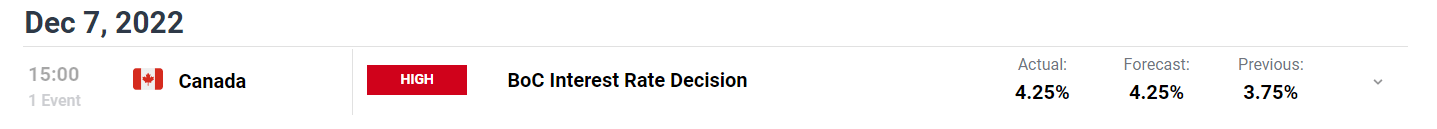

[ad_1]

BoC Hikes by 50 bps in Potentially its Final Hike

The Bank of Canada’s Governing Council voted to raise the overnight rate by 50 basis points to 4.25%, where the rate could remain. The Bank mentioned that the Governing Council, “will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target”.

Recommended by Richard Snow

Introduction to Forex News Trading

Customize and filter live economic data via our DailyFX economic calendar

Further mention of weakening economic growth was communicated where the Bank maintains that the risk of recession remains possible into the first half of next year despite the fact that global growth appears more resilient than anticipated during the October meeting.

Third quarter growth in Canada surprised to the upside but signs of slowing have appeared particularly via ‘interest sensitive’ housing market. Early signs of lower price pressures can also be seen via a lower ‘three month’s rate of change in core inflation’.

The Governing Council has therefore identified that the effects of prior rate hikes has started to cool demand and has stunted the momentum of higher, broad-based price pressures. In light of this, and the worsening economic outlook, we may have just witnessed the last rate hike but this will of course, depend on data from now until the end of January.

