[ad_1]

Gold Price (XAU/USD), Chart, and Analysis

- US CPI tops the economic docket today.

- 60/40 call on whether there is a US rate hike later this month.

Recommended by Nick Cawley

How to Trade Gold

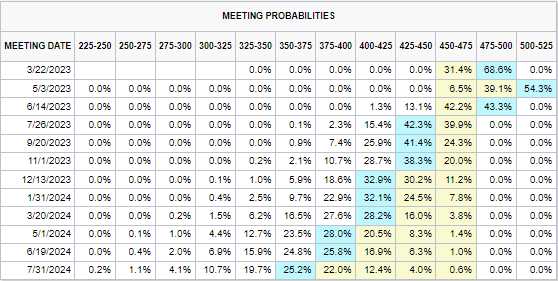

The global interest rate background has changed dramatically over the last few days with interest rate hikes being priced out by the hour. The collapse of SVB Bank and Signature Bank in the US has prompted markets to reduce rate hike expectations sharply, with one 25bp rate hike in the US seen as a coin toss at the March meeting, before rate cuts are seen from the end of Q2 onwards.

US Dollar Grips on as SVB Fallout Brings US CPI Into View Ahead of the Fed

