[ad_1]

US Inflation Meets Expectations on Both Measures

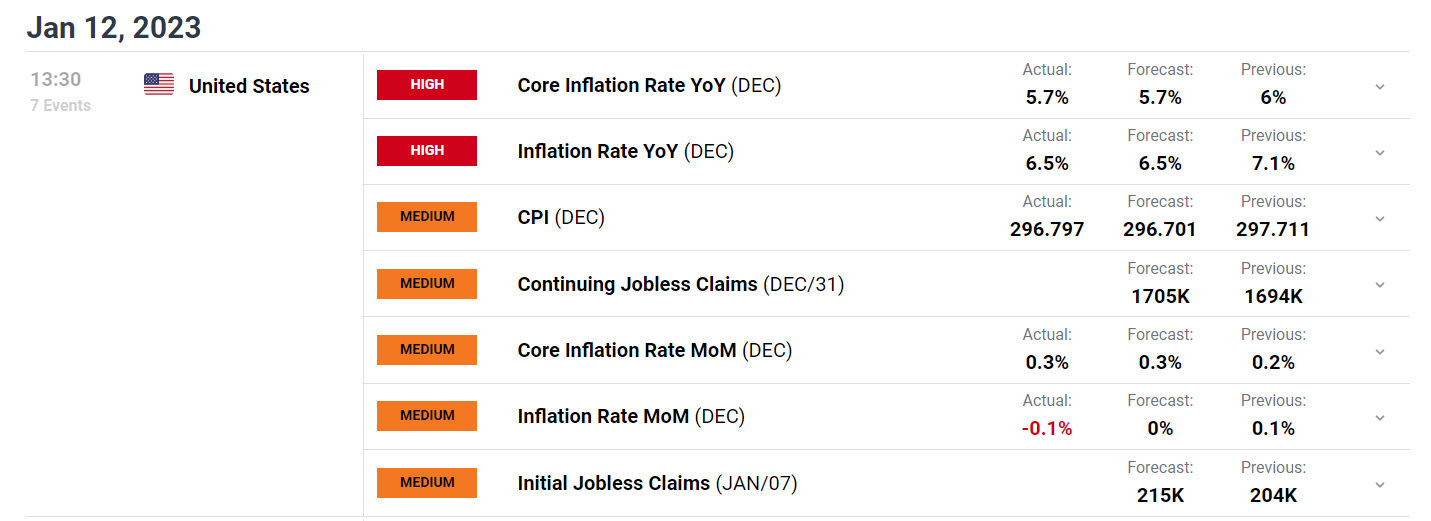

- US headline CPI (Dec) 6.5% vs prior 7.1%

- US core CPI (Dec) 5.7% vs 6% prior

- Market pricing for a 25 bps hike next month remain largely unchanged. S&P shoots higher, USD dips.

Recommended by Richard Snow

Get Your Free Equities Forecast

Customize and filter live economic data via our DailyFX economic calendar

Food prices rose 0.3% in December while the energy index declined 4.5%, as energy and gas prices continue to drop at the pumps. The biggest contributor to the index, shelter, contributed 0.8% to the overall monthly change from November.

“The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes“ – BLS

Market Response and a Case for a Fed Pause?

Positioning heading into the CPI report suggested markets expected another leg lower on the inflation front. S&P500 futures rose in anticipation while the benchmark for USD strength, the US dollar index, consolidated around the March 2020 high of 103 after a spate of heavy losses at the back of last year continuing into 2023.

