[ad_1]

Australian Dollar, AUD/USD, China, FOMC Minutes – Asia Pacific Market Open

Recommended by Daniel Dubrovsky

Get Your Free AUD Forecast

Asia-Pacific Market Briefing – Nasdaq 100 Sinks With Tesla as Treasury Yields Soar

The Australian Dollar roared higher on Wednesday, making it one of the best-performing developed currencies. AUD/USD gained 1.71%, the most since early November. Meanwhile, the Japanese Yen underperformed. This meant that AUD/JPY soared an impressive 2.92% on the best day since 2016. Put another way, the move was 4 standard deviations from the average looking at daily data since 2016.

Most of AUD’s gain occurred during Wednesday’s Asia-Pacific trading session. During that time, investors likely priced in the potential economic impacts of future trade flows between Australia and China due to a couple of developments. First, reports crossed the wires that Chinese regulators approved USD 1.5 billion for Ant Group to raise capital. Then, China discussed a partial end to an Australian coal import ban.

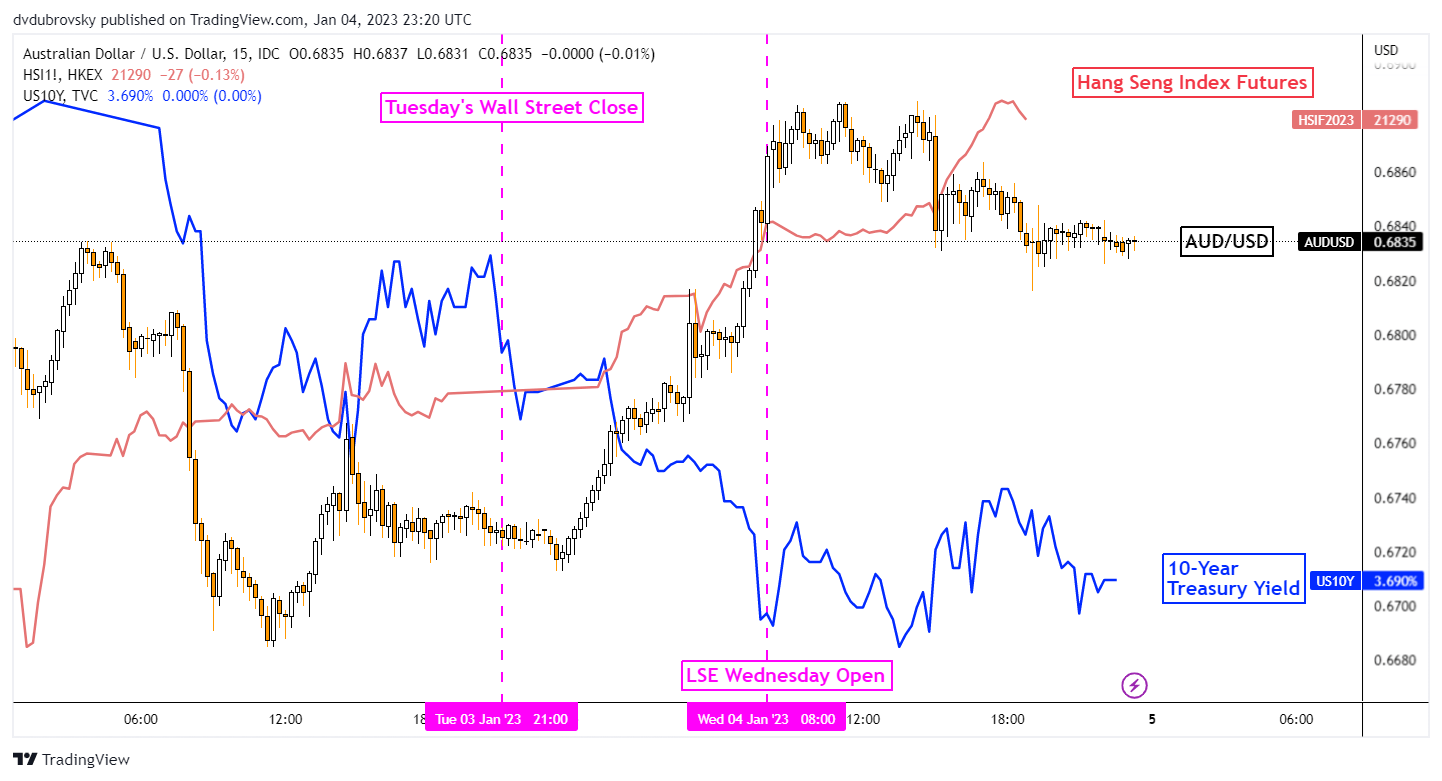

Looking at the chart below, AUD/USD can be seen roaring higher alongside Hang Seng Index futures. Meanwhile, the 10-year Treasury yield sank as the Chinese Yuan rallied. In fact, USD/CNH closed at its lowest since August. But, the DXY US Dollar index continues to trade in a narrow range since December. Relatively speaking, this could speak to traders placing more confidence in China’s economy.

