[ad_1]

GBP/USD – Prices, Charts, and Analysis

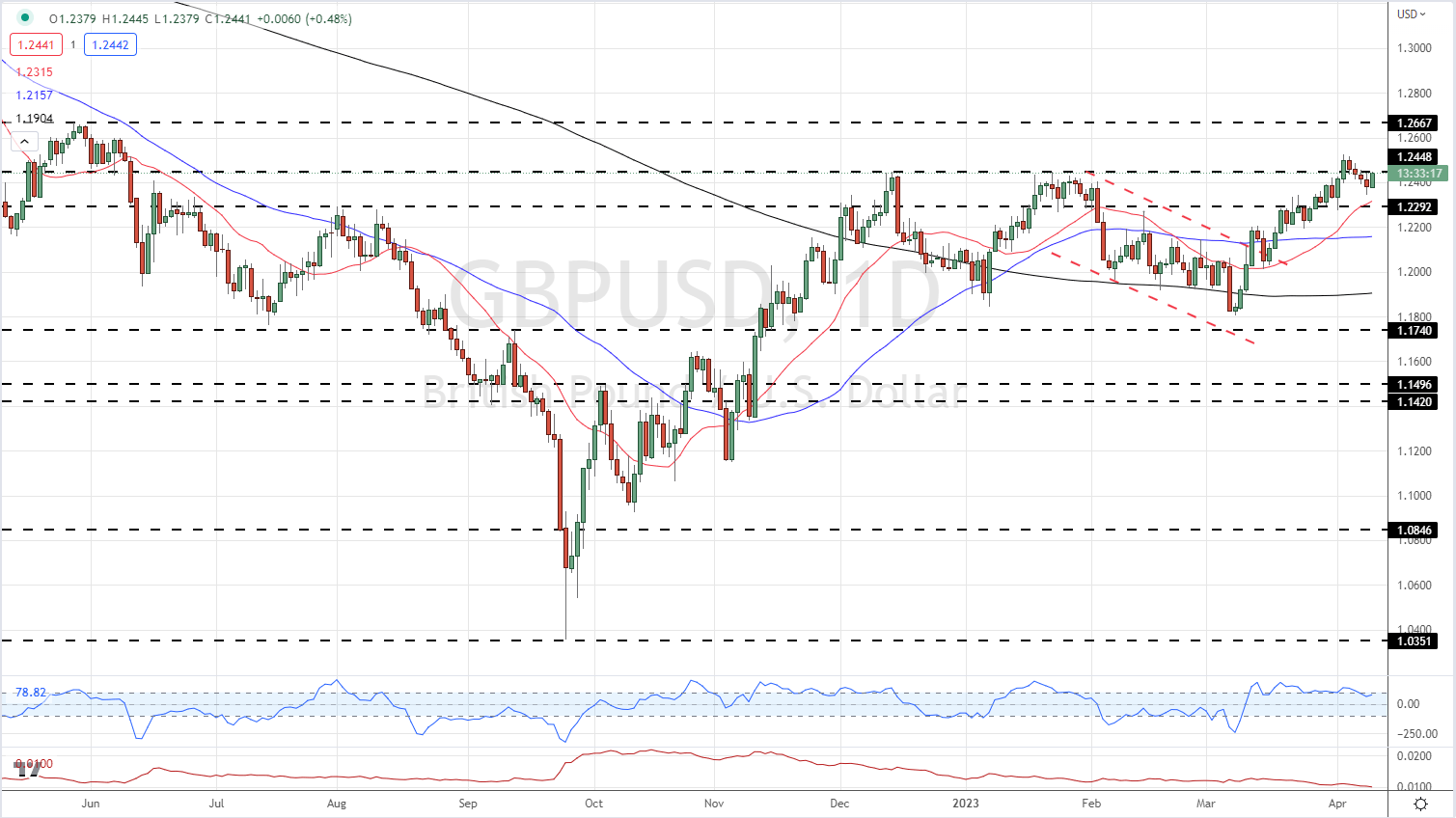

- Cable eyes resistance at 1.2448.

- The US dollar gives back some of Friday’s NFP strength.

- US inflation data and the FOMC minutes are released on Wednesday.

Recommended by Nick Cawley

Get Your Free GBP Forecast

The British Pound is gaining on the US dollar in early European turnover with USD weakness the main driver of the move. Last Friday’s US NFP report showed the American jobs market in robust health with the unemployment rate back down at 3.5%, just above a recent multi-year nadir. The latest CME fed fund futures predictions now show that markets are expecting one final 25 basis point rate hike at the May FOMC meeting before the hiking cycle is paused.

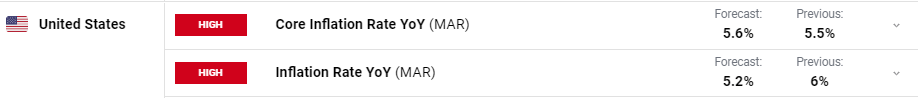

The latest look at US inflation (March) is released on Wednesday (13:30 UK) and is expected to show annual headline inflation falling to 5.2% from 6%, while core inflation is seen nudging 0.1% higher to 5.6%.

Later Wednesday, the minutes of the March FOMC meeting are released and these should give the market more clarity on the Fed’s views on inflation and the future path of interest rates.

Last Friday’s US Nonfarm Payroll report showed that the US jobs market remains healthy. A further 236k jobs were added last month, in line with market expectations, while the unemployment rate ticked 0.1% lower to 3.5%.

March Jobs Report: Nonfarm Payrolls Rise by 236,000, wage Growth Cools to 4.2%

GBP/USD currently trades around 1.2435, just under 0.5% higher on the session. The pair is near an old line of resistance around 1.2450, a level that has held the pair at bay over the past few months. All three moving averages are positive and supportive of a move higher. If cable can break through resistance, then 1.2525 comes into play before a multi-month high at 1.2667 comes into view.

GBP/USD Daily Price Chart – April 11, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 0% | 1% | 0% |

| Weekly | 31% | -15% | 1% |

A Big Shift in Weekly Retail Positioning

Retail trader data show 46.42% of traders are net-long with the ratio of traders short to long at 1.15 to 1.The number of traders net-long is 5.21% higher than yesterday and 35.02% higher from last week, while the number of traders net-short is 6.59% lower than yesterday and 26.22% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

What is your view on the GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]