[ad_1]

AUD/USD ANALYSIS & TALKING POINTS

- USD poised to strengthen as FOMC looms, leaving AUD vulnerable.

- Positivity around China has not borne fruit for AUD as COVID cases rise.

- Rising wedge formation could indicate a leg lower.

Recommended by Warren Venketas

Get Your Free AUD Forecast

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

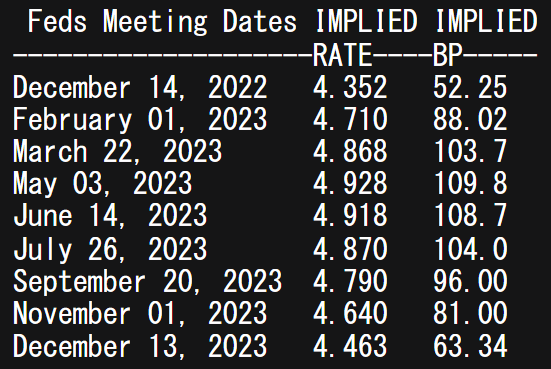

The pro-growth Australian dollar has remained relatively stable this week, not on the ‘growth’ factor or risk sentiment but rather a marginally weaker USD. This comes after no real U.S. data inputs or Fed officials (FOMC blackout period) but what seems to be rates markets making room for higher rates next week. The terminal rate for the Fed funds futures have similarly declined below 5% to 4.928% in May 2023 ( see table below).

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

FEDERAL RESERVE INTEREST RATE PROBABILITIES

Source: Refinitiv

From an AUD perspective, commodity prices are weighing negatively on the currency coupled with weaker GDP data yesterday. The RBA decision earlier in the week seemed to be overshadowed by the U.S. ISM services data which has thrown a spanner in the works ahead of next week’s Fed interest rate decision.

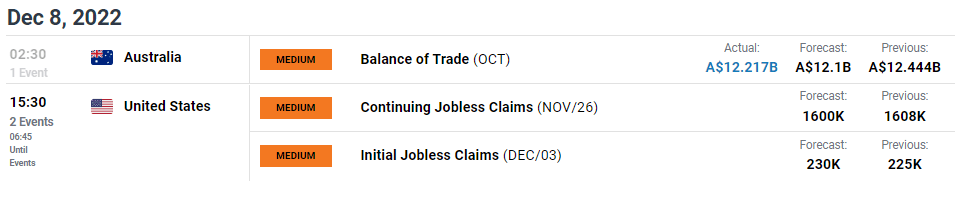

This morning began positively for the Aussie dollar with a better than expected balance of trade print for October however, the main focus for today will come from U.S. labor data (see economic calendar below). Anything surprising to the upside will backup last week’s Non-Farm Payroll (NFP) data and ISM statistic which should bring AUD/USD bears flocking.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

The Chinese economy has been receiving much attention of recent after the easing of COVID restrictions. Initially, commodity markets and prog growth currencies like the AUD received welcomed support but has since dissipated due to rising COVID cases which have caused concern. More clarity around COVID control and how the impact over manufacturing and economic growth is required before markets can really get behind a China re-opening.

Overall, the current fundamental headwinds facing the AUD outweighs that off the USD which could suggest possible downside risk for the Australian dollar over the next few weeks.

TECHNICAL ANALYSIS

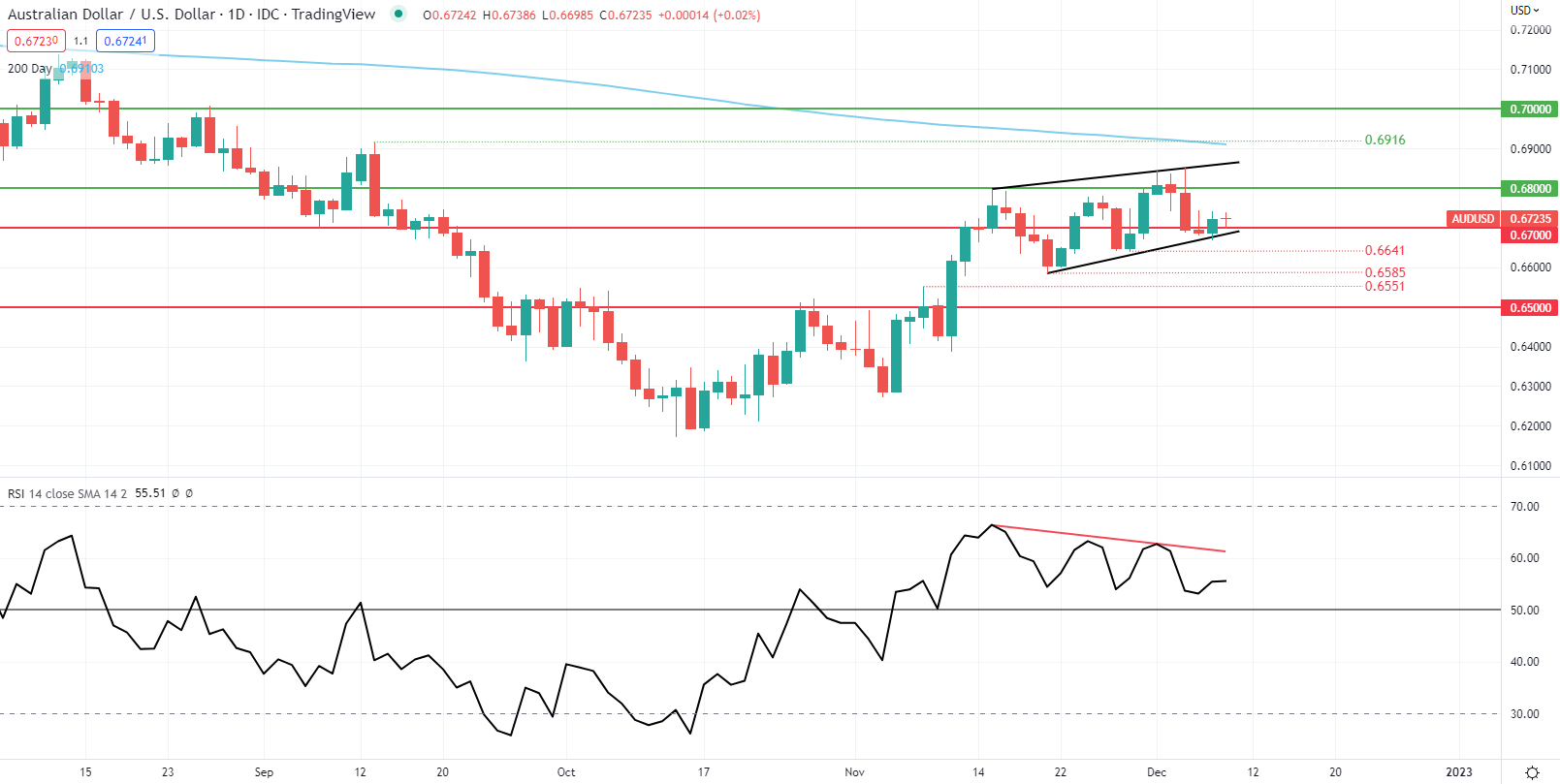

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action has managed to keep it’s head above the psychological 0.6700 handle but within the lower bound of the developing rising wedge pattern (black). As mentioned in previous analysis the Relative Strength Index (RSI) continues to exhibit signs of bearish/negative divergence which often leads to subsequent downside. A break below wedge support which seems to coincide with the 0.6700 support level could spark this move lower, exposing subsequent support zones.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: MIXED

IGCS shows retail traders are currently LONG on AUD/USD, with 59% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment but recent changes in long and short positioning result in a short-term cautious bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]