During Wednesday’s Wall Street trading session, the latest FOMC meeting minutes crossed the wires. The document revealed that policymakers were increasingly pushing back against rate cut expectations for later this year. That reintroduced volatility on Wall Street, but it was not enough to send the Dow Jones, S&P 500 and Nasdaq 100 into the red as equities generally finished the day higher.

Australian Dollar Soared During Wednesday Asia-Pacific Trade

Thursday’s Asia Pacific Trading Session – Focus Remains on Sentiment

Thursday’s Asia-Pacific trading session is lacking notable economic event risk. That is placing traders’ focus on general market sentiment. At first glance, a positive day on Wall Street could bode well for regional bourses, pushing the Hang Seng Index and ASX 200 higher. But, be wary of the volatility that the FOMC meetings introduced as the session wrapped up. Further gains in local indices could bode well for the sentiment-linked Australian Dollar.

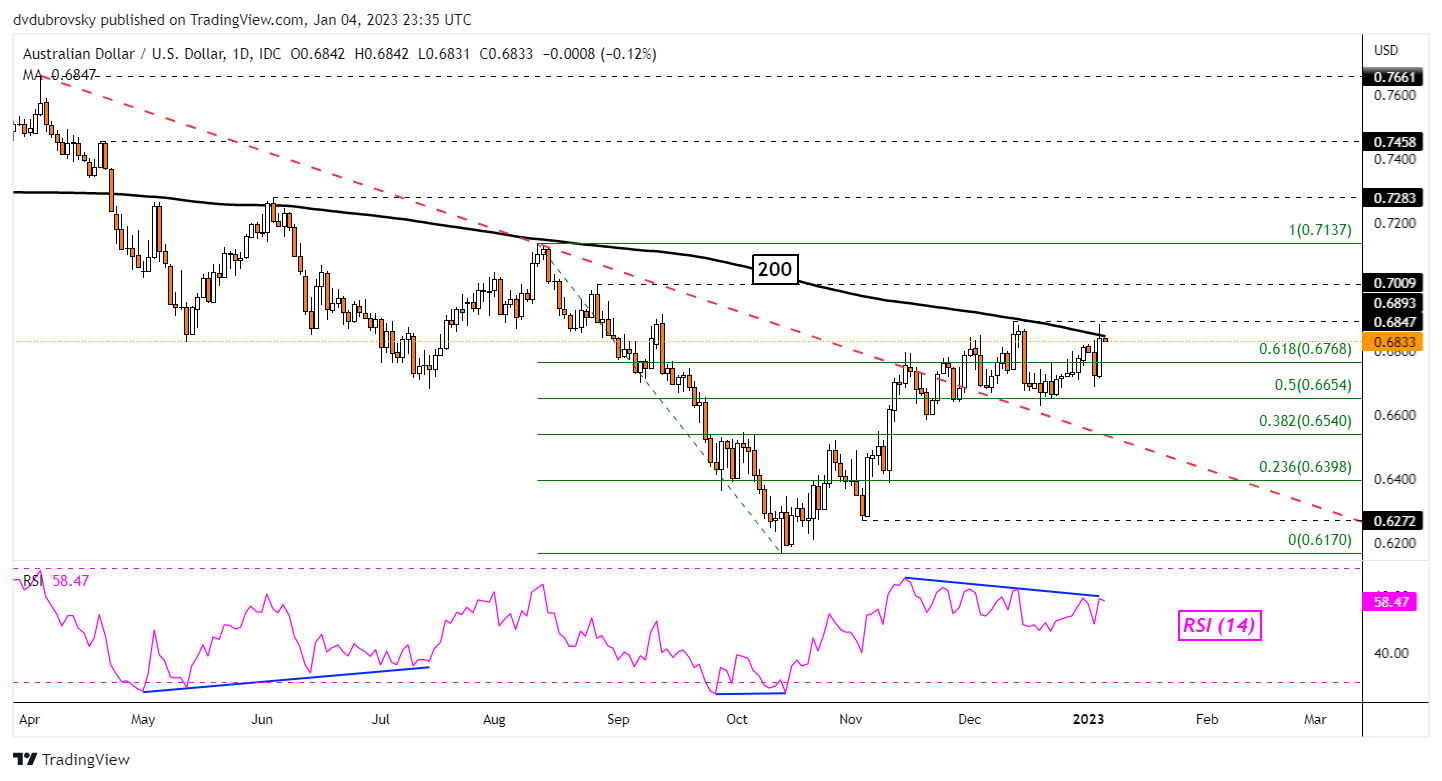

Australian Dollar Technical Analysis

Despite the Australian Dollar’s surge, AUD/USD was unable to clear the December peak at 0.6893. That likely reinforced this price as key resistance. Meanwhile, the 200-day Simple Moving Average continues to hold, maintaining the downside bias. This is as negative RSI divergence shows that upside momentum is fading. That can at times precede a turn lower. As such, it seems premature to turn longer-term bullish on AUD/USD. A confirmatory breakout above resistance would likely be that catalyst.

Recommended by Daniel Dubrovsky

Get Your Free Top Trading Opportunities Forecast

AUD/USD Daily Chart

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

[ad_2]