[ad_1]

CRUDE OIL ANALYSIS & TALKING POINTS

- Chinese growth story continues to back higher crude oil prices.

- Cautious trading ahead of Fed Chair Powell’s testimony later today.

- Will triangle breakout extend higher post-Powell?

Recommended by Warren Venketas

Get Your Free Oil Forecast

CRUDE OIL FUNDAMENTAL BACKDROP

Crude oil is looking for its 6th consecutive positive day this Tuesday which has gathered steam from positivity around the Chinese economy. Although China revised growth forecasts (GDP) higher to 5% after a roughly 3% last year, markets were expecting something in the range of 5.5-6%. Markets have since dismissed this and seem to be focusing on the fact that there is a marked improvement which should lead to higher oil consumption while heightening the chance for GDP figures to outstrip the 5% projection. The end of 2022 saw an increase in stockpiles and thus spare capacity but since the China ‘re-open’ and removal over COVID restrictions came into play, this seems to be on the decline.

Foundational Trading Knowledge

Commodities Trading

Recommended by Warren Venketas

The focal point for today comes via Fed Chair Jerome Powell who will be testifying in front of the Senate Banking Committee (see economic calendar below) and will be sure to stoke some market volatility. Guidance around the thinking of the Fed in upcoming meetings after taking into account strong US economic data will be of key concern. Currently, money markets are expecting a 25bps rate hike in the next meeting but a 50bps increment is not completely off the table. Anything slightly hawkish could weigh on crude oil prices as the USD strengthens.

Closing out the US trading session sees the API weekly report come under the spotlight and should stocks show another fall, crude oil may receive some support.

