AUD/USD ANALYSIS & TALKING POINTS

- Better than expected Chinese data provided a boost to the AUD extending bullish support.

- Economic data today: US PPI and retail sales.

- AUD/USD bulls looking to break above the 0.67 resistance level.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

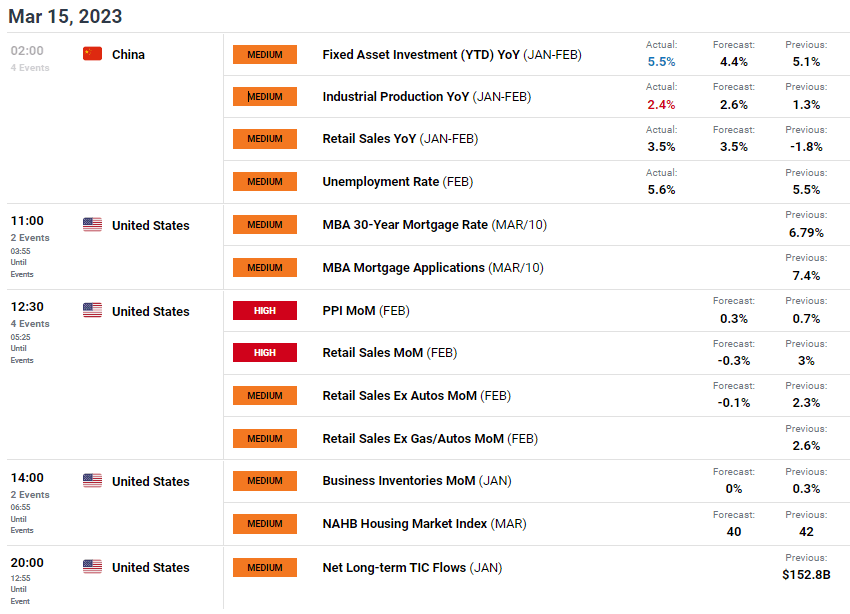

The Australian dollar looked to Chinese activity data (see economic calendar below) earlier this morning which came in rather mixed but overall positive for the Chinese economy. In particular, fixed asset investment jumped to 5.5%, highlighting a marked improvement in construction project investments. The slight optimistic slant to the data gave support to the Aussie dollar by way of a hopefulness in commodity exports. Being a pro-growth currency, the AUD responds well to encouraging growth data in from China being their largest importer of Australian commodities.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

Later today, the economic calendar is focused solely on US data with the PPI and retail sales reports for February in focus. Both are expected to come in lower than prior releases which could see the U.S. dollar weaken further should actual numbers come in line with estimates. That being said, markets are still unsure of the Fed path forward considering yesterday’s US CPI provided little guidance. In addition, the Silicon Valley Bank (SIVB) and Signature Bank collapses are still being mulled over with regard to its systemic impact on the global economy.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

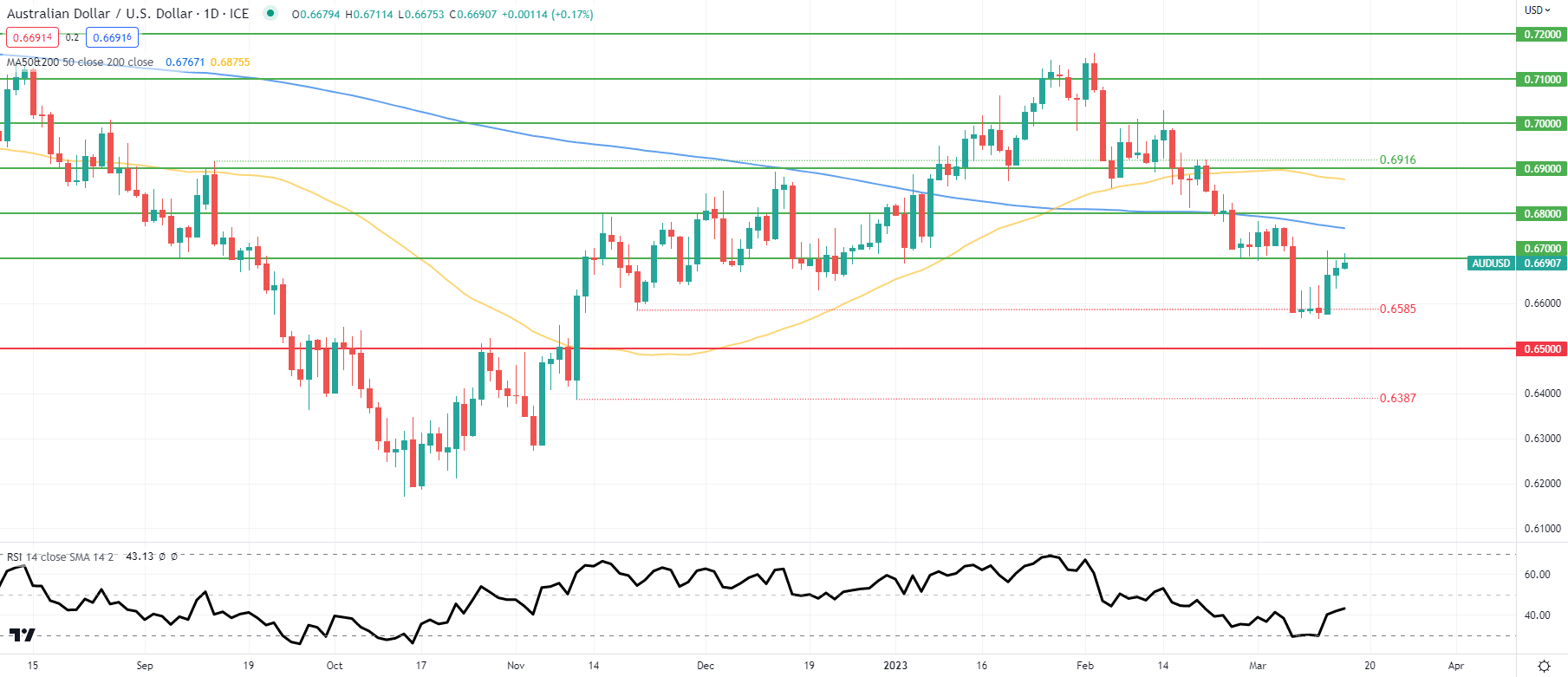

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action now has the AUD marginally weaker against the USD year-to-date, wiping out all of it’s 2023 gains since early February. Sandwiched between the 0.6585 swing support low area and 0.6700 psychological handle, the pair looks towards some form of fundamental catalyst to give market participants a directional bias.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Looking at the Relative Strength Index (RSI) reading, the pair remains in bearish territory for now but a break above 0.6700 could push the level above the midpoint 50 level favoring upside momentum.

Key resistance levels:

- 0.6800

- 200-day MA (blue)

- 0.6700

Key support levels:

IG CLIENT SENTIMENT DATA: BULLISH

IGCS shows retail traders are currently LONG on AUD/USD, with 69% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning we arrive at a short-term upside disposition.

Contact and followWarrenon Twitter:@WVenketas