[ad_1]

German Dax 40, FTSE 100 Latest:

- German Dax builds in a solid range that has continued to hold over the past few weeks.

- FTSE 100 dips below the 20-day MA (moving average) – strikes over wages in the UK rise but stocks hold steady (at least for now).

- Equity indices remain resilient ahead of central bank meetings and dampened sentiment.

Recommended by Tammy Da Costa

Get Your Free Equities Forecast

European equities are holding steady in a solid range with Dax and FTSE both stalling at resistance.

As markets prepare for the next batch of rate decisions, political and economic turmoil has been overshadowed by expectations that inflation may have peaked.

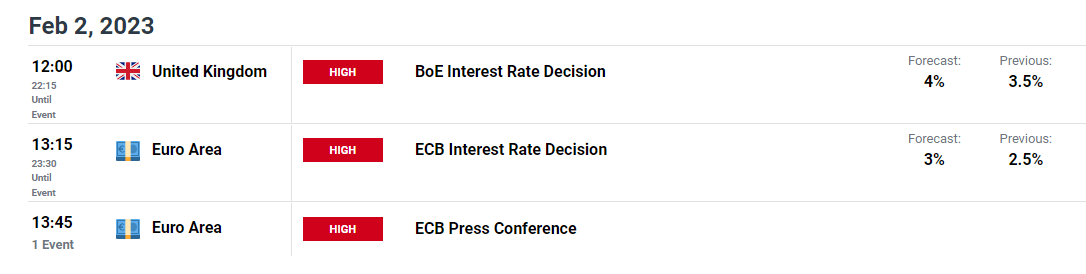

With the ECB (European Central Bank) and BoE (Bank of England) expected to implement another 50 basis-point increase on Thursday, the FOMC is expected to announce a 25-basis point rate hike later today.

DailyFX Economic Calendar

Although earnings have been mixed, there has been a notable deceleration in growth forecasts over the past year. However, with the fundamental backdrop largely priced in, global stock indices have remained resilient, rising to levels last seen before the onset of the war in Ukraine (which began on 24 Feb 2022).