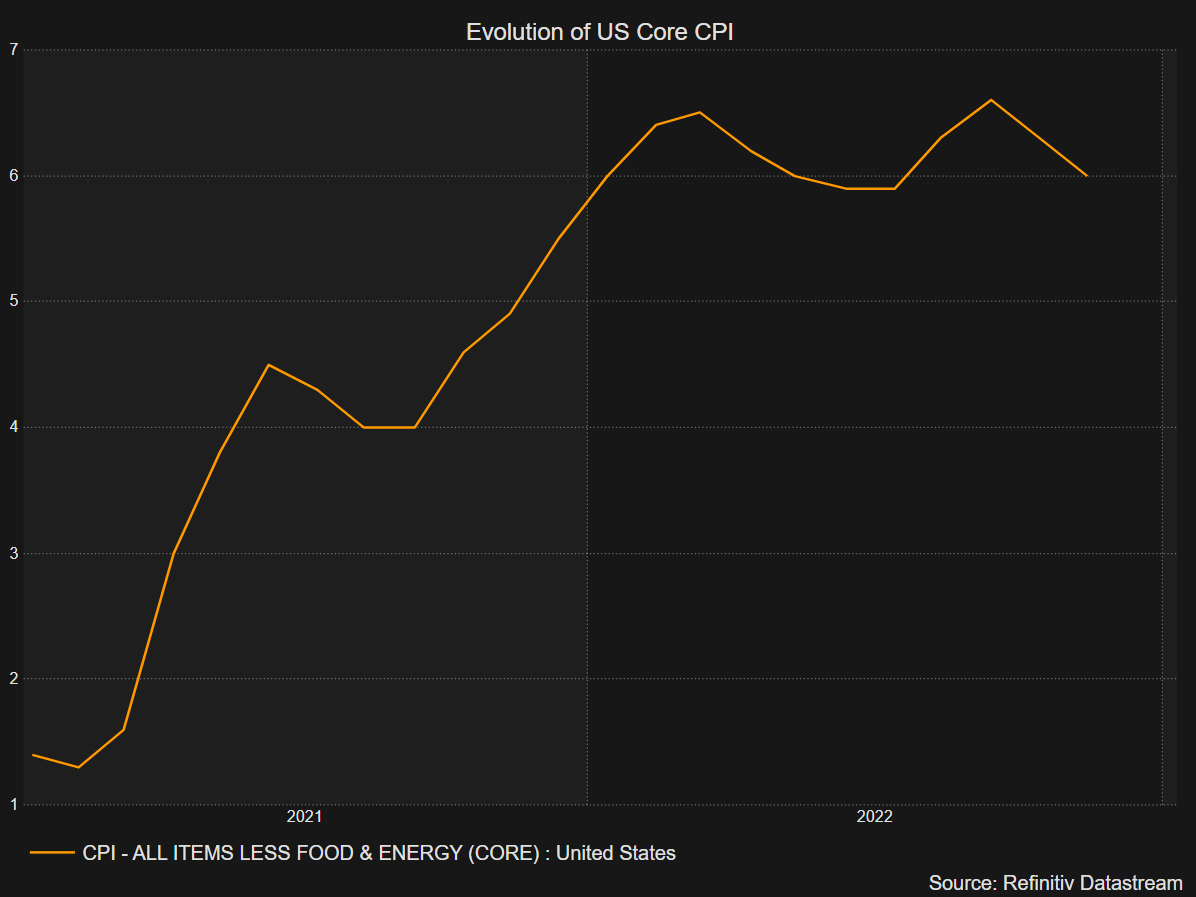

For a long time now, stubbornly high US shelter data had resulted in a drag for prior inflation prints given its large weighting (32.77% of the reading) and lagging nature. More real time rent/housing data, however, points to these readings trending lower in months to come.

Towards the end of 2022, Jerome Powell highlighted US inflation ex-shelter as a better gauge of inflation.

With inflation coming down and financial conditions remaining tight, market expectations for next month’s interest rate setting meeting remain largely in favor of a 25 bps hike (77%). With core goods dropping and concerns on Wall Street about a likely recession, we may just see a change in tone form the Fed on February the 1st.

US Core CPI (Inflation Minus Volatile Food and Energy Prices)

Source: Refinitiv Datastream, prepared by Richard Snow

Recommended by Richard Snow

Introduction to Forex News Trading

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]