[ad_1]

- Australian Dollar was pummelled against a strong US Dollar

- The threat of a US recession appears to be gaining mainstream attention

- Questions remain around China’s re-opening. Will it drive AUD/USD direction?

Recommended by Daniel McCarthy

Get Your Free AUD Forecast

The Australian Dollar was crushed late Tuesday as the US Dollar roared higher with the market posturing defensively across many asset classes. It has steadied somewhat in the Asian session so far today.

The mood toward risk and growth-linked assets turned sour to start the trading year with a focus on the scope and depth of a potential US recession.

Former New York Federal Reserve President William Dudley made comments highlighting that if a recession unfolds, it will be a Fed-induced slowdown. If inflation is reined in by that point, he said that the Fed could ease monetary policy and he didn’t see a risk to financial stability. Nonetheless, the threat of a US recession continues to swirl.

The Fed meeting minutes for the last Federal Open Market Committee (FOMC) meeting are due out later and might shed further light on the board’s outlook for the tightening cycle.

Perhaps more importantly, the market will also be eyeing jobs and inflation data ahead of the next FOMC at the beginning of February.

There also appears to be a growing perception that the re-opening of China may not produce the economic boost to global growth that had been hoped for.

Former Australian Prime Minister Kevin Rudd has been on the wires regarding China’s about-face on their zero-case Covid-19 policy.

In an interview with Bloomberg television, he said that the change in tack has called into question the political decision-making fallibility of President Xi Jinping. He referred to this as “a dent in the armour for the long term.”

Mr Rudd is fluent in Mandarin and is considered a Sinophile having studied the language at the Australian National University.

If choppy waters are emanating out of China, Australia’s trade surplus might be undermined, and the Aussie Dollar may face headwinds.

Recommended by Daniel McCarthy

How to Trade AUD/USD

AUD/USD TECHNICAL ANALYSIS

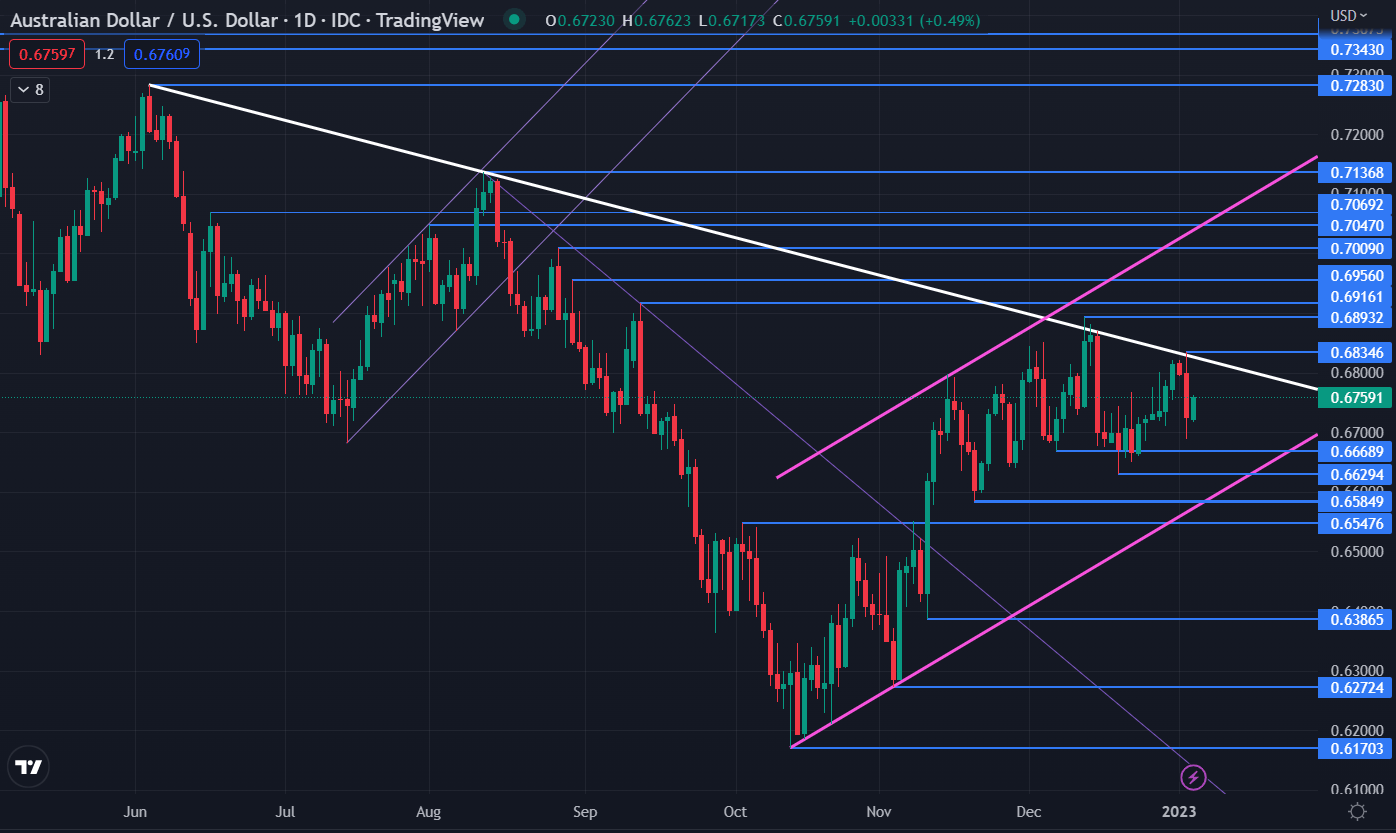

AUD/USD attempted to overcome a descending trend line yesterday but failed. Although it has been in the 0.6585 – 0.6893 range for two months, it remains within an ascending trend channel.

Support may lie at the ascending trend line which is currently intersecting at a previous low at 0.6585. The breakpoints and prior lows of 0.6669, 0.6629, 0.6548 and 0.6387 may also provide support.

On the topside, resistance could be at the descending trend line, currently near 0.6825, or the previous peaks of 0.6893, 0.6916, 0.6956 and 0.7009.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]