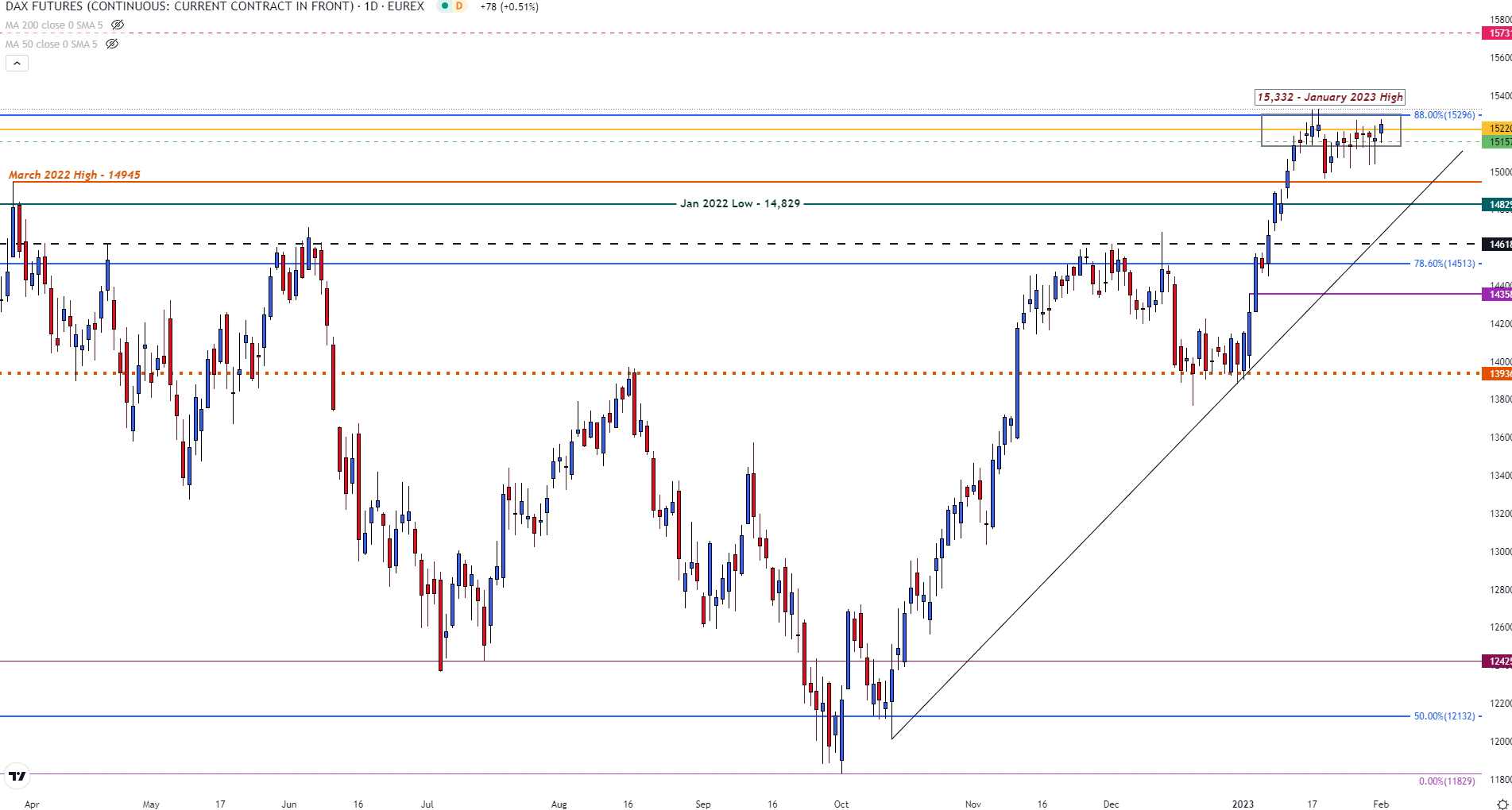

Dax 40 Technical Analysis

At the time of writing, Dax futures are trading marginally higher, slightly above 15,220. With recent price action trading in a tight zone of support and resistance between 15,150 & 15,280; the 88% Fibonacci retracement of the 2020 – 2021 move has formed an additional barrier at 15,296.

Dax Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Since reaching a high of 15,332 last month, bullish momentum eased, driving Dax towards psychological support at 15,000. But, after rebounding off this level, prices stabilized in the current range. As pressure continues to build, bulls have a few hurdles to clear before prices can retest the 2022 high of 16,274.

With the 15,300 psychological level hovering above, a break of 15,400 could open the door for the Feb 2022 high of 15,731.

On the contrary, a move below 15,150 and a break of 15,000 could fuel bearish momentum towards the Jan 2022 low at 14,829.

FTSE Technical Analysis

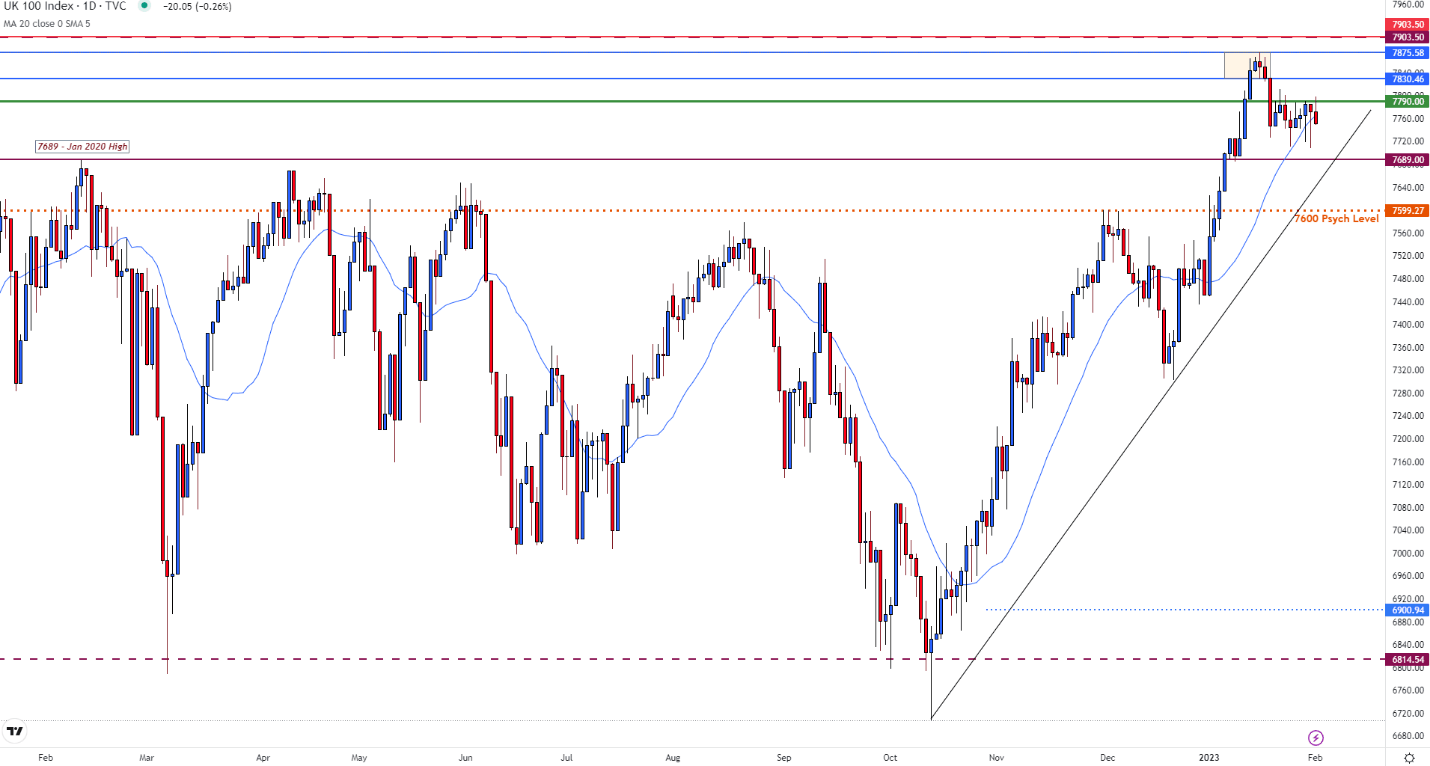

Despite the unrest over wages in the UK, the FTSE 100 continues to trade above 7,750. While the 20-day MA (moving average) holds as support at 7764, a break of 7,689 (January 2020 high) may allow bears to drive prices towards 7,600.

FTSE 100 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

For the upside to prevail, bulls need to clear 7,800 in an attempt to break the January high of 7,875.58.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]