[ad_1]

UK GDP Key Points:

Recommended by Zain Vawda

Get Your Free GBP Forecast

READ MORE: USD/CAD Rangebound Ahead of Important Canadian Inflation Data

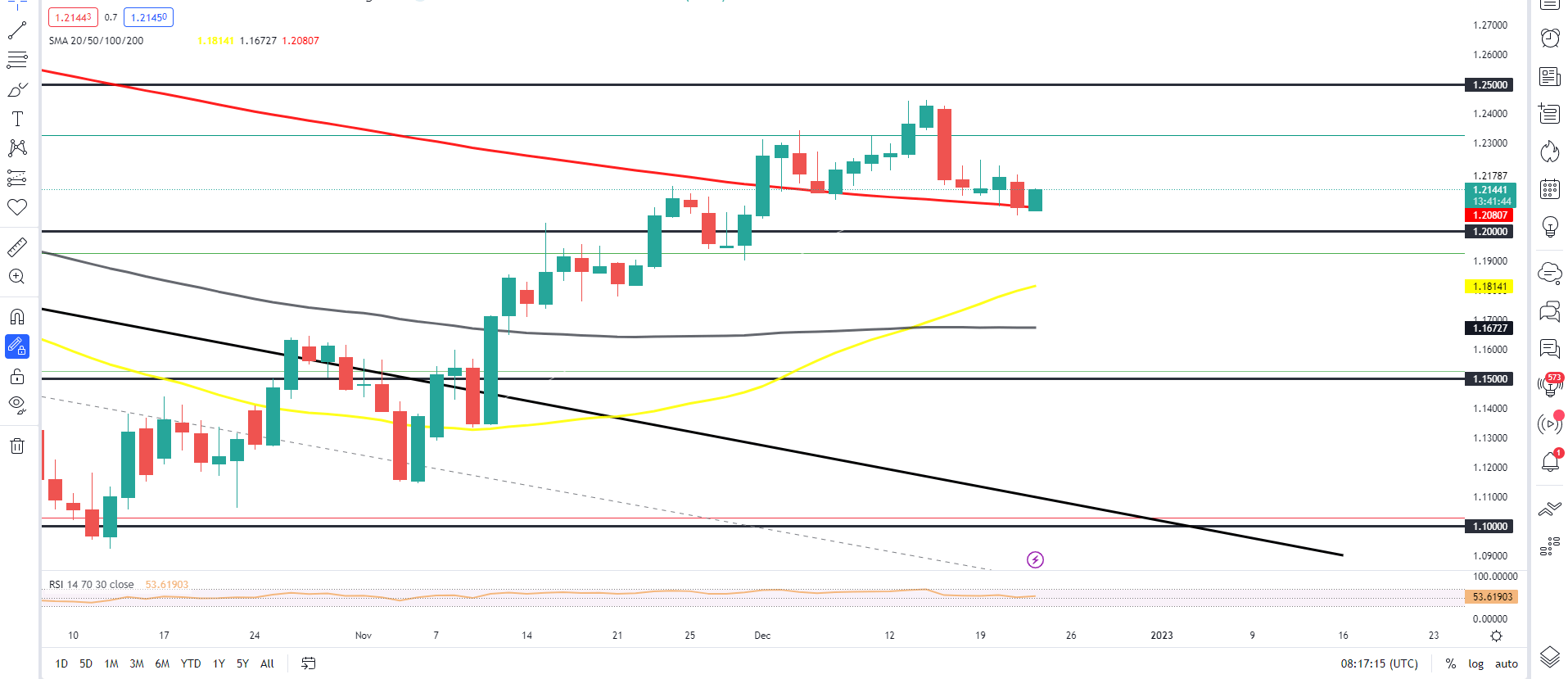

GBP/USD continues to flirt with a break or bounce of the 200-day MA just below the 1.2100 level. Earlier this morning we had weaker than expected UK Q3 GDP data which failed to inspire a break lower with the lack of liquidity in markets no doubt playing a role. The data adds further credence to the belief that the UK has slipped into a recession.

