[ad_1]

EUR/USD PRICES, CHARTS AND ANALYSIS:

Recommended by Zain Vawda

Get Your Free EUR Forecast

EUR/USD FUNDAMENTAL OUTLOOK

EURUSD posted modest gains in the Asian session following yesterday’s drop toward the 1.0600 handle. The US Dollar index has seen a slight resurgence following the European open, with the 1.0600 level making way and the 1.0500 level looking more and more likely to be reached.

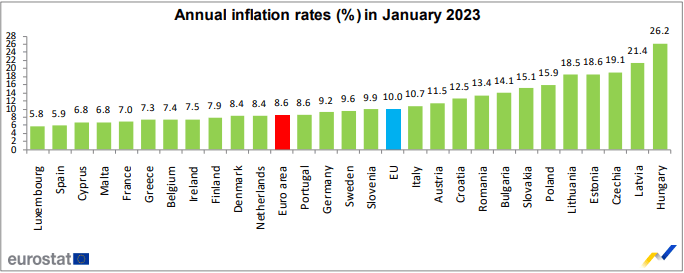

This morning brought Eurozone Inflation data for January with annual inflation down to 8.6% in the euro area and down to 10.0% in the EU. In January, the highest contribution to the annual euro area inflation rate came from food, alcohol & tobacco (+2.94 percentage points, pp), followed by energy (+2.17 pp), services (+1.80 pp) and non-energy industrial goods (+1.73 pp) according to data published by Eurostat, the statistical office of the European Union.

Source: Eurostat

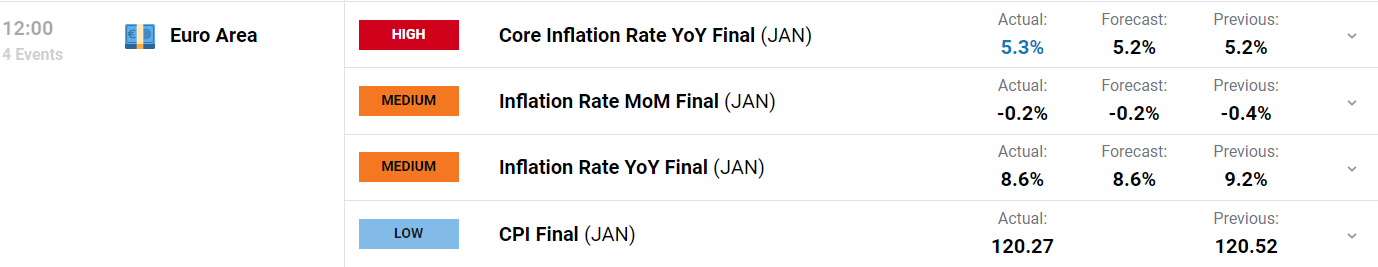

Core inflation however ticked higher coming in at 5,3%, a new record and likely cementing a 50bps hike by the ECB next month. This comes a week after comments by ECB President Christine Lagarde stating her intention for a half point hike.

For all market-moving economic releases and events, see the DailyFX Calendar

FOMC MEETING MINUTES

The Federal Reserve meeting minutes released last night confirmed the hawkish rhetoric from Fed officials over the past two weeks. The key takeaways obviously being that the Fed is committed to higher rates for longer to bring inflation down to its 2% target. The minutes showed that a few Fed officials preferred a 50bps hike at the meeting with the majority sticking to a 25bps hike. Much of the hawkish rhetoric has been priced in already with the Fed funds peak rate expectation already rising from 4.8% to around 5.3% during the month of February. This begs the question, how much higher can the dollar index rise? There is of course a possibility that we continue to see the Dollar index remain supported heading into the March meeting.

Later today we have US GDP Growth Rate 2nd estimate for Q4 2022 with forecasts sitting at 2.9%. We will also get continuing and initial jobless claims which should give further insights into the strength of the labor market and comments from Fed policymaker Bostic ahead of tomorrow’s key US PCE data (Fed’s preferred measure of inflation).

TECHNICAL OUTLOOK AND FINAL THOUGHTS

Given that the FOMC minutes did not spring up any new hawkish surprises it has been interesting to see the dollar index rally continue this morning. Meanwhile the Eurozone core inflation data continues to rise with my view that inflation is far more entrenched in economies globally than market participants believe.

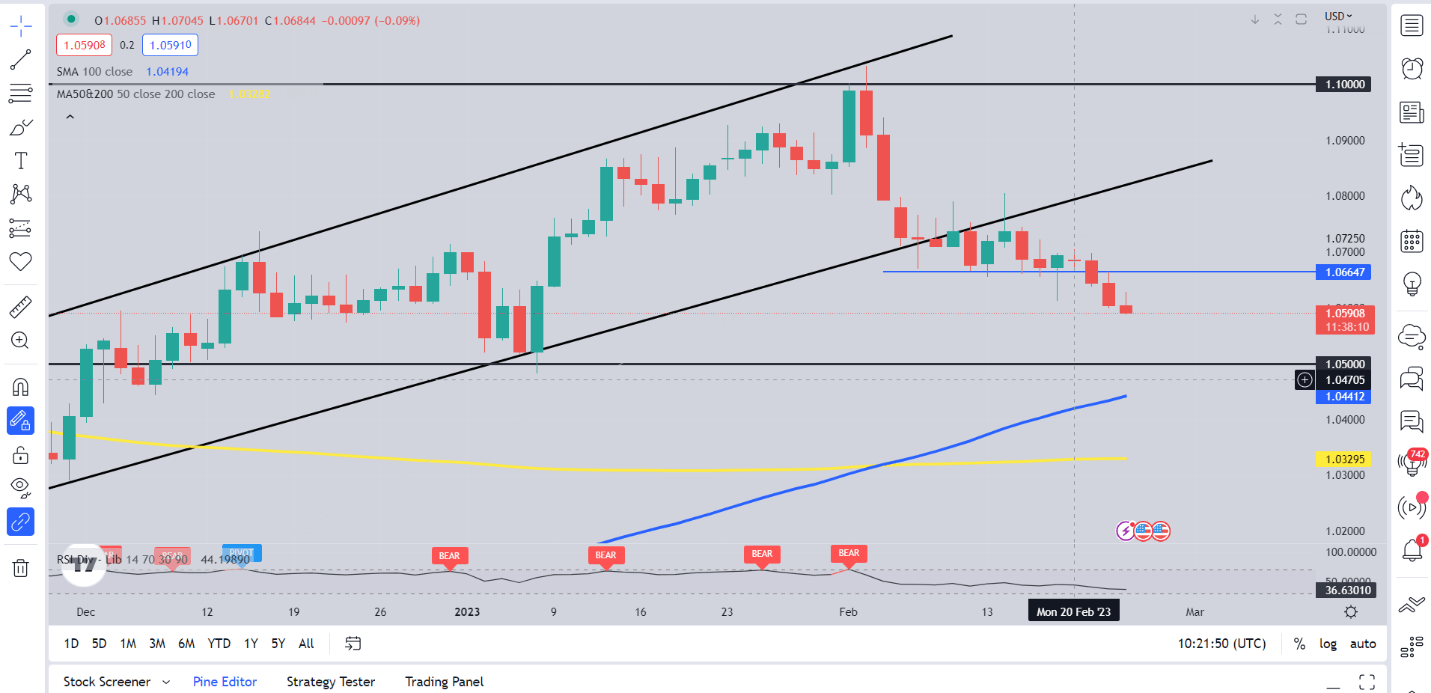

From a technical perspective, EURUSD saw a daily candle close just above the key 1.0600 level following last night’s FOMC minutes release. This key support level has now given way opening up the possibility of continued downside with immediate support resting around the 1.055 handle and below that at 1.0500. A daily candle close below the 1.0600 handle is still needed in my opinion for the move to be sustainable moving forward.

EUR/USD Daily Chart – February 23, 2023

Source: TradingView

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]