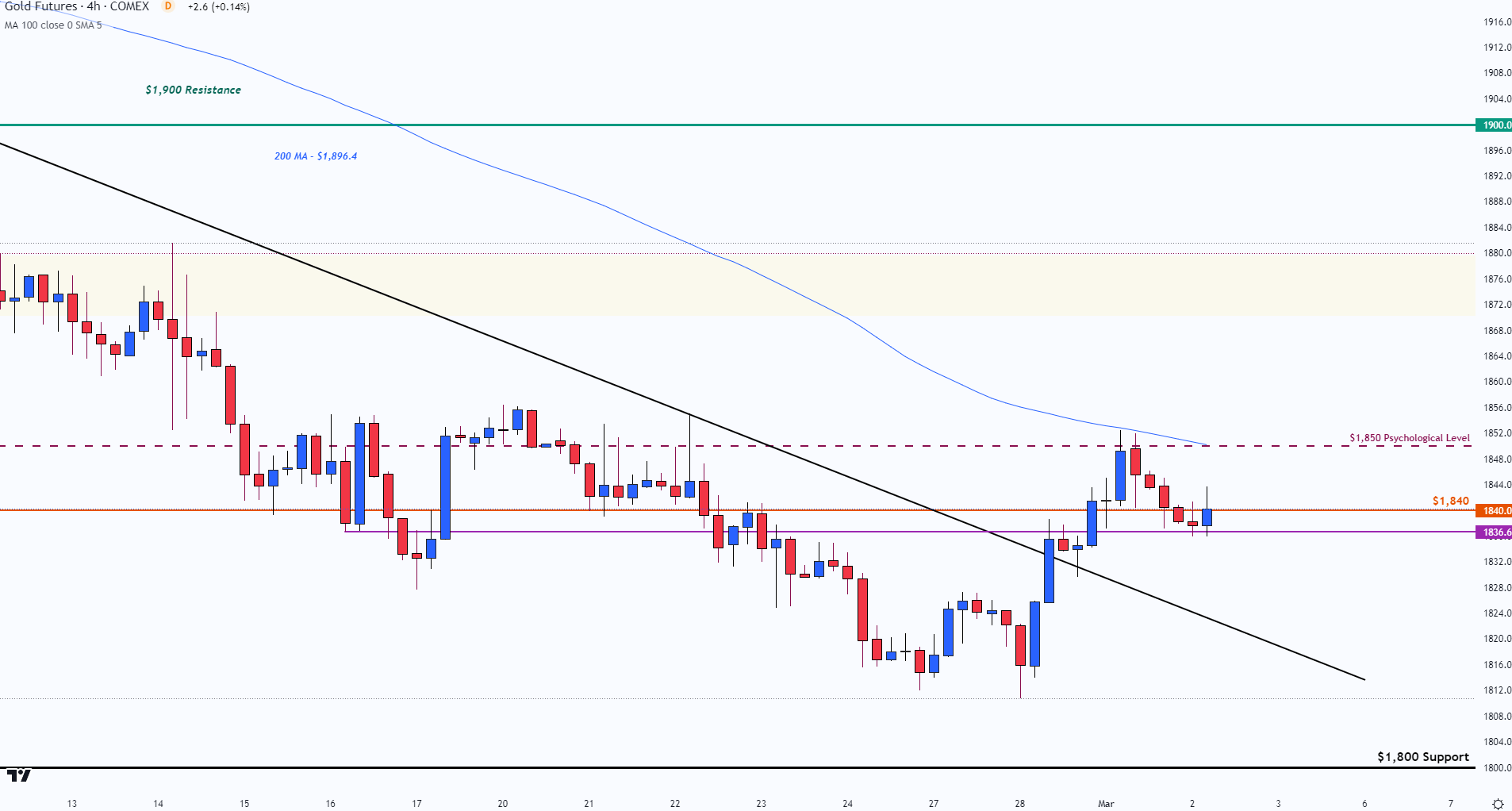

With Gold (XAU/USD) futures rebounding off the 100-week MA (moving average) at $1,812 last week, a move higher has lifted prices toward resistance at $1,840.

As this level continues to hold as support and resistance for price action, the four-hour chart highlights the technical relevance of the tight range currently holding bulls and bears at bay.

Gold Price Chart (GC1!) – Four-hour

Chart prepared by Tammy Da Costa using TradingView

Gold Price Levels – Looking Ahead

| Support | Resistance |

|---|---|

| $1,829.9 (January low) | $1,840 |

| $1,812 (100-week MA) | $1,850 (psychological level) |

| $1,800 (psychological support) | $1,880 |

| Change in | Longs | Shorts | OI |

| Daily | 4% | -1% | 2% |

| Weekly | 5% | 9% | 6% |

Silver (XAG/USD) Technical Outlook

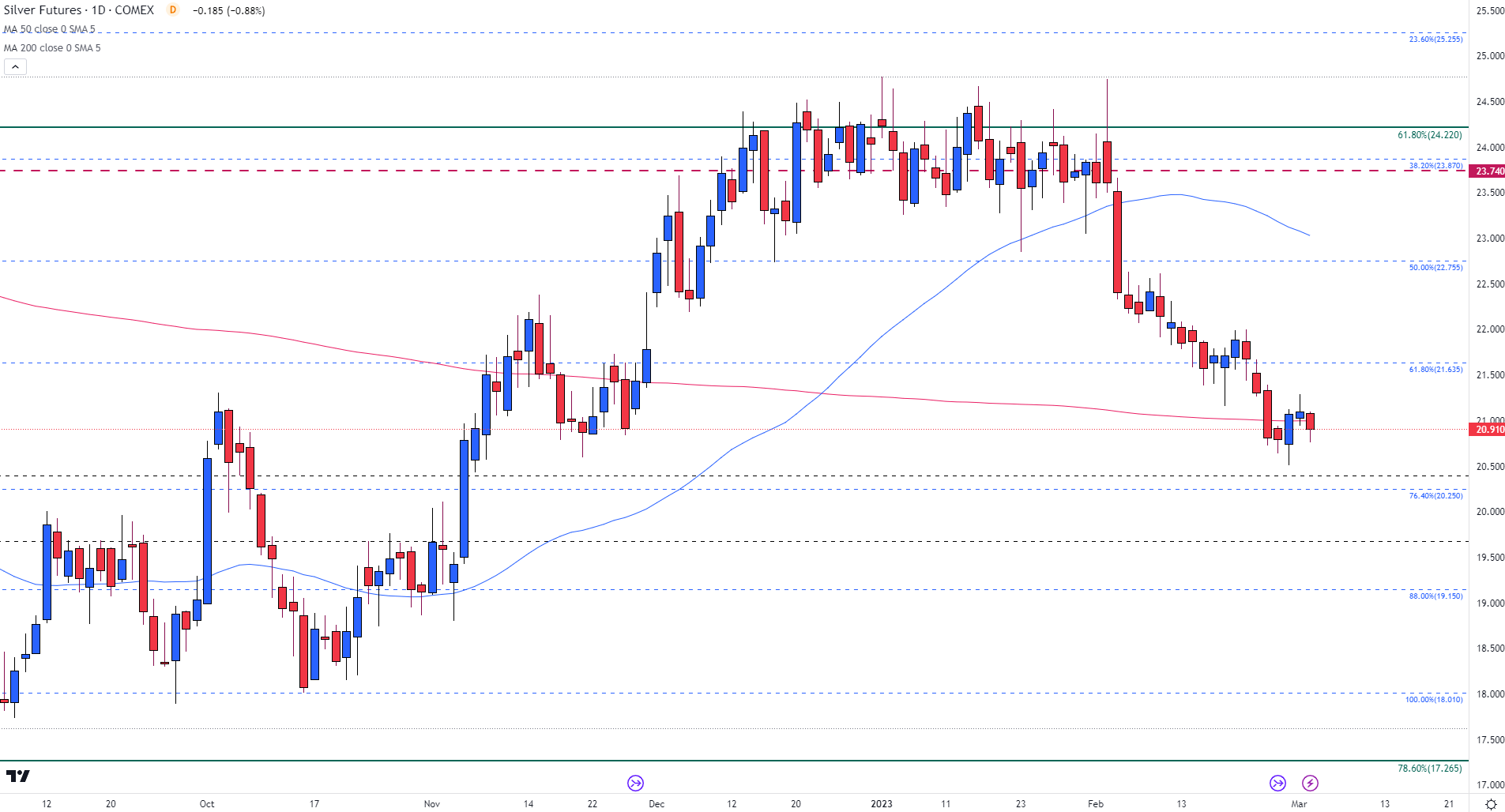

After temporarily testing $21,285 in yesterday’s session, silver futures moved lower, erasing 0.84% in today’s session (at the time of writing).

With the 200-day MA holding as resistance just below $21.00, a solid-body at the top of the current daily candle represents a distinct zone of resistance around this zone.

Silver Price Chart (SI1!) – Daily

Chart prepared by Tammy Da Costa using TradingView

Silver Price Levels – Looking Ahead

| Support | Resistance |

|---|---|

| $20.50 (psychological level) | $20.996 (200-day MA) |

| $20.25 (Fibonacci support) | $21.00 (psychological level) |

| $20.00 (psychological support) | $21.285 (weekly high) |

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707