CRUDE OIL OUTLOOK: SLIGHTLY BEARISH NEAR TERM

- Oil prices fell roughly 4% this week, pressured by demand concerns amid rapidly rising interest rates

- Although oil could trade lower in the coming days, its medium-term outlook remains constructive thanks to the reopening of the Chinese economy

- This article examines the key technical levels to watch in WTI crude oil futures next week

Recommended by Diego Colman

Get Your Free Oil Forecast

Most Read: Gold Charges Toward Fibonacci Support as Markets Bet on Higher Fed Peak Rates

Oil prices, as measured by the WTI front-month futures contract, finished the week sharply lower, down roughly 4% to trade around $76.5 per barrel, undermined by U.S. dollar strength and higher U.S. Treasury yields. Bond rates have risen dramatically this month on hawkish repricing of the Fed’s tightening path, raising fears that the increasingly restrictive monetary policy environment could curtail growth and dent commodities.

WTI and other international benchmarks were also pressured by worries that China’s fuel demand is not yet taking off amid depressed mobility, as Covid-19 continues to rip through the country after the abrupt removal of most pandemic control measures. There is no denying that these concerns are valid, but the current situation in the communist nation is temporary. Once the population achieves herd immunity, the economy should come back with a vengeance, boosting energy consumption. This could occur in short order.

Although market jitters and risk-off sentiment may weigh on cyclical commodities from time to time in the coming days and weeks, China’s reopening, coupled with resilient U.S. economic activity, should create a supportive backdrop for crude later in the year. The bullish scenario should also be reinforced by restrained and disciplined OPEC+ production, with the cartel expected to stick to current output quotas, even if the market balance shifts into a supply deficit during the second half of 2023.

In summary, oil retains a constructive outlook and is biased to the upside over a medium-term horizon on the back of favorable fundamentals, but in the very near future, prices will stay volatile and could fall further, especially if sentiment deteriorates on Wall Street. Speculation is a strong catalyst and can, at times, dictate the short-term direction for most tradable assets.

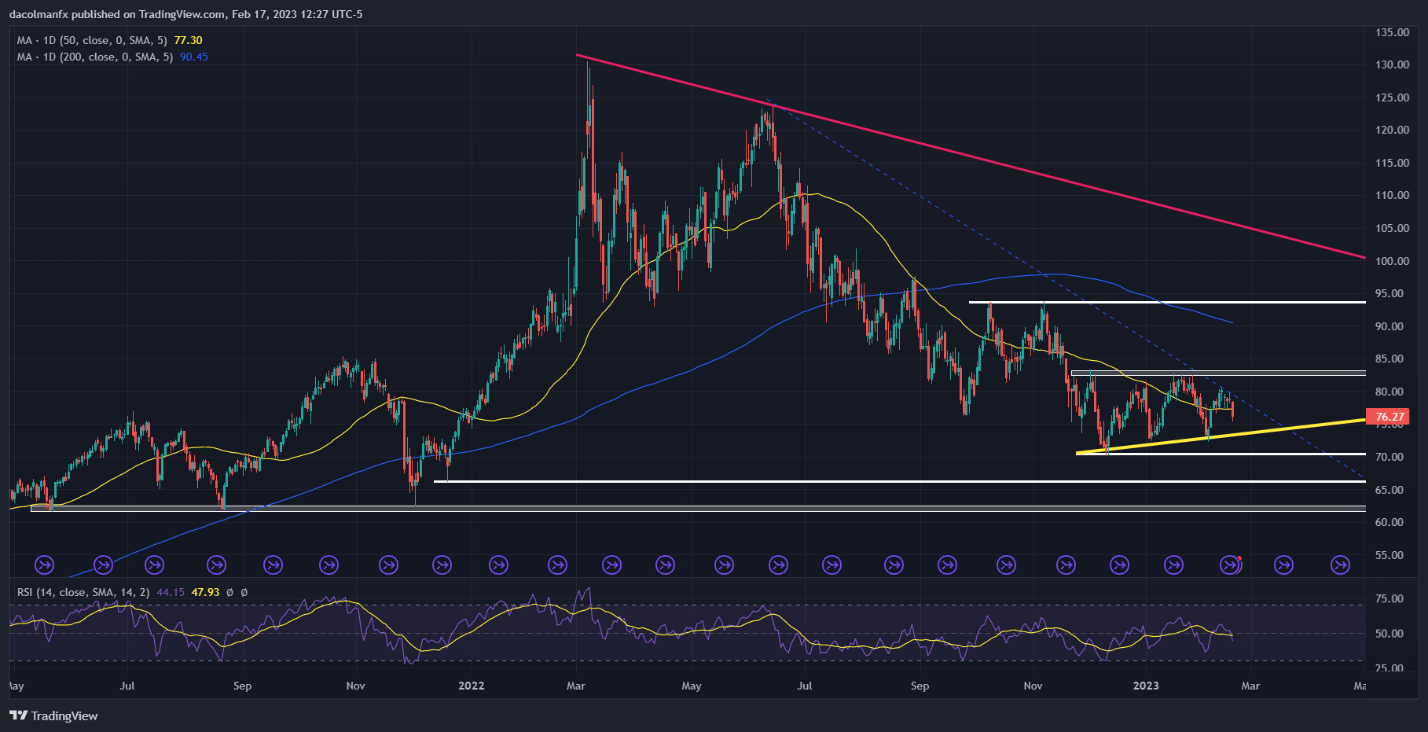

In terms of technical analysis, oil appears to be developing a head and shoulders pattern as seen in the daily chart below. This bearish formation could be confirmed if prices complete the second shoulder and break below the neckline at around $73.50. This breakdown could spark the next leg lower, paving the way for a retest of the $70 area, followed by $66.20.

On the flip side, if buyers return and trigger a bullish reversal, initial resistance can be found around the psychological level of $79. If that ceiling is breached on the topside, upside momentum could accelerate, with the January high becoming the next area of focus for market bulls.

| Change in | Longs | Shorts | OI |

| Daily | 15% | -31% | 0% |

| Weekly | 16% | -36% | -1% |