[ad_1]

UK FLASH PMI KEY POINTS:

Recommended by Zain Vawda

Get Your Free GBP Forecast

The S&P Global/CIPS UK Manufacturing Flash PMIincreased to 49.2 in February of 2023 from 47 in January, beating market forecasts of 47.5, preliminary estimates showed. Both the manufacturing and service sectors achieved a return to growth with services smashing estimates coming in at 53.3 compared to estimates of 49.2. Survey respondents credited the jump to customer demand and improving confidence as supply shortages eased and inflation showed signs of moderation.

February data resulted in the slowest overall increase in average cost burdens since April 2021. Prices charged inflation eased only fractionally, especially in the service economy while many businesses commented on the need to pass on higher wages, food costs and energy bills.

Customize and filter live economic data via our DailyFX economic calendar

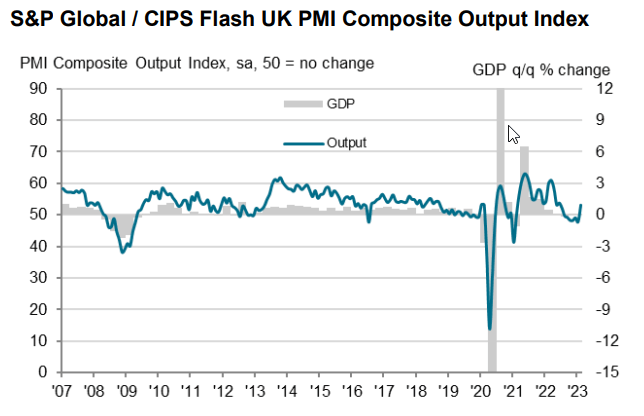

At 53.0 in February, up sharply from 48.5 in January, the headline seasonally adjusted S&P Global / CIPS Flash UK Composite Output Index registered above the 50.0 no-change value for the first time since July 2022.

Sources: S&P Global, CIPS, ONS.

Some encouraging news regarding near-term prospects was also provided by the survey as new work received by the UK private sector businesses increased for the first time in 7 months. The upturn in the service sector contrasted with a marginal reduction in the manufacturing sector as service providers saw export sales rise for a 3rd consecutive month. The data does bode well for the prospects of a shallow recession with the data releases to come likely to hold the key.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

UK POSTS BUDGET SURPLUS SURPRISE IN JANUARY

The UK public finances data released this morning smashed estimates with a surplus of GBP5.4 billion in January with forecasts predicting a deficit of nearly GBP8 billion. Such a shortfall would’ve been the UK’s largest in 25 years. The surplus is largely due to tax collection but remains well below the January 2022 number as energy subsidies and custom duties paid to the European Union kept the surplus in check.

Market reaction

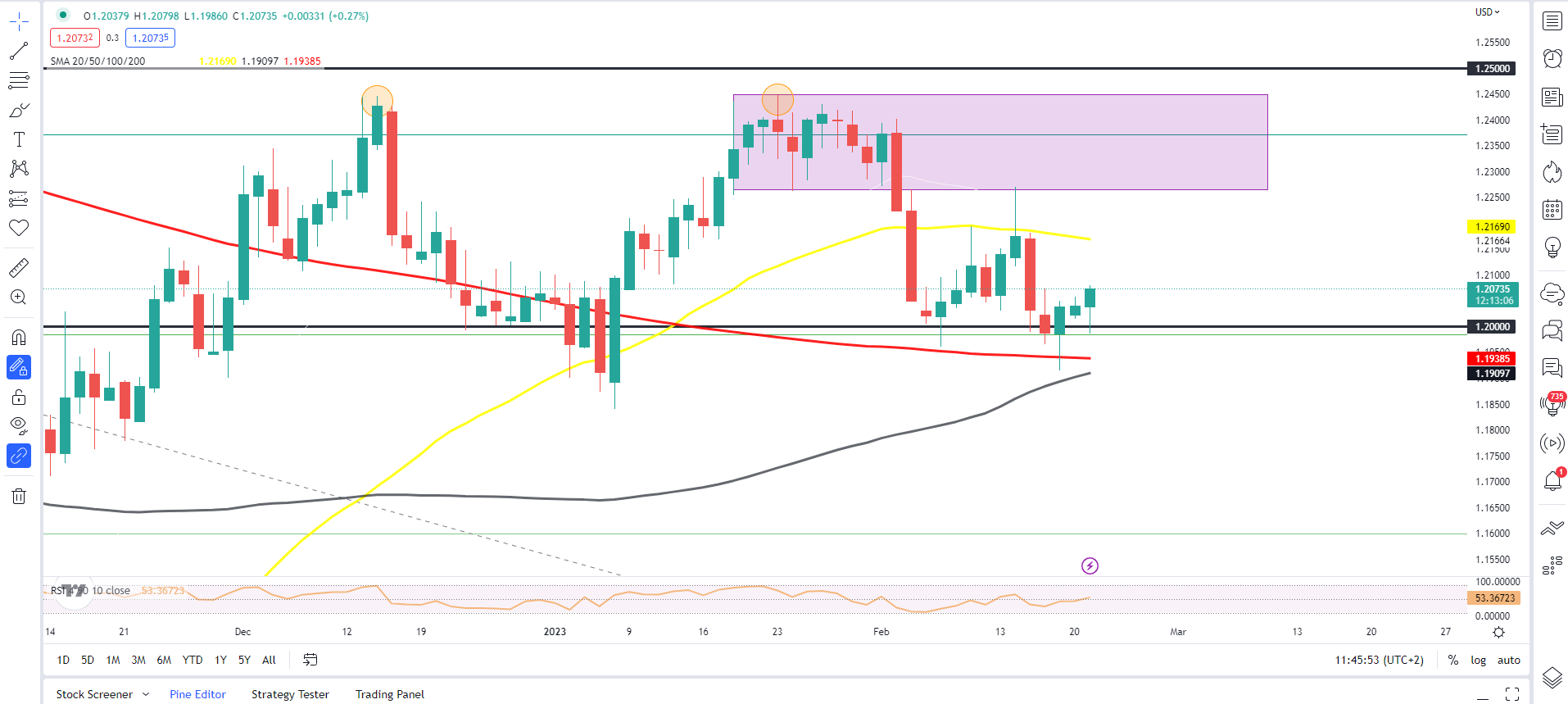

GBPUSD Daily Chart

Source: TradingView, prepared by Zain Vawda

The Initial reaction to the data saw GBPUSD spike 85 pips higher with the 1.2100 level now firmly in sight. The 1.2100 handle remains key in the short term if we are to see further upside.

Looking at the bigger picture however, GBP remains under pressure with markets currently pricing in a further 25bps hike in March and maybe one more before a pause from the Bank of England (BoE). My opinion is that we may only get one more 25bps hike before a pause and should this come to fruition it could add further pain for the GBP moving forward as the US Federal Reserve looks set to hike rates well into the summer months. Should the Fed follow through we could see a sustained push below the 1.2000 handle for GBPUSD in the medium-term.

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]