Market Response

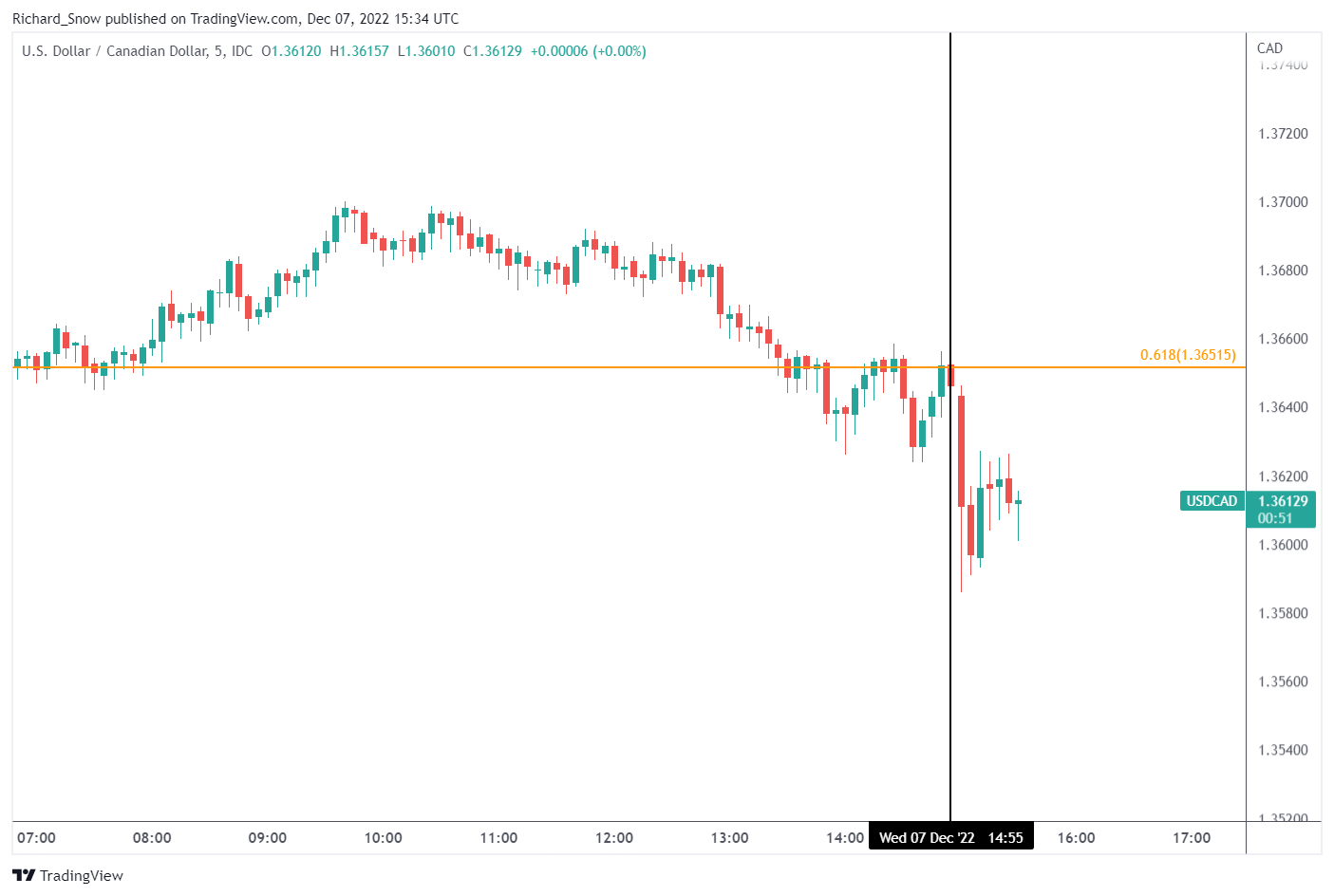

In yesterday’s BoC preview, USD/CAD and GBP/CAD were analyzed for potential short-term movement after the release. USD/CAD showed little response after the data release, trading marginally lower.

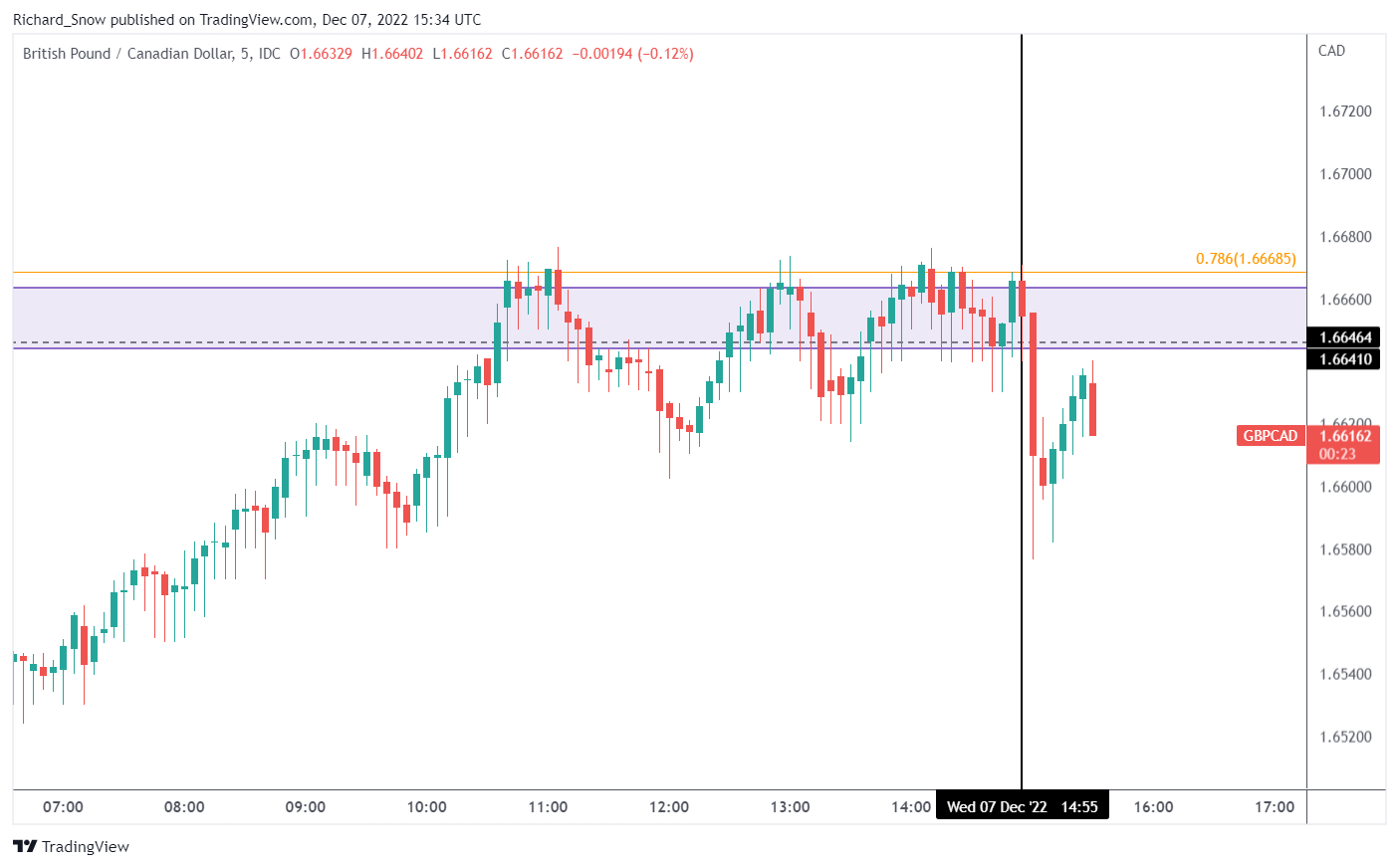

GBP/CAD also eased marginally in the aftermath of the decision. The zone of resistance and immediate rejection of the 78.6% Fibonacci level continues to keep higher prices at bay

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]