Credit Suisse Price and Chart Analysis

- UBS buys Credit Suisse as the SNB looks to stem any potential financial contagion

- Global central banks increase US dollar liquidity.

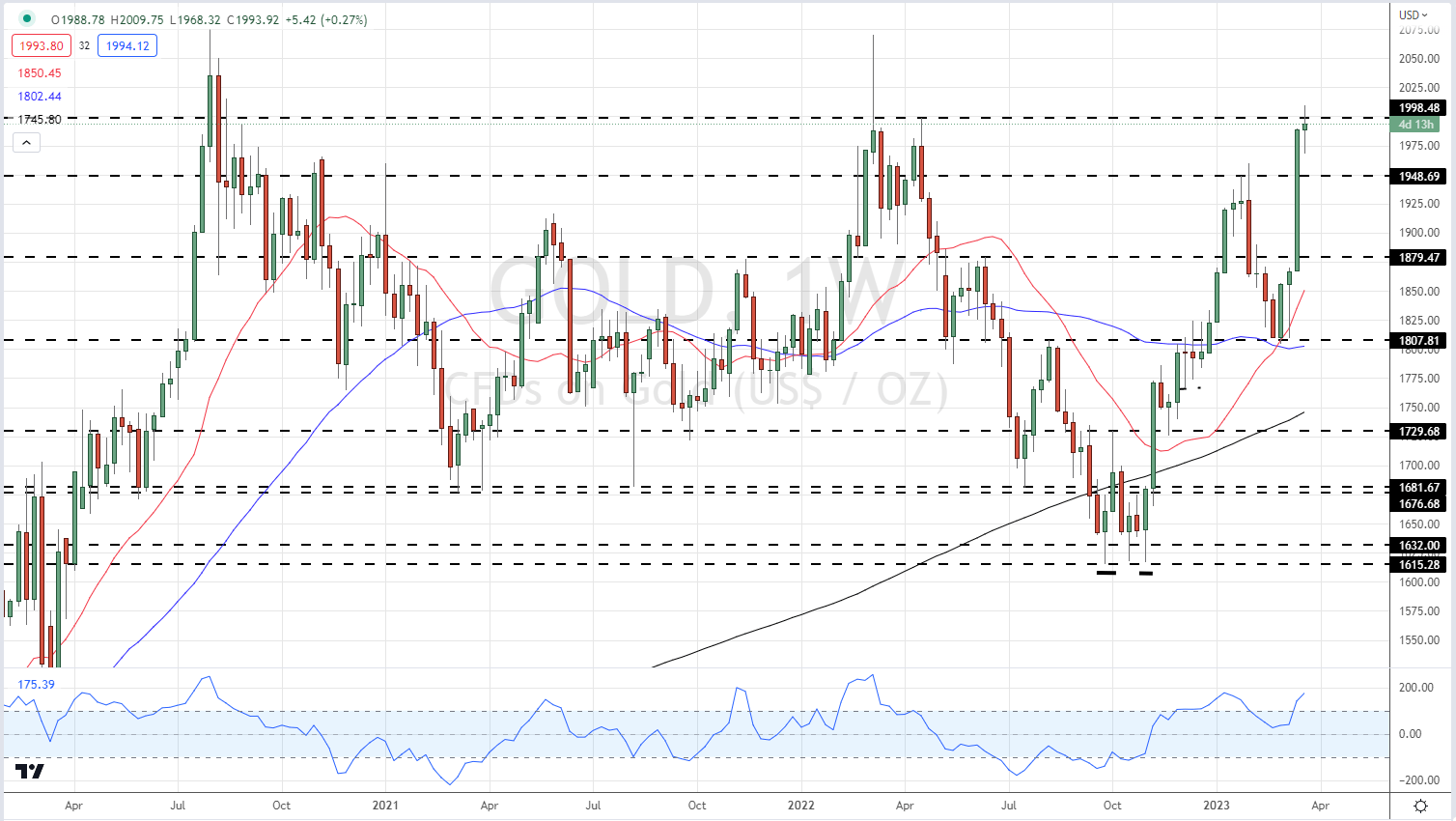

- Safe-haven bid, gold hits a one-year high.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

European bank shares open the session lower despite the news over the weekend that Swiss bank UBS bought troubled rival Credit Suisse for around $3.2 billion in a deal pushed by the Swiss government. To help facilitate the deal, the Swiss government has offered to guarantee any losses up to $9.6bn, while the Swiss National Bank will offer up to $110 billion of liquidity. According to SNB president Thomas Jordan,

it was important to act quickly to shore up confidence in the sector before financial markets opened on Monday. As part of the rescue package, Credit Suisse AT1 bonds will be written down to zero with holders shouldering a $16 billion loss.

A host of other G7 bankers were burning the midnight oil over the weekend. The Federal Reserve announced on Sunday that the Bank of Canada, Bank of England, Bank of Japan, the European Central Bank, the Swiss National Bank, and the Federal Reserve would take ‘coordinated action to enhance the provision of liquidity via the standing US dollar liquidity swap line arrangements’.

Federal Reserve Dollar Liquidity

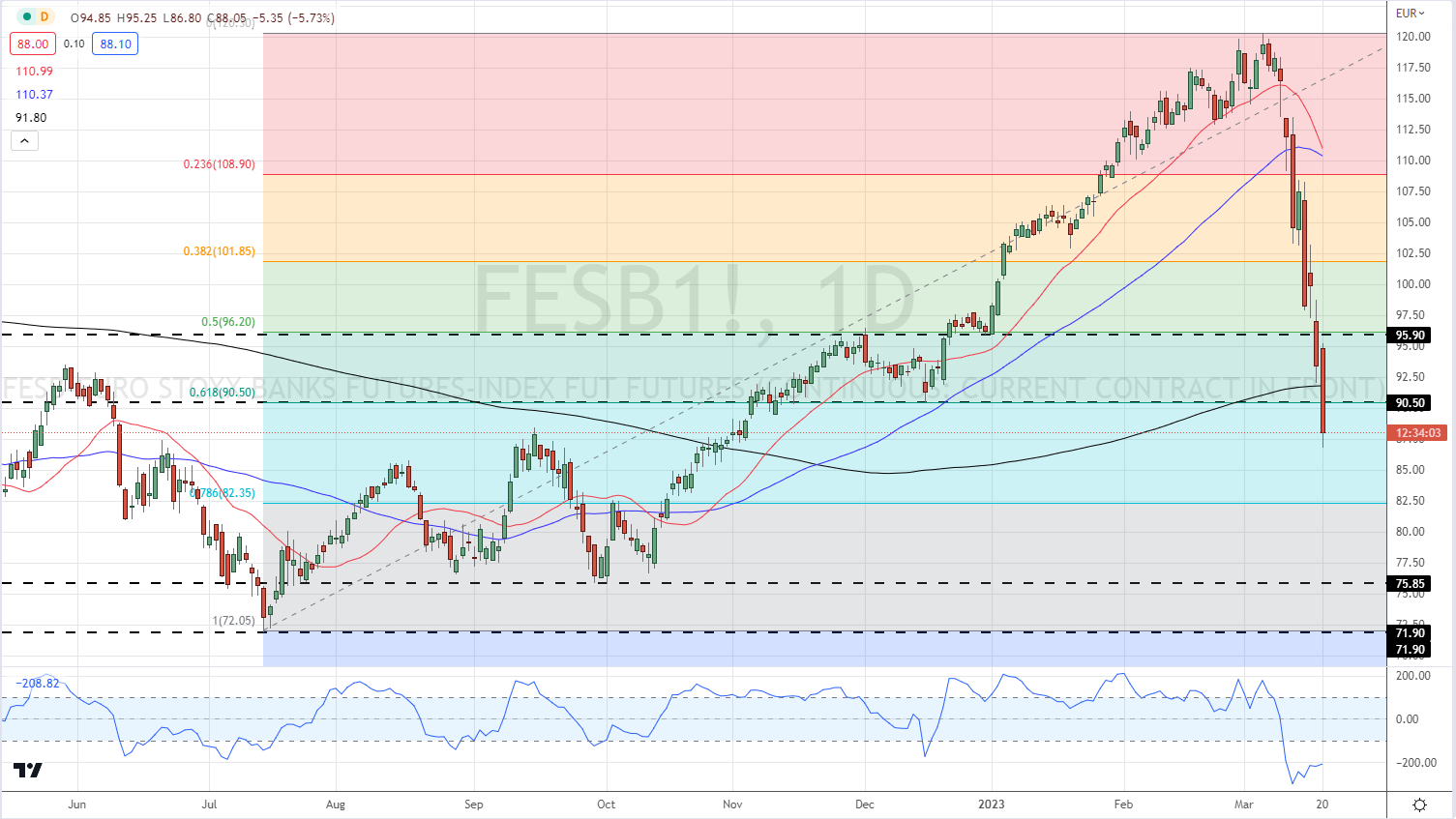

European Banks opened the week on the back foot despite the coordinated action seen over the weekend.

