[ad_1]

BRENT CRUDE OIL (LCOc1) ANALYSIS & TALKING POINTS

- Crude oil prices dismissive of higher stockpiles.

- Higher demand projections driving crude oil but USD rebound may limit upside potential.

- Bear flag remains in focus but a long way to go before we see breakout potential.

Recommended by Warren Venketas

Get Your Free Oil Forecast

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Brent crude oil is tracking higher this Thursday despite a large stockpile in the U.S. as reflected by the weekly API and EIA crude oil stock change report. The overshadowing factor comes from OPEC and the IEA revision to their demand forecasts for 2023. Higher than previously expected demand is driving crude oil bulls as optimism from China’s re-opening has given a boost to the demand-side.

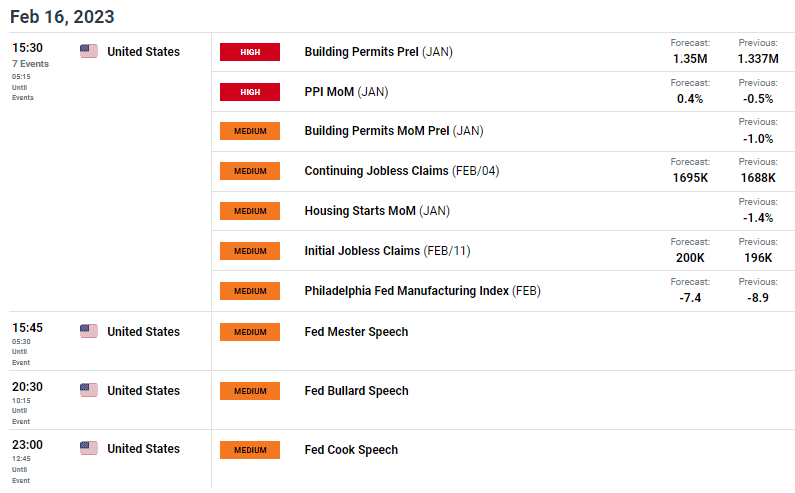

From a USD perspective, there has been lots going on this week from sticky inflation figures (CPI report) to exceptional retail sales data. Unfortunately for the greenback, the information has not transferred through to the Dollar Index (DXY) in a significant manner but today’s host of Fed speakers could continue to push the hawkish rhetoric and buoy the dollar. Building permits and PPI data are the only high impact events for today but focus will also be given to the jobless claims data to see whether the recent stellar Non-Farm Payroll (NFP) release is substantiated. The dollar is also being weighed down by an aggressive ECB and volatility may extend through to today with ECB officials featuring on the economic calendar as well.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

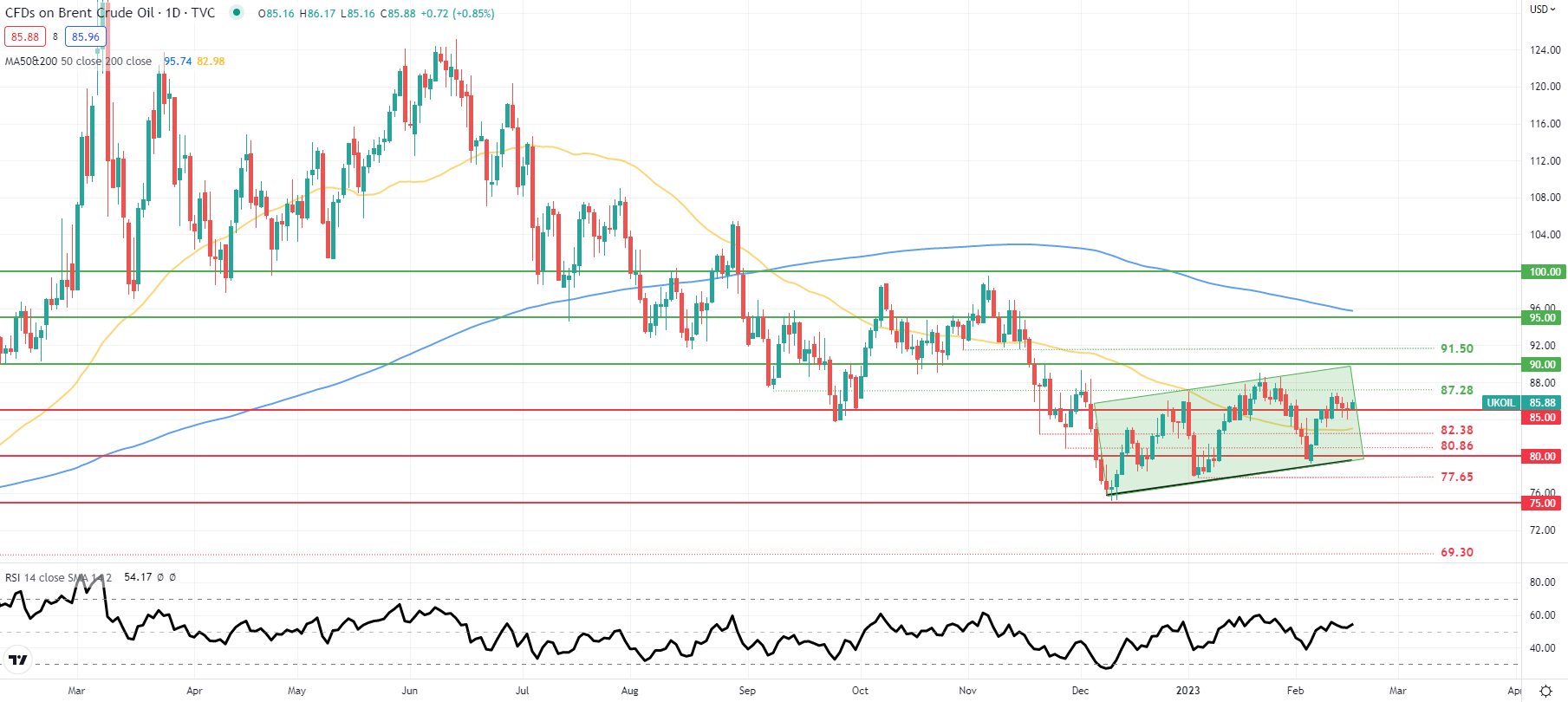

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily Brent crude chart above remains within the developing bear flag chart pattern (green) holding above the 85.00 psychological support handle. Being a bearish continuation pattern, the bias will naturally be skewed to the downside which could come from a stronger dollar later today.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are NET LONG on Crude Oil, with 68% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment; however, due to recent changes in long and short positioning we arrive at a short-term upside disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]