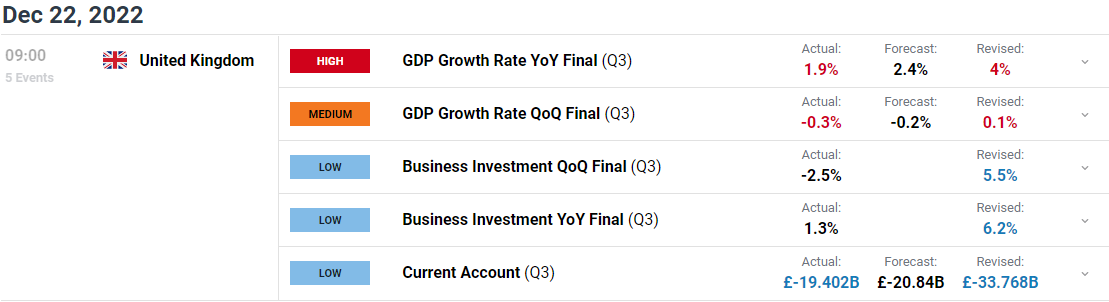

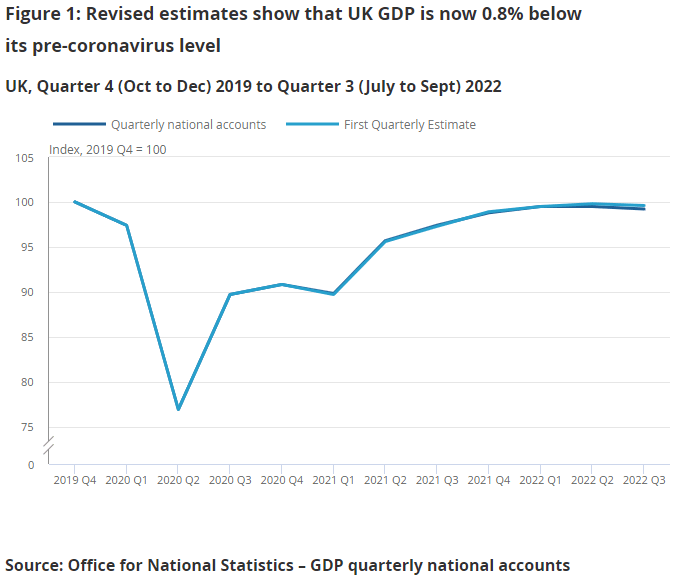

UK GDP data is estimated to have fallen by 0.3% in Q3, a downward revision from the first estimate of 0.2%. We have seen downward revisions across 2022 meaning that real GDP is now estimated to be 0.8%, below its pre-pandemic level (revised from the previous estimate of being below 0.4%). Real households’ disposable income (RHDI) continues to feel the effects of the rising cost of living as it fell by 0.5% this quarter; this is the fourth consecutive quarter of negative growth in the RHDI. Output is now estimated to have fallen by 0.3% which was revised from a first estimate fall of 0.2%, mainly reflecting revisions to estimates of production and construction output.

Customize and filter live economic data via our DailyFX economic calendar

Most service sub-sectors have seen a slowdown, yet services output grew by 0.1% in Quarter 3 2022, revised up from a first estimate of flat output. Compared with pre-coronavirus (COVID-19) pandemic levels, services output is now 1.3% below its Quarter 4 (Oct to Dec) 2019 levels, revised down from previously 0.9% below. We did see the UK’s trade deficit for goods and services improve in Quarter 3 2022.

Market reaction

GBP/USD continues to flirt and find support off the 200-day MA. This mornings weaker than expected GDP data looked like it could facilitate a break lower, however the weaker dollar has seen the pair edge higher in early European trade. The poor GDP data and slightly dovish stance by the BoE last week are likely to cap upside gains as the week winds down.

Discover what kind of forex trader you are

The pair is up 60 pips from its daily low around the 1.2060 level, with a daily candle break and close below the 200-day MA may see a test of the psychological 1.2000 level. Upside resistance rests around the 1.2200 level should we see further upside.

GBPUSD Daily Chart, December 22, 2022

Source: TradingView, prepared by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]