E Stoxx Banking Futures

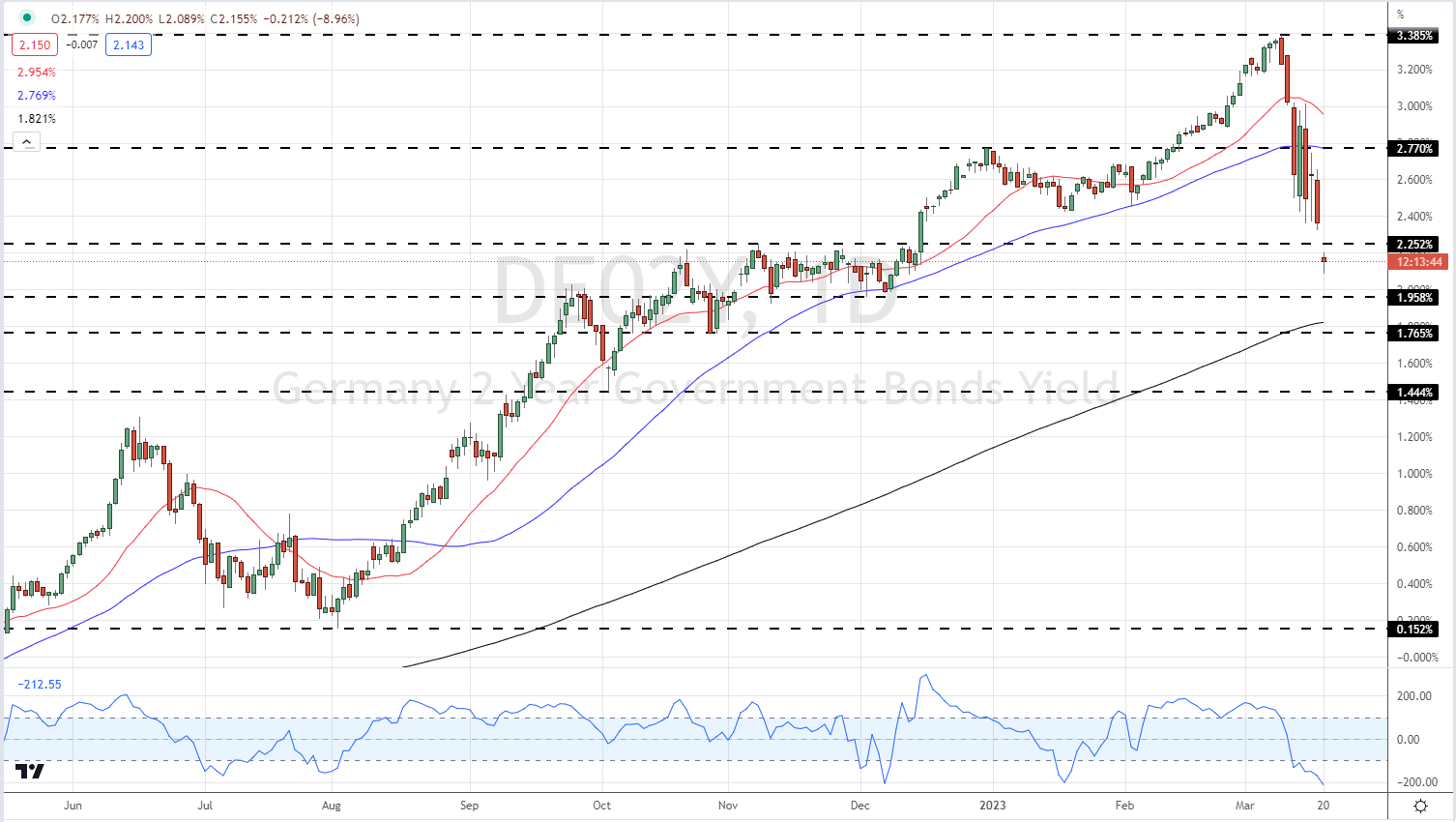

Investors continue to flock to safe-haven products with the yield on the 2-year German bond (Schatz), the de-facto Euro Area benchmark, falling to a fresh multi-month low.

2-Year German Bond Yields

Chart via TradingView

Recommended by Nick Cawley

Building Confidence in Trading

Other safe-haven assets rallied on early Monday. The Japanese Yen made a new one-month high against the US dollar, short-dated US Treasury yields continued to fall, while gold fleetingly broke above $2,000/oz. and made a new one-year high.

Gold Daily Price Chart

Looking ahead, this week we have monetary policy decisions by both the US Federal Reserve and the Bank of England, with a range of options seen for both central banks. The Bank of England is likely to increase the Bank Rate by 25 basis points but may well hold fire and leave rates unchanged, while the a 25bp rate hike is seen as a coin toss by the Federal Reserve.

For all market-moving data and events see the DailyFX Economic Calendar

What is your current market view – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.