[ad_1]

Euro, EUR/USD, US Dollar, AUD/USD, China, Crude Oil, Gold – Talking Points

Recommended by Daniel McCarthy

Introduction to Forex News Trading

The Euro is weaker today as the US Dollar gains ahead of a crucial week of central bank meetings and data.

The Federal Reserve, the European Central Bank (ECB) and the Bank of England (BoE) lead the line-up. All three banks are priced by the market to lift rates by 50 basis points (bps).

Risk assets in general have come under pressure on Monday despite more signalling from China that they could be shifting away from their highly restrictive Covid-19 policy. A top health official has said that the death rate of the omicron variant is roughly the same as the flu.

APAC equities are a sea of red and the growth-linked Australian Dollar is the worst-performing currency through the Asian session.

US PPI on Friday was hotter than forecast at 7.4% year-on-year to the end of November. US CPI on Tuesday is now in focus.

Crude oil is steady so far despite news that a significant North American pipeline remains shut. The Keystone Pipeline connects the Canadian oil fields with the US Gulf Coast.

The WTI futures contract is near US$ 71.60 bbl while the Brent contract is a touch above US$ 76.50 bbl at the time of going to print. Gold has eased below US$ 1,800 while Treasury yields beyond 2-years slipped a couple of bps.

Elsewhere, US officials have asked Japan to curb chip exports to China, adding to last week’s request to the Netherlands for the same action.

It is a busy day for UK data with the trade balance, industrial and manufacturing production figures being the highlight.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade EUR/USD

EUR/USD TECHNICAL ANALYSIS

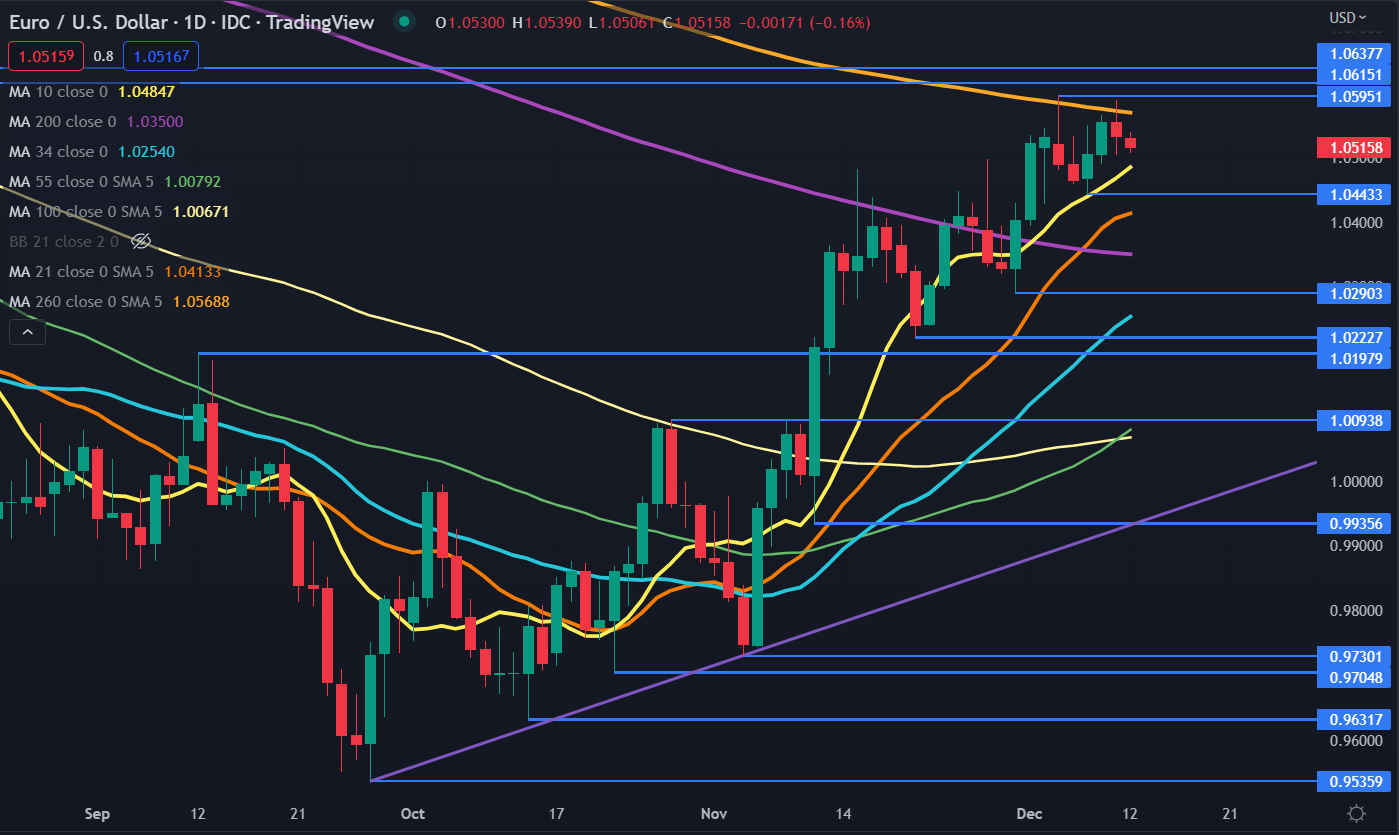

EUR/USD has been rallying since making a twenty-year low at 0.9536 in October. It traded as high as 1.0595 but it has been unable to overcome a breakpoint and previous peak at 1.0615 and 1.0638 respectively. These levels may continue to offer resistance.

The 260-day simple moving average (SMA) was also in that region and could also provide resistance, currently at 1.0569.

On the downside, support might be at the prior lows and breakpoints of 1.0443, 1.0290, 1.0223 and 1.0198.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]