[ad_1]

EUR/USD Price, Chart, and Analysis

- The Euro shrugs off a better-than-expected German ZEW release.

- EUR/USD struggling to push higher as the greenback grabs a small bid.

Recommended by Nick Cawley

Get Your Free EUR Forecast

For all market-moving economic releases and events, see the DailyFX Calendar

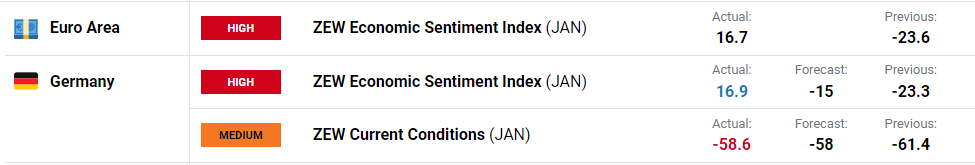

The latest ZEW German economic sentiment index jumped in January beating both last month’s reading and market forecasts. The positive reading, the first one since February 2022, points to ‘a noticeable improvement in the economic situation over the next six months’ while the prospect that inflation will continue to fall, ‘has brightened expectations for the consumer-related sectors’, according to ZEW President Professor Achim Wambach. The comparable Euro Area index also rose sharply.

ZEW – Optimistic Start to the Year

Today’s ZEW release had little to no effect on the Euro which is treading water against the US dollar so far today. The greenback is trying to nudge higher ahead of the US open but remains under longer-term pressure as rate expectations are pared back. While today’s US economic docket is bare, tomorrow’s sees the release of the latest producer price data at 13:30 GMT. Core PPI monthly data is expected to turn lower after last month’s uptick, while the annual figure is also seen falling lower as factory gate prices dip further. The monthly figure is expected at 0.1% compared to 0.4% in November while the annual figure is forecast to fall to 5.7% from a prior 6.2%. Falling consumer and factory gate prices will please the Fed and keep interest rate hikes expectations anchored at their current low levels.

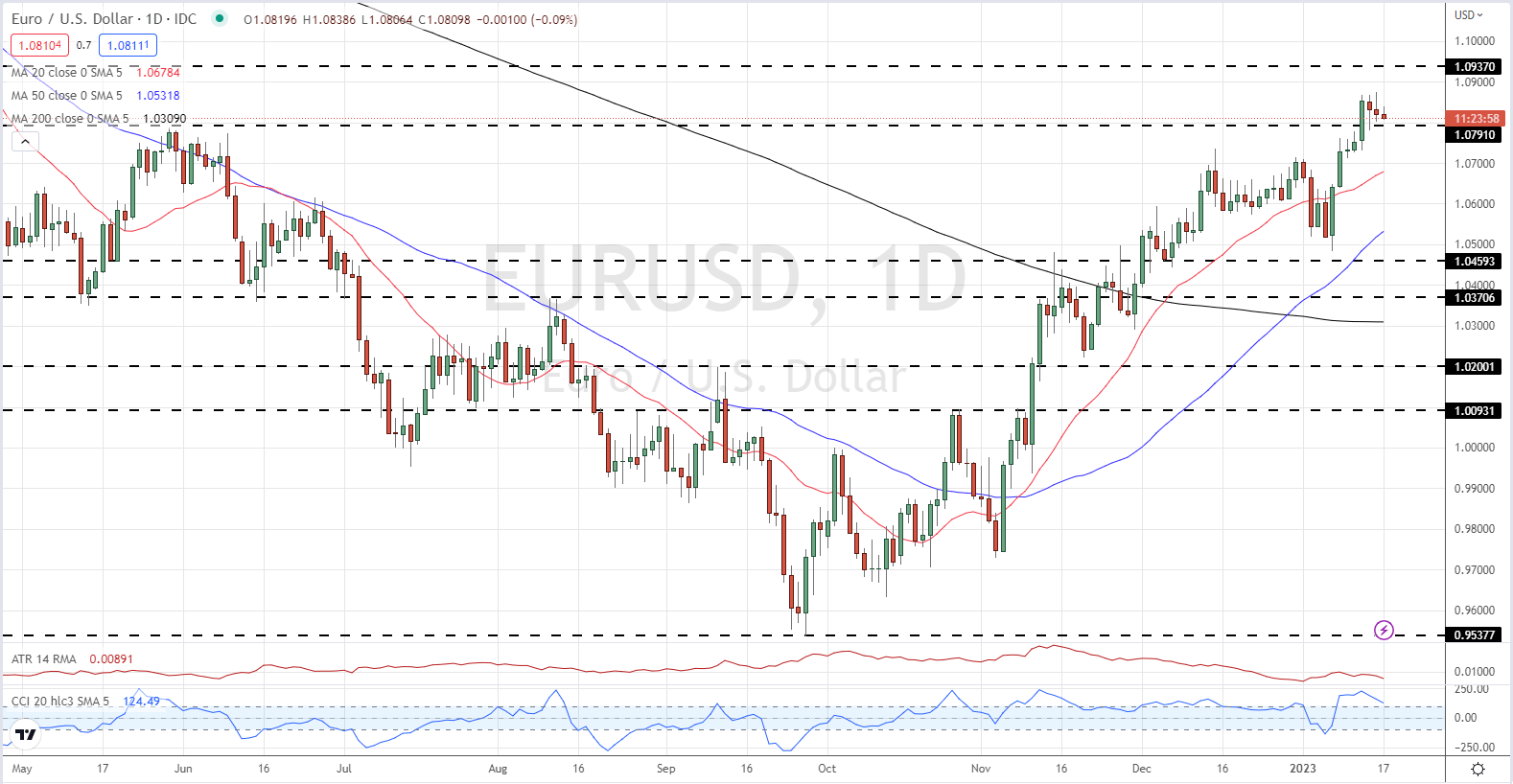

EUR/USD remains above 1.0800 with first-line support seen around 1.0790. A break below here would bring into play a cluster of recent highs and lows all the way down to 1.0700. Monday’s 1.0874 high is the first upside target.

EUR/USD Daily Price Chart – January 17, 2023

Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | 12% | 5% | 8% |

| Weekly | 26% | -10% | 1% |

Retail Traders Remain Short But Top Up Their Net-Long Positions

Retail trader data show 37.45% of traders are net-long with the ratio of traders short to long at 1.67 to 1.The number of traders net-long is 15.81% higher than yesterday and 23.16% higher from last week, while the number of traders net-short is 1.35% higher than yesterday and 10.19% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]