[ad_1]

POUND STERLING ANALYSIS & TALKING POINTS

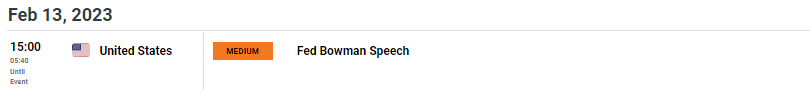

- Quite trading day expected today with Fed speak on the docket.

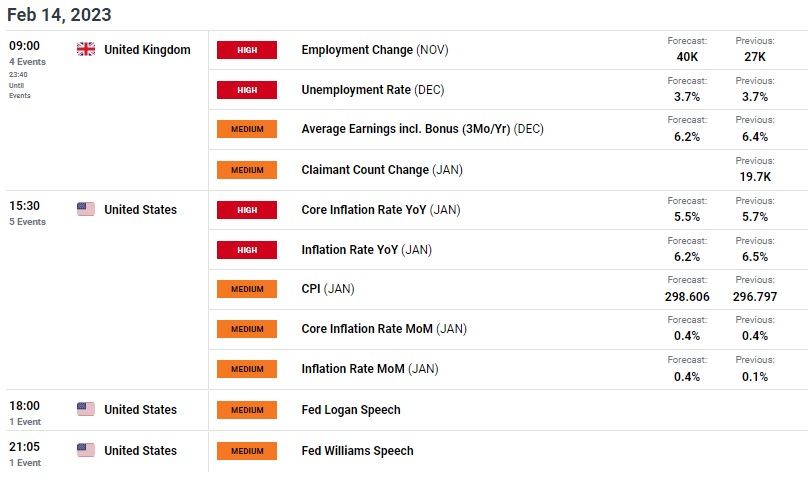

- UK labor and US CPI takes the limelight tomorrow.

- Key psychological levels under threat.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The British pound is relatively unchanged from last week’s close with slight weakness against a bid USD this Monday morning. The Fed’s Harker released a mixed statement last night which included eliminating 50bps interest rate hikes going forward as well as removing the chance of the Federal Reserve lowering rate in 2023. The latter seemed to have bolstered the greenback because money markets as per the implied Fed funds futures currently price in a cut at some point towards the latter half of the year. Later today, yet another Fed speaker (Bowman) will be in focus and should she echo this hawkish sentiment, the pound could be in for further downside against the U.S. dollar going into tomorrow.

Today is unlikely to generate large price swings in cable with market participants exercising caution ahead of tomorrow’s key economic releases (see economic calendar below). UK employment looks to remain robust as per forecasts but diving into the earnings portion of the report, a decline could possibly bring about a less aggressive reaction from the Bank of England (BoE) by way of softening inflationary pressures in the services sector.

From a U.S. standpoint, the CPI report will dominate headlines and while both core and headline prints are expected to fall, the rate of decline is not as many expected and shows signs of persistence that could sustain the recent dollar rally thus weighing negatively on the pound.

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

Introduction to Technical Analysis

Moving Averages

Recommended by Warren Venketas

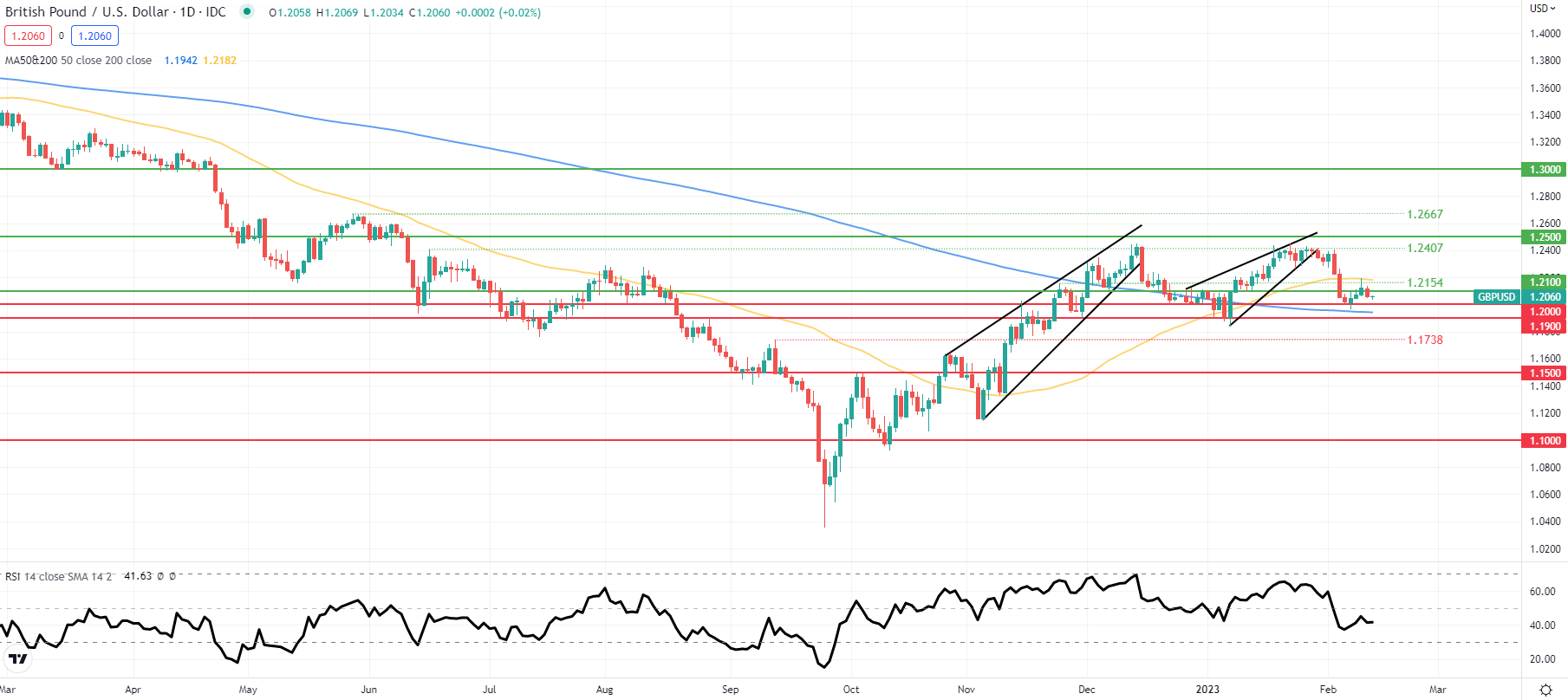

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily GBP/USD price action remains contained between the 50-day SMA (yellow) and 200-day SMA (yellow) respectively. The 1.2000 psychological support handle holds firm but tomorrow’s fundamental catalysts may well see this level tested depending on the outcome of the data. Bearish momentum is still in favor via the Relative Strength Index (RSI) level; however, carefulness pre and post-release should be considered with emphasis on sound risk management technique.

Key resistance levels:

- 1.2407

- 50-day SMA

- 1.2154

- 1.2100

Key support levels:

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 59% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we arrive at a short-term upside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]