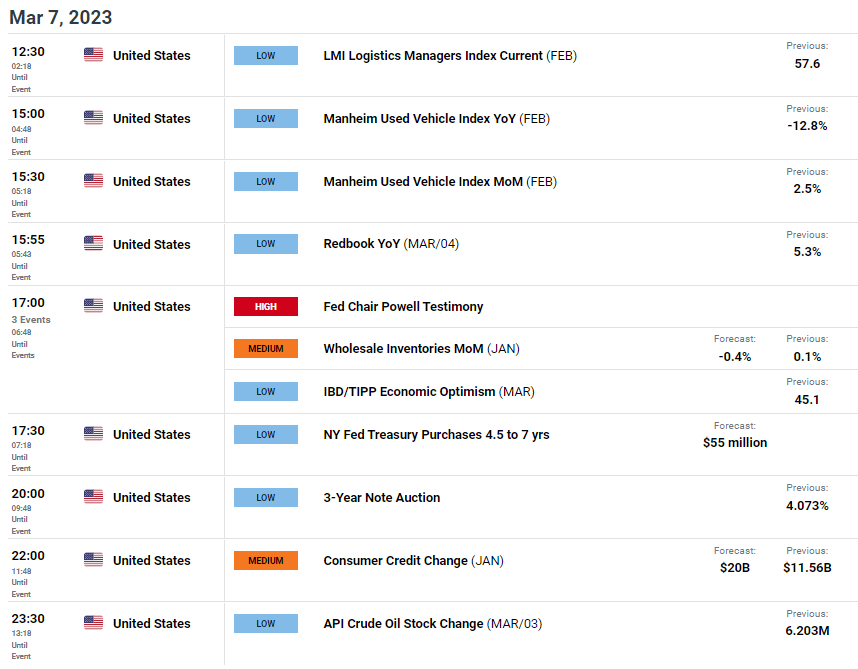

ECONOMIC CALENDAR

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

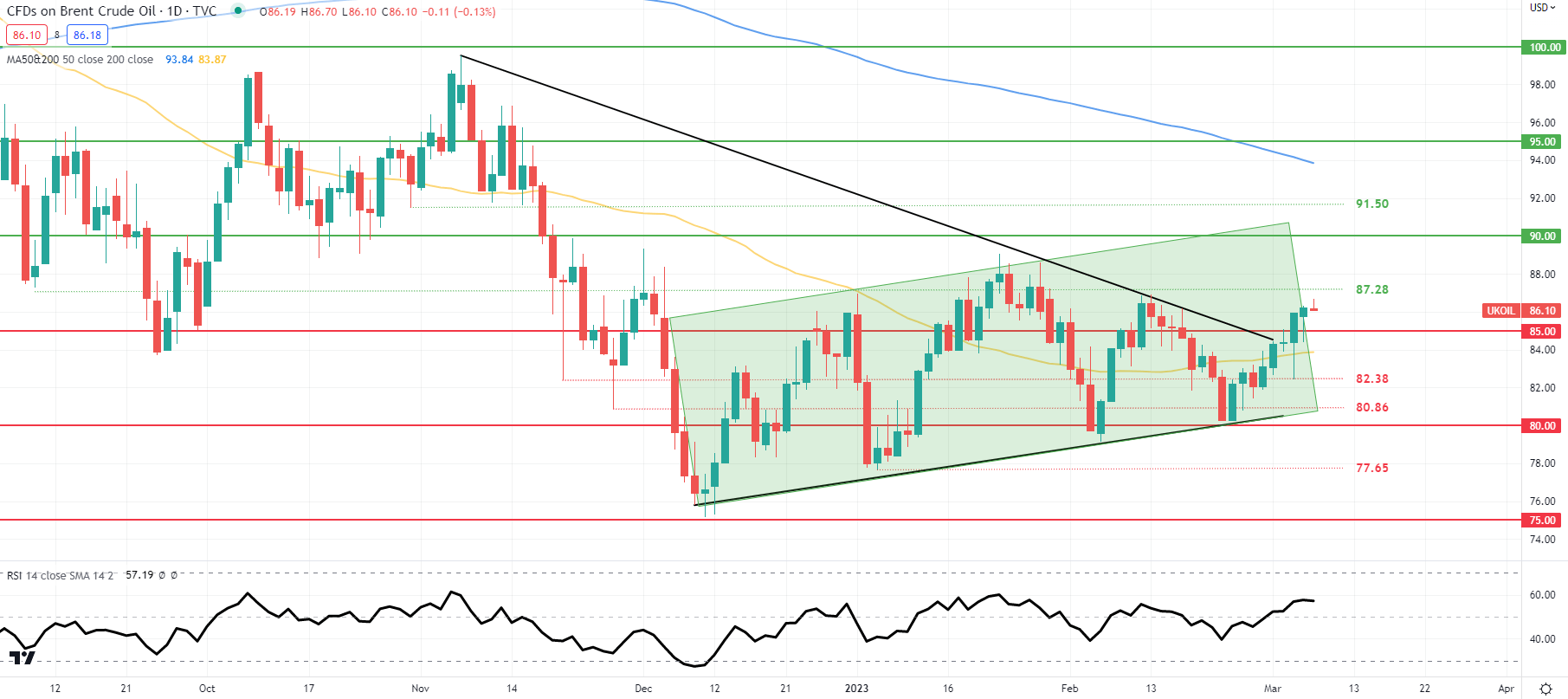

BRENT CRUDE (LCOc1) DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily Brent crude chart has surpassed the 85.00 psychological handle but remains withing the bear flag chart pattern (green). This could point to short-term upside followed by medium-term weakness as the Relative Strength Index (RSI) looks to push higher towards overbought territory.

Key resistance levels:

Key support levels:

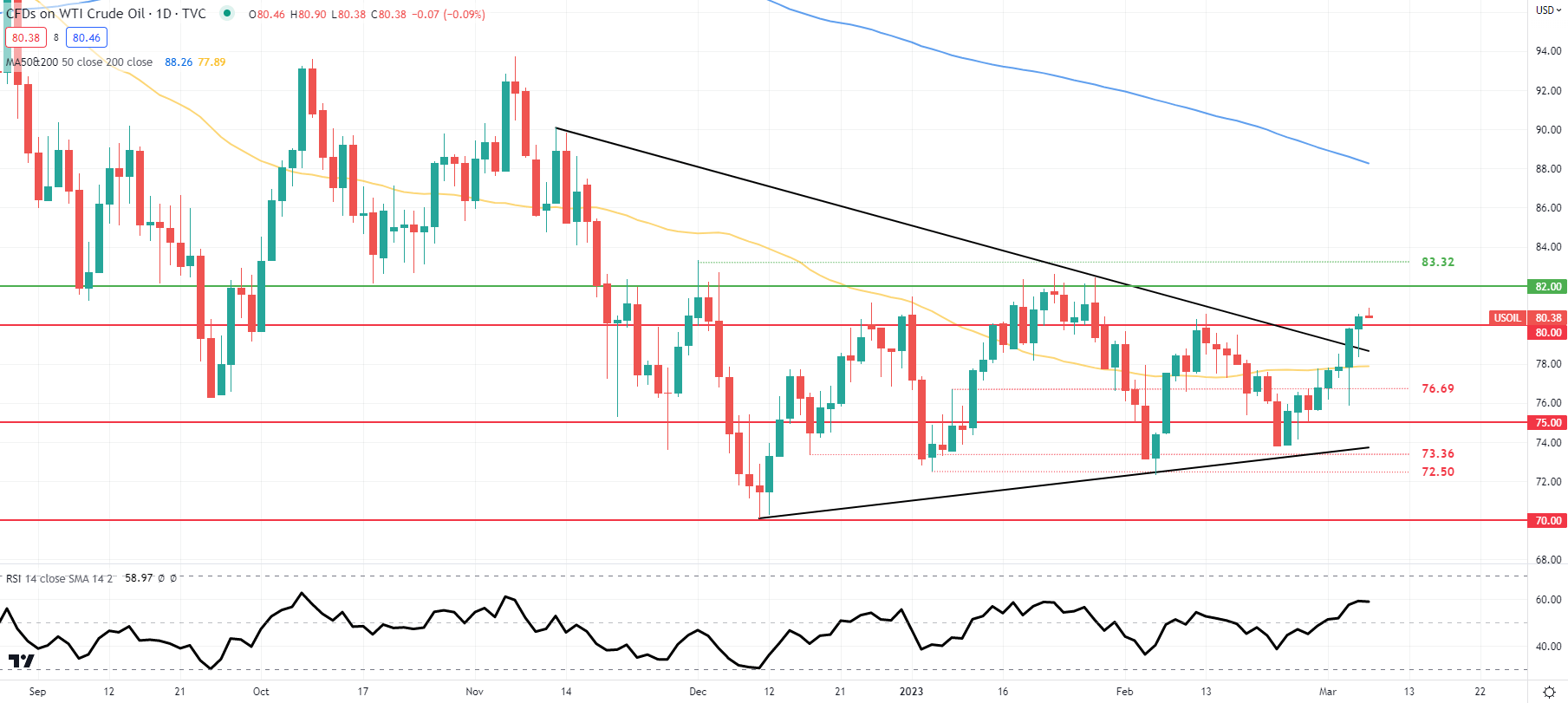

WTI CRUDE (CLc1) DAILY CHART

Chart prepared by Warren Venketas, IG

The WTI daily chart reflects a similar move breaking out of the symmetrical triangle formation (black) now trading above the 80.00 level. Today’s price movement should be relatively range bound prior to Fed Chair Jerome Powell’s address but could see some large swings depending on the testimony.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT: BULLISH

IGCS shows retail traders are NET LONG on Crude Oil, with 58% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment; however, due to recent changes in long and short positioning we arrive at a short-term upside disposition.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]