[ad_1]

Crude Oil, US Dollar, WTI, FOMC, Fed, API, Crack Spread, Volatility – Talking Points

- Crude oil has had a tumultuous week so far and volatility may continue

- The Fed still has its work cut out and further tightening might be on the cards

- Inflation and inventory data probably haven’t helped crude. Where to for WTI?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Crude oil sunk to a 3-month low overnight after headline US inflation hit forecasts, coming in at 6.0% year-on-year and 0.4% month-on-month. Monthly core CPI was a slight beat at 0.5% instead of the 0.4% anticipated but the annual number was in line at 5.5%.

The market has appeared to have backtracked toward a 25 basis point (bp) hike from the Federal Reserve next week after pondering a pause in the aftermath of the failure of Silvergate Corp., SVB Financial and Signature Bank over the last few days.

With the Fed now viewed as hawkish again, recession fears seem to be lingering with the tightening cycle yet to play out.

Having said that, the terminal rate is now being priced by interest rate markets almost 100 bp lower than where it was at this time last week. Next week’s Federal Open Market Committee (FOMC) meeting might provide more guidance on the veracity of the market outlook for the Fed’s rate path.

Recommended by Daniel McCarthy

How to Trade Oil

Adding to bearish sentiment, crude oil inventories rose 1.155 million barrels to the end of last week in the US according to reports from the American Petroleum Institute (API). At the same time, gasoline inventories fell by 4.6 million barrels

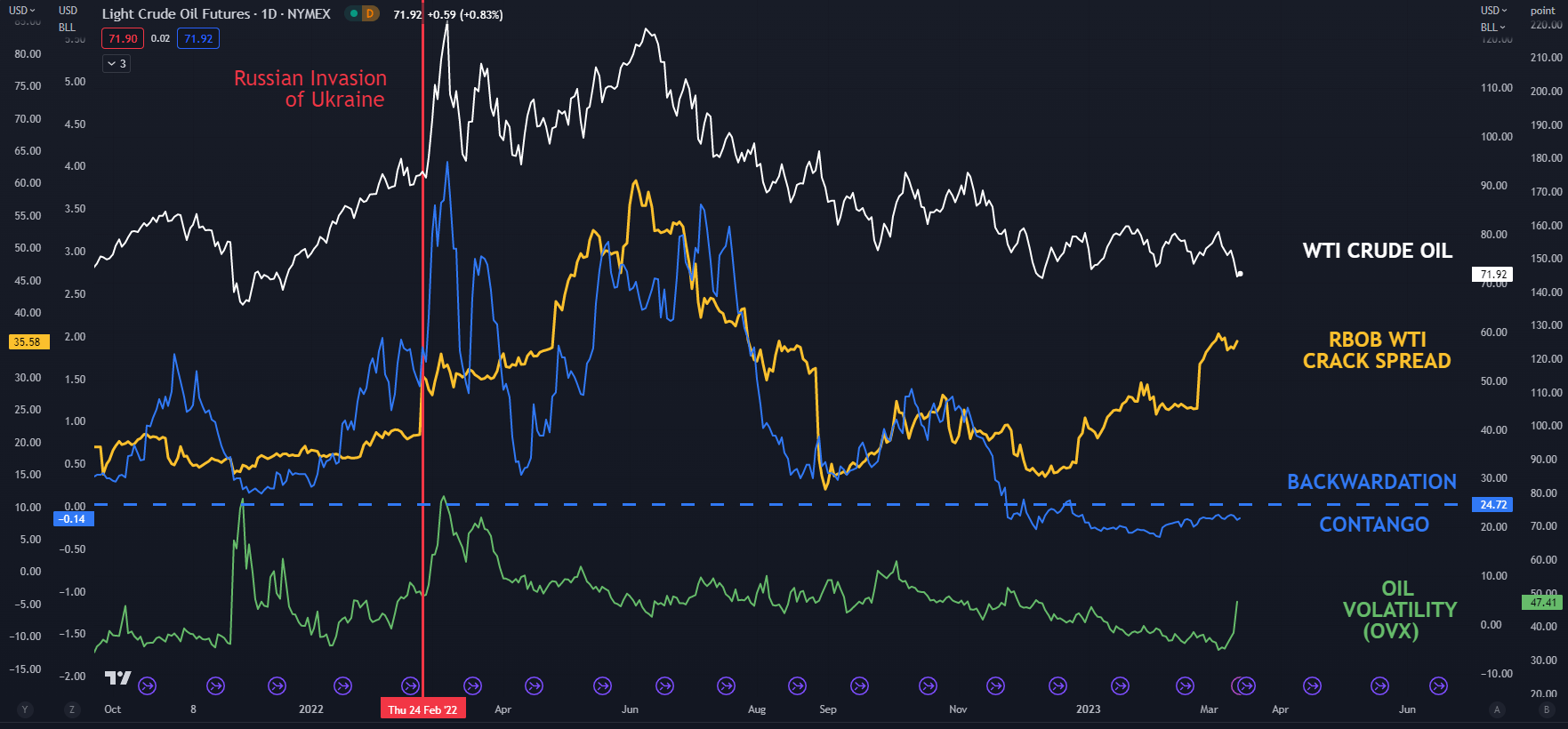

That data may support the current level of the crack spread between the WTI crude and RBOB gasoline futures contracts. The crack spread bifurcates the difference in price between WTI crude oil and refined RBOB gasoline.

It shows the refined product remaining elevated relative to the crude product. This might eventually be supportive of WTI.

Conversely, the move down has seen overall volatility tick higher and may suggest the oil market is looking to cover exposure in the move. The OVX index measures the volatility of oil in a similar way that the VIX index measures the implied volatility on the S&P 500.

Separately, the May 2023 25-delta risk-reversal moved further in favour of puts overnight as it moved toward -6.7 from around -3.0 where it had been trading for the last few weeks.

The risk reversal is the price of a call option in volatility terms less the price of a put option in volatility terms for the same date and delta. This could suggest that more ‘insurance’ is being taken out for downside protection rather than on the upside.

The front two WTI futures contracts reveal a slight bias toward contango, which at the margin might allow for some softening in price.

While the macro environment might be stabilising after the shock collapse of the three banks, the oil market will be watching the official US Energy Information Agency (EIA) inventory data that is due later today.

WTI CRUDE OIL, CRACK SPREAD, BACKWARDATION/CONTANGO, VOLATILITY (OVX)

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]