Australian Dollar, AUD/USD, US Dollar, Fed, SVB, ABS, CPI, RBA – Talking Points

- The Australian Dollar softened after a mild monthly CPI figure

- AUD had been lifted in the overnight session with a positive market mood

- If the RBA holds still next Tuesday, where will that leave AUD/USD?

Recommended by Daniel McCarthy

How to Trade AUD/USD

The Australian Dollar bounced higher overnight with increasing risk appetite lifting some pockets of the market but missing others. Today’s CPI number then undermined it with the RBA’s rate path now the centre of attention.

The Aussie, Kiwi and other high beta currencies found support as did some commodities going into the New York close. WTI crude oil has rallied over 6% so far this week.

Wall Street softened slightly on Tuesday as focus returns to the possibility of a Fed rate hike at its next meeting in early May.

The apparent resolution of the banking crisis has allayed investors’ fears of further contagion for now. US regulators made a pilgrimage to Capitol Hill to appear before the Senate yesterday.

They highlighted that the problem with SVB Financial was basic mismanagement of the balance sheet.

Referred to as a duration mismatch or asset-liability mismatch, the bank used customers’ deposits to buy Treasuries with several years to maturity. This means that cash deposits (liabilities) of zero-day maturity are being hedged using long-dated bonds (assets).

The value of these bonds (assets) deteriorated significantly when their yields moved higher at a rapid rate through 2022. The obligation to depositors (liabilities) remained unchanged.

The upside for sentiment is that on the face of it, the problem at SVB is unique to that bank, rather than a systemic problem.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

In any case, AUD/USD consolidated near 67 cents on that news in the lead-up to today’s Australian Bureau of Statistics (ABS) monthly CPI figure.

They started this data series in September last year and there are two such releases between the quarterly figures. These prints cover 62-73% of the weighted quarterly basket.

The RBA’s mandated inflation target of 2-3% over the business cycle is marked against the quarterly CPI.

Today’s figure came in at 6.8% year-on-year to the end of February against the 7.2% anticipated. The benign reading of price pressure sunk the Aussie.

Unfortunately, this monthly number is yet to prove itself to be a reliable indicator of where the quarterly full basket CPI will be.

The only comparison of the two data points is the year-on-year number to the end of 2023. Those prints saw a disparity of 0.6%.

The RBA appears likely to pause for the first time in its rate hike cycle since last May at their April monetary policy meeting. The interest rate market does not expect any more hikes and is pricing in a 25 basis point cut by the end of the year.

The official first-quarter CPI will be released near the end of April. It will be closely watched for clues on the validity of where inflation truly lies ahead of the RBA’s next decision in May.

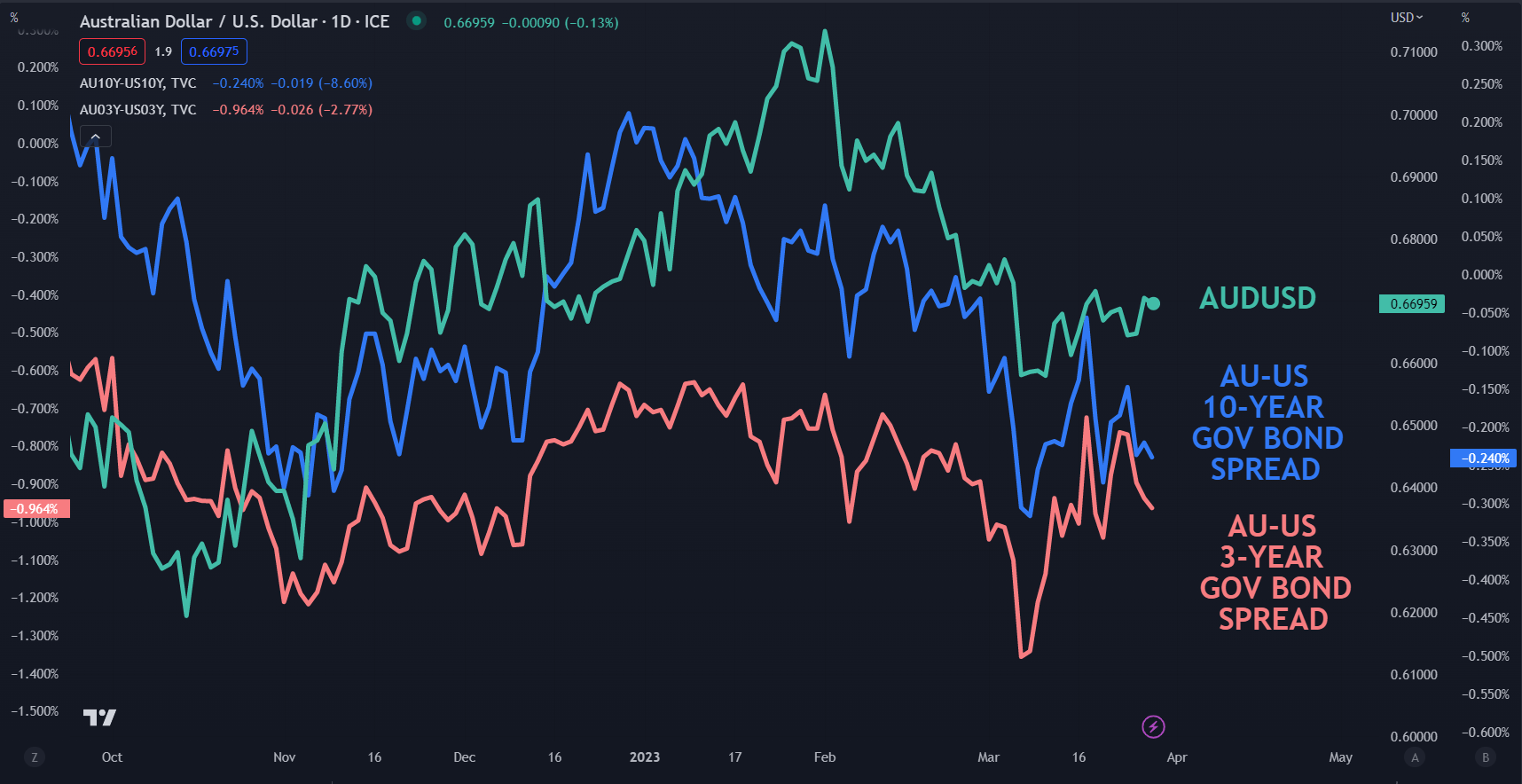

US yields collapsed in the wake of the banking crisis but have steadied since. ACGBs followed the lead and their yields sunk with the US notes.

The benchmark 10-year bonds have a yield differential near 25 basis points in favour of the greenback while the 3-year part of the curve is around 95 basis points toward the ‘big dollar’. The larger gap in the short end highlights the disparity between the RBA and the Fed.

AUD/USD AGAINST 3- AND 10-YEAR AU-US BOND SPREAD

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter