[ad_1]

AUDUSD PRICE, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

How to Trade AUD/USD

Most Read: US Dollar Struggles to Gain Ground as Treasury Yields Leap. Where to for USD?

AUDUSD FUNDAMENTAL BACKDROP

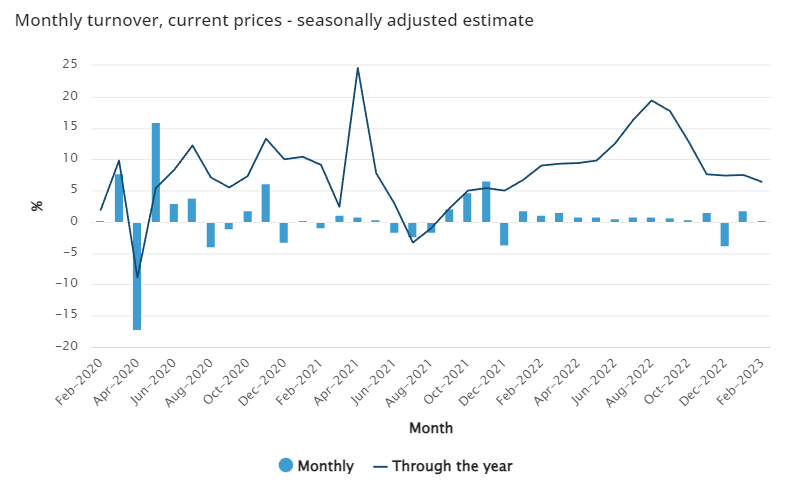

AUDUSD caught a fresh bid in the Asian session with a retest of the 0.6700 level helped by marginally better than forecast retail sales numbers. The preliminary MoM retail sales data came in 0.2% against forecasts of 0.1% yet displayed a sharp drop from the January print of 1.8%. The Aussie Dollar has also benefitted from an improvement in risk sentiment and a lackluster start to the week by the US Dollar.

Source: Australian Bureau of Statistics

The retail sales print may be an indication of the lagging effects of rate rises by the Reserve Bank of Australia and suggests that consumers are tightening their spending habits. This makes the case for a pause from the RBA at its upcoming April meeting all the more compelling, given the global landscape as well as the domestic one.

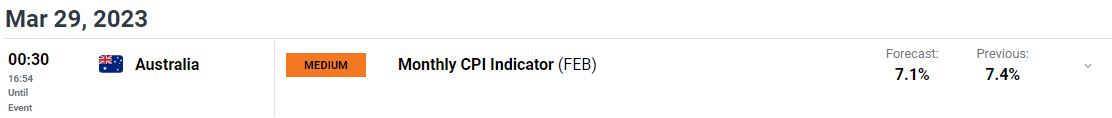

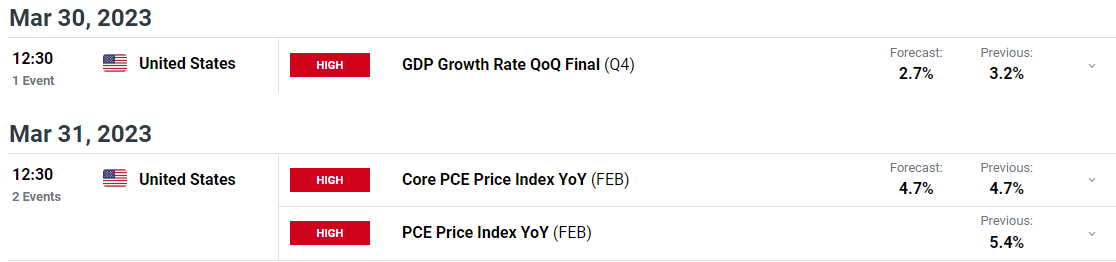

We do have quite a bit of economic event risk ahead on the calendar this week starting with today’s US CB Consumer Confidence data, as well as the GDP and Feds preferred inflation gauge the Core PCE numbers due out on Thursday and Friday respectively. On the Australian front we have the CPI data out tomorrow which could further add credence to a pause from the RBA while a higher-than-expected figure could see those bets fade ahead of the April meeting.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

The US Dollar has had an underwhelming start to the week as sentiment improves. A continuation of that today could see the Aussie Dollar continue to rise ahead of the inflation data release tomorrow.

The technical outlook on AUDUSD is showing higher highs and higher lows since bottoming out on March 10. Price does however remain below the key 0.6700 level and has been struggling to find any momentum above. The 200-day MA rests above at the 0.6750 handle and could cap any gains should we find some momentum above the 0.6700 level today ahead of the CPI data release.

Alternatively, a rejection of 0.6700 today and a return for dollar bulls could see price return toward the 0.66250 support area and potentially a retest of the YTD at 0.6560.

AUD/USD Daily Chart – March 28, 2023

Source: TradingView

KEY RESISTANCE LEVELS:

- 0.6750 (200-Day MA)

- 0.6830 (50-day MA)

KEY SUPPORT LEVELS:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Written by: Zain Vawda, Markets Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]