FTSE 100 ANALYSIS & TALKING POINTS

- China’s manufacturing sector managed its strongest gain since April, 2012 last month

- Stocks in Asia and Europe got a boost

- The London benchmark is well-stocked with mining names that look hopefully to China

Recommended by David Cottle

Get Your Free Equities Forecast

FTSE 100 INDEX FUNDAMENTAL BACKDROP

The FTSE 100 index shared in a general boost for stocks Wednesday following some blockbuster manufacturing data out of China.

That country’s Purchasing Managers Index for February stormed in at 52.6, the fastest pace of expansion since April 2012 and well above January’s anemic 50.1 print. In the logic of PMI surveys, 50 is the point which separates growth from contraction.

The data have provided support for the more obviously growth-tracking assets such as stocks and the commodity dollars of Australia and New Zealand. London’s blue-chip benchmark index is well-stocked with the miners and diggers who stand to gain if Chinese raw material demand perks up, and it duly logged gains.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

China’s service sector also managed solid growth, raising hopes that the substantial lifting of Covid-related restrictions has put some serious spring back into China’s economic step.

The FTSE 100 isn’t desperately dependent on its home economy, but there was some rare cheer there this week too. Prime Minister Rishi Sunak reached a deal Tuesday with the European Union over the status of Northern Ireland, which, it is hoped, will open up broader post-Brexit trade between the EU and its former member state.

The Bank of England struck a note of gloomy realism, with Governor Andrew Bailey saying on Wednesday that there was no easy way out of the country’s cost of living crisis. He added that further interest rate rises were likely to be data-dependent, however, although of course he could not rule them out. His words didn’t obviously dampen investor enthusiasm for a FTSE still focused on those China numbers.

Recommended by David Cottle

Get Your Free GBP Forecast

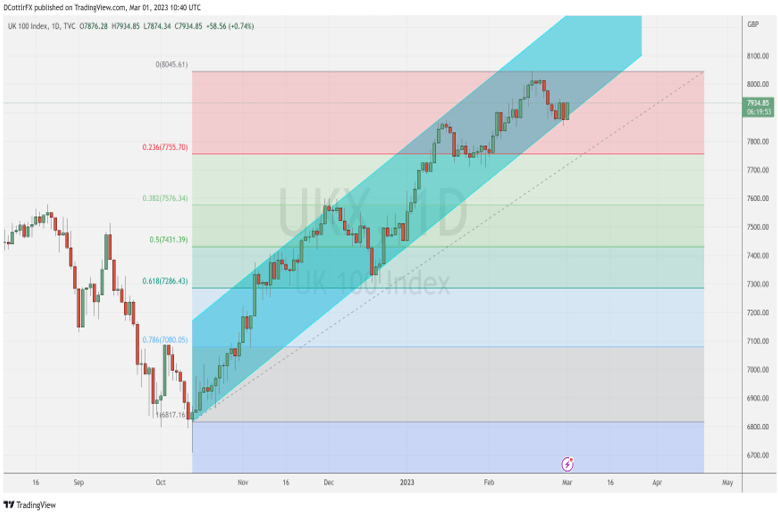

FTSE 100 Technical Analysis

Chart Compiled Using TradingView

The index has enjoyed along with many others a strong run of gains since October 2022, but there may be some signs that a bit if exhaustion is setting in. This may simply be a consolidative phase of course, and a precursor to more gains, but, all the same, near-term price action is likely to bear close watching.

A well-respected uptrend channel from those October lows is coming under pressure and it will be interesting to see if the index can manage to close above it this week. The channel will break on any fall below 7788.05.

If that gives way, focus will quicky shift to the first Fibonacci retracement of the rise up from October to the peaks of mid-February. That comes in at the 7755.70 level, not far below the current market.

A slide to this point may suggest that a head and shoulders formation is brewing on the daily chat and that in turn could point to further falls, but the index has yet to fall so far below the peaks of last month as to put them out of range of a determined bullish attempt.

However, IG’s own sentiment index supports the view that upside progress will be hard-won, at least in the near term. Only 20% of traders are on the bullish side.

–By David Cottle for DailyFX