[ad_1]

EUR/USD PRICE, CHARTS AND ANALYSIS:

- EUR/USD Arrests Slide Below the 1.0800 Handle as Overall Sentiment Improves.

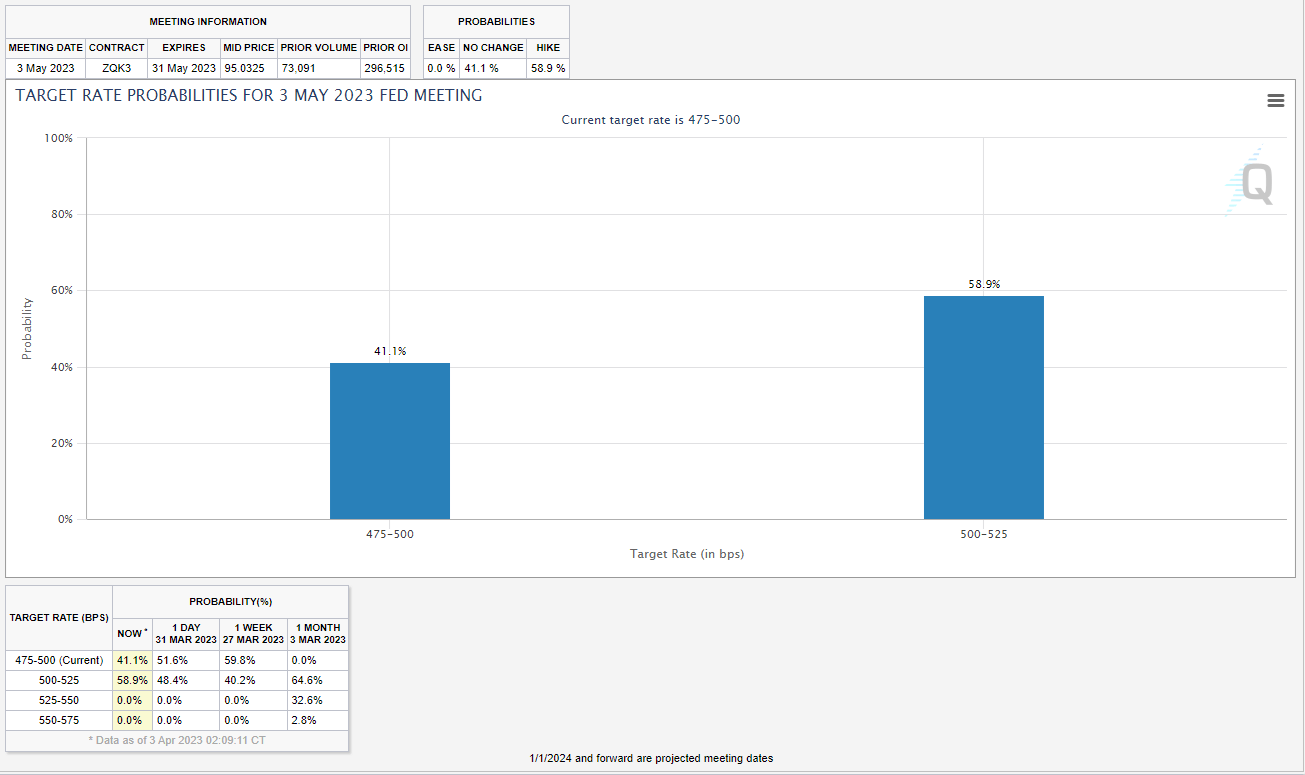

- Market Participants are Pricing in a Higher Probability of a 25bps hike by the FED in May.

- Technicals Hint at Further Upside if we Remain Above the 1.0800, with 1.1000 a Possibility.

- To Learn More About Price Action, Chart Patterns and Moving Averages, Check out the DailyFX Education Section.

Recommended by Zain Vawda

Download the Updated Q2 Forecast Now

EUR/USD FUNDAMENTAL OUTLOOK

EURUSD faced selling pressure in the Asian session as a combination of dollar strength and recessionary fears dented sentiment. EURUSD has recovered since the London open with a 70 pip bounce leaving the pair trading marginally up for the day (at the time of writing) around the 1.0850 handle.

The weekend brought a surprise production cut by OPEC which has seemingly raised fears around a global recovery as well as stoked inflation fears as oil prices are expected to head higher. The move by OPEC has also helped spur on a higher probability of a 25bps hike by the Fed at its upcoming March meeting. According to the CME FedWatch Tool Markets are now pricing in a 58.9% probability of 25bp hike, up from 48.4% a day ago.

Source: CME FedWatch Tool

At the back end of last week, we had some hawkish comments from Fed members as well which started a modest dollar recovery during Fridays New York Session. We heard comments from Fed policymaker Susan Collins who emphasized the need for higher rates as the Fed looks to tame inflation while policymaker Williams said he expects inflation to drop to around 3.25% in 2023, before the Fed may achieve its inflation target of 2% in 2024.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

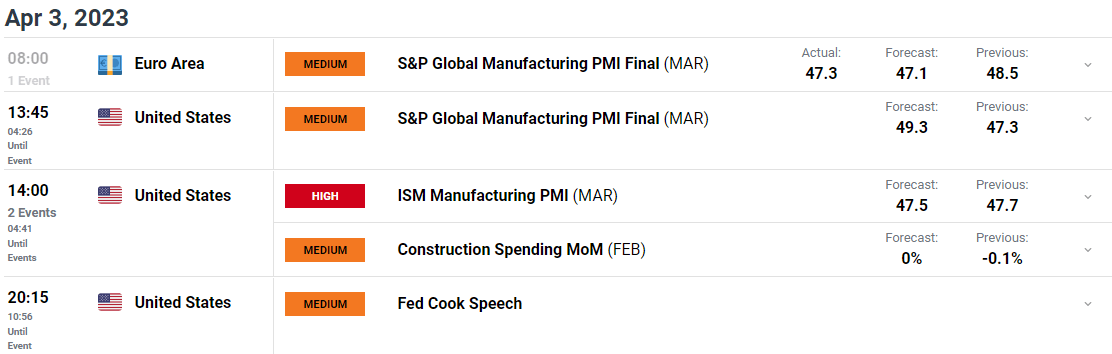

On the economic docket for the day, we have had the final S&P PMI data from the Euro Area. The main focus will however be on the US session as we have ISM Manufacturing PMI later today as well as comments from Fed policymaker Cook which dollar bulls will be keeping a close eye on.

For all market-moving economic releases and events, see the DailyFX Calendar

TECHNICAL OUTLOOK AND FINAL THOUGHTS

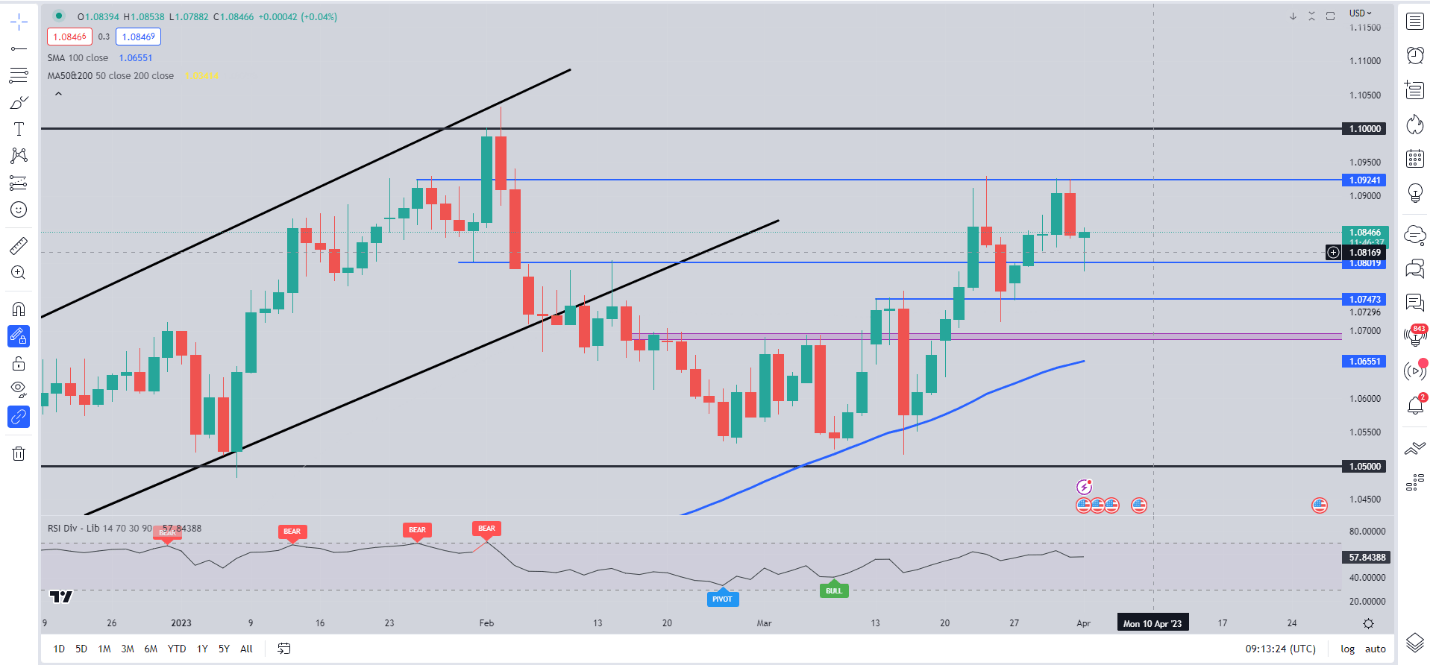

The overnight rally by the US dollar has been wiped away following the London open with EURUSD trading marginally higher for the day. ISM data later may provide some impetus to the dollar but if sentiment continues to improve Euro bulls could take control, with a retest of the 1.0900 and 1.0920 resistance level a possibility. Upside still appears the most favorable path with price action and Fundamentals still supportive of EURUSD moving higher with 1.1000 a possibility.

From a technical perspective, EURUSD remains in a delicate position with the 1.0800 handle holding the key to its next move. A failure to close below the 1.0800 handle leaves euro bulls firmly in control with immediate resistance around the 1.0920 area before the key psychological 1.1000 level may come into play.

Should we see a return of the uncertainty experienced in the Asian session and record a daily candle close below the 1.0800 level, support at 1.0750 and 1.0690 may come into focus. Bear in mind this is NFP week and thus continued rangebound trade may be a possibility ahead of the Friday release.

EUR/USD Daily Chart – April 3, 2023

Source: TradingView

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Zain Vawda

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]