[ad_1]

EUR/USD Price, Chart, and Analysis

- ECB will go ahead with a half-point rate hike.

- EUR/USD may move further higher as the Fed decides.

Recommended by Nick Cawley

Forex for Beginners

Most Read: Euro Week Ahead Forecast: Will ECB Hawks Gain the Upper Hand on Rate Hikes?

The European Central Bank (ECB) will go ahead and hike interest rates by 50 basis points at tomorrow’s meeting, despite the ongoing banking sector turmoil, according to a Reuters sources report. According to this morning’s report, the ECB believes markets are calming, that inflation remains stubbornly high, and that their credibility would be damaged if they didn’t deliver a half-point rise on Thursday. Recall that at the last meeting, where the central increased rates by 50bps, President Lagarde specifically said that they would raise rates by the same amount in March.

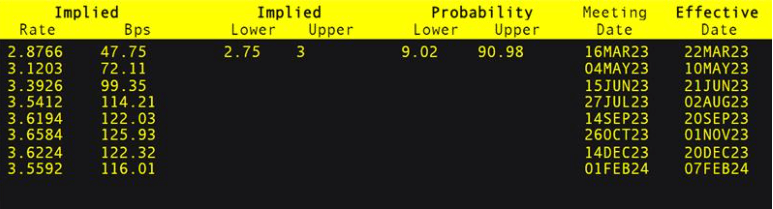

The financial markets are pricing in a 50 basis point hike tomorrow with further, smaller increases seen over the coming months. One ECB hawk, Austrian central bank governor Robert Holzmann, recently called for four consecutive half-point hikes to control rampant Euro Area inflation. This call however was made before last week’s US bank turmoil and subsequent contagion fears.

The ECB source report also revealed that the central bank believes that inflation will still be significantly above target (2%) in 2024 and slightly above in 2025. Euro area annual inflation is currently 8.5%, according to a flash Eurostat report.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

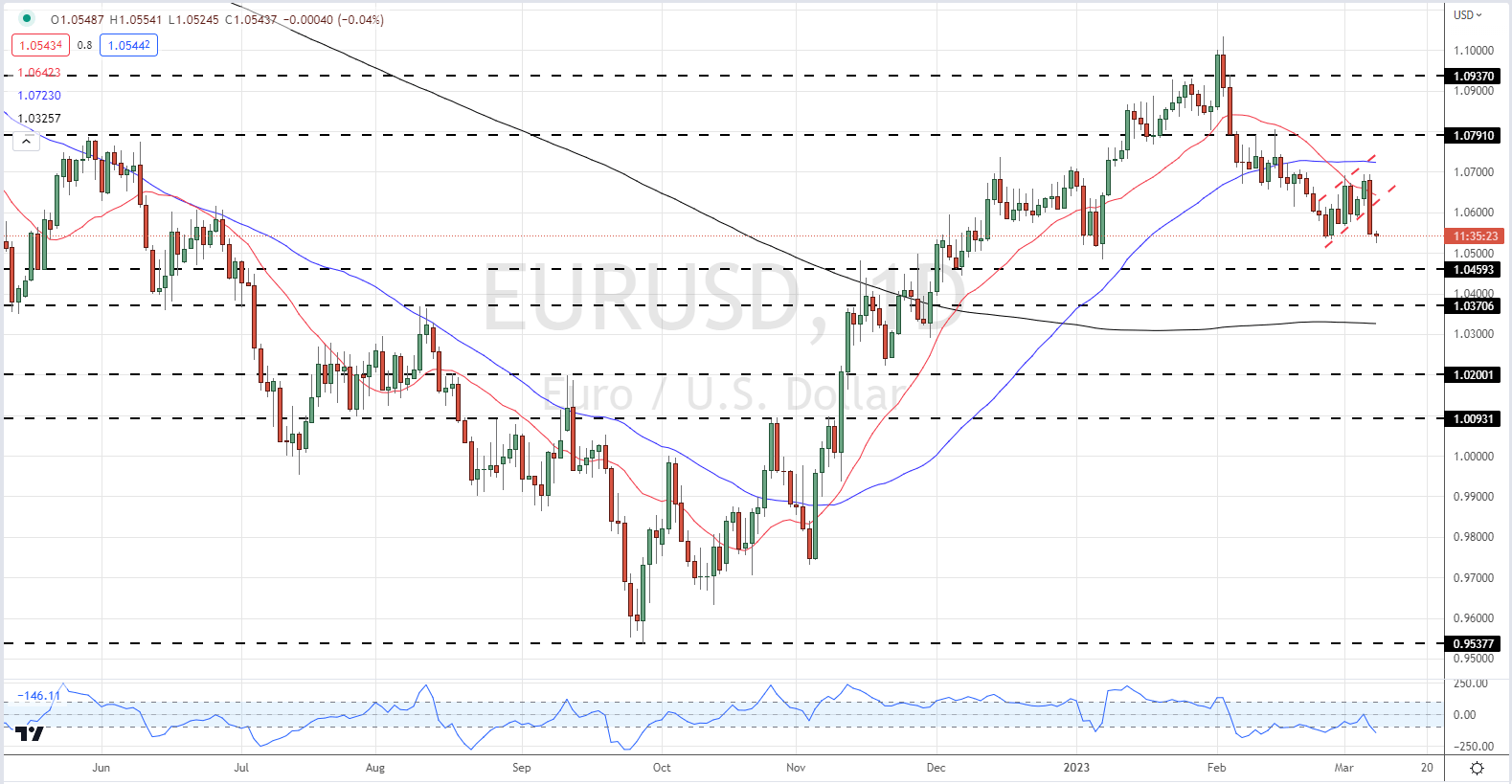

EUR/USD continues its recent, slow, move higher and touched a fresh one-month high of 1.0760 earlier today. The daily chart shows a bullish channel steering the pair higher, supported by all three moving averages. The CCI indicator is in overbought territory and this may temper further short-term gains. The next level of resistance is seen at 1.0790/1.0800 ahead of 1.0900, while a cluster of recent lows around 1.0530/1.0540 should provide firm support.

EUR/USD Daily Price Chart – March 15, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 1% | 10% | 6% |

| Weekly | -33% | 51% | -4% |

Big Shifts in Retail Positioning

Retail trader data show 44.80% of traders are net-long with the ratio of traders short to long at 1.23 to 1.The number of traders net-long is 0.60% higher than yesterday and 32.81% lower from last week, while the number of traders net-short is 9.46% higher than yesterday and 52.68% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]