Australian Dollar, AUD/USD, RBA, CPI, Commodities, ASX 200, US Dollar – Talking Points

- The Australian Dollar has absorbed fundamentals factors without blinking

- AUD/USD remains anchored near 67 cents after the US Dollar rallied overnight

- Commodities continue to contribute to the bottom line. Will they boost AUD/USD?

Recommended by Daniel McCarthy

Trading Forex News: The Strategy

The Australian Dollar remains near 67 cents after 3Q quarter-on-quarter GDP came in below forecasts of 0.7% at 0.6% and against the previous 0.9%.

Annual GDP to the end of July was 5.9% instead of the 6.3% anticipated and the prior read of 3.6% was revised lower to 3.2%.

Overall, the domestic data shows a strong economy but might potentially be showing signs of growth fatigue.

Today’s GDP figures come after the Reserve Bank of Australia’s 25-basis point increase in their cash rate target to 3.10% yesterday, the eighth hike since lift-off in May.

The latest inflation read is way above the RBA’s target band of 2-3% at 6.9% year-on-year.

Recommended by Daniel McCarthy

How to Trade AUD/USD

Current account figures also revealed yesterday showed a deficit for the first time since the first quarter of 2019 at AUD -2.3 billion.

A healthy trade surplus was offset by a record income deficit that has been largely attributed to booming dividends paid by miners to offshore entities. Strong domestic demand also contributed to the deficit.

While Australian miners are often in the headlines for their contribution to the trade surplus, soft commodities continue to deliver food to the world.

Data this week from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) revealed an upgrade to total 2023 winter crop production to 63 million tonnes, the second highest on record.

This comes despite widespread crop abandonment in the eastern states after spring flooding events there. Wheat and canola production is forecast to reach a new record.

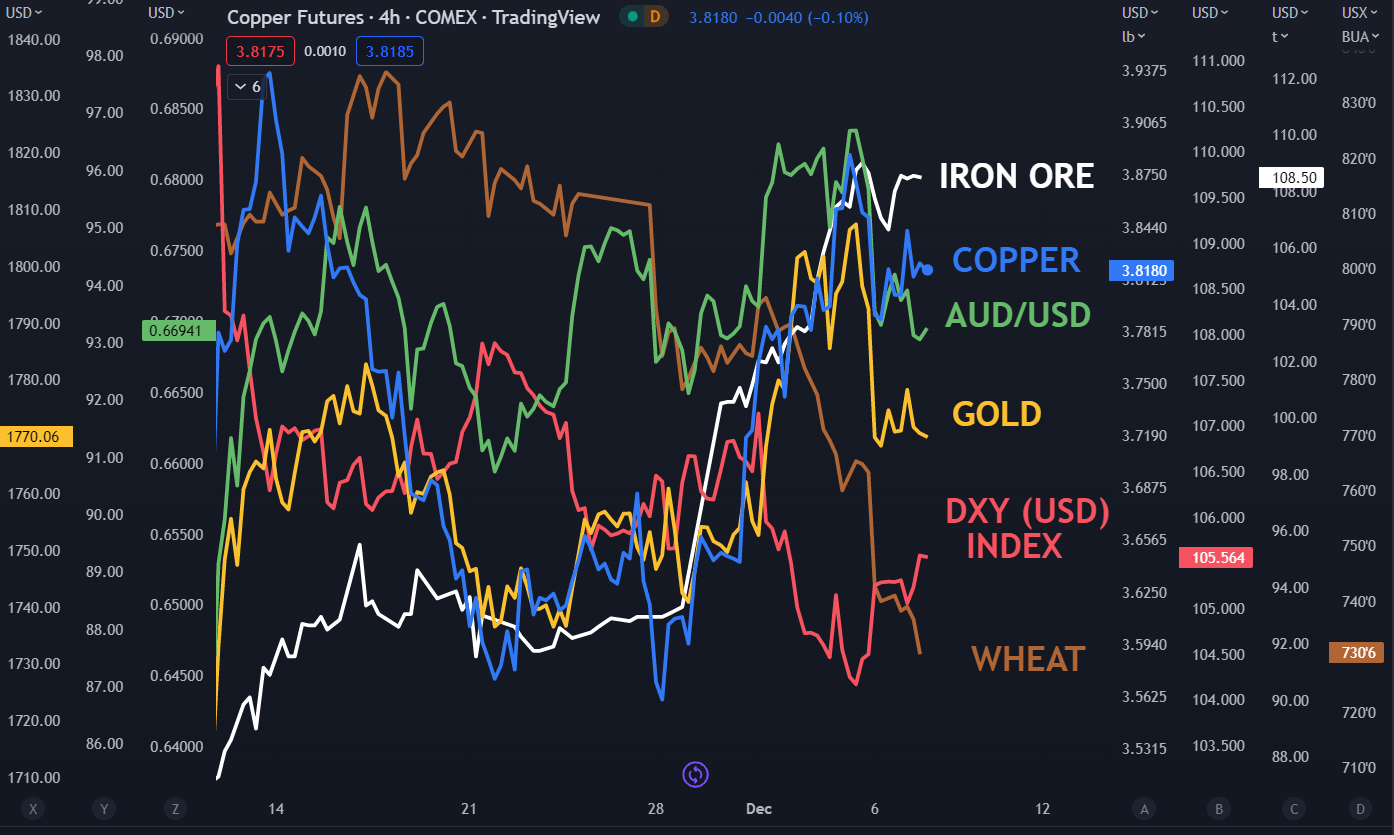

Unfortunately, wheat prices are trading at a 14-month low due to a bumper crop in the northern hemisphere.

At the same time, industrial metals such as iron ore and copper have surged higher over the last month driven by hopes of China easing its highly restrictive zero-case Covid-19 policy.

The ASX 200 was hardly blipped on today’s data after opening lower thanks to a soft Wall Street lead.

For the Aussie Dollar, it appears to remain at the whim of the US Dollar with the most significant AUD/USD moves occurring when the ‘big dollar’ ricochets around.

AUD/USD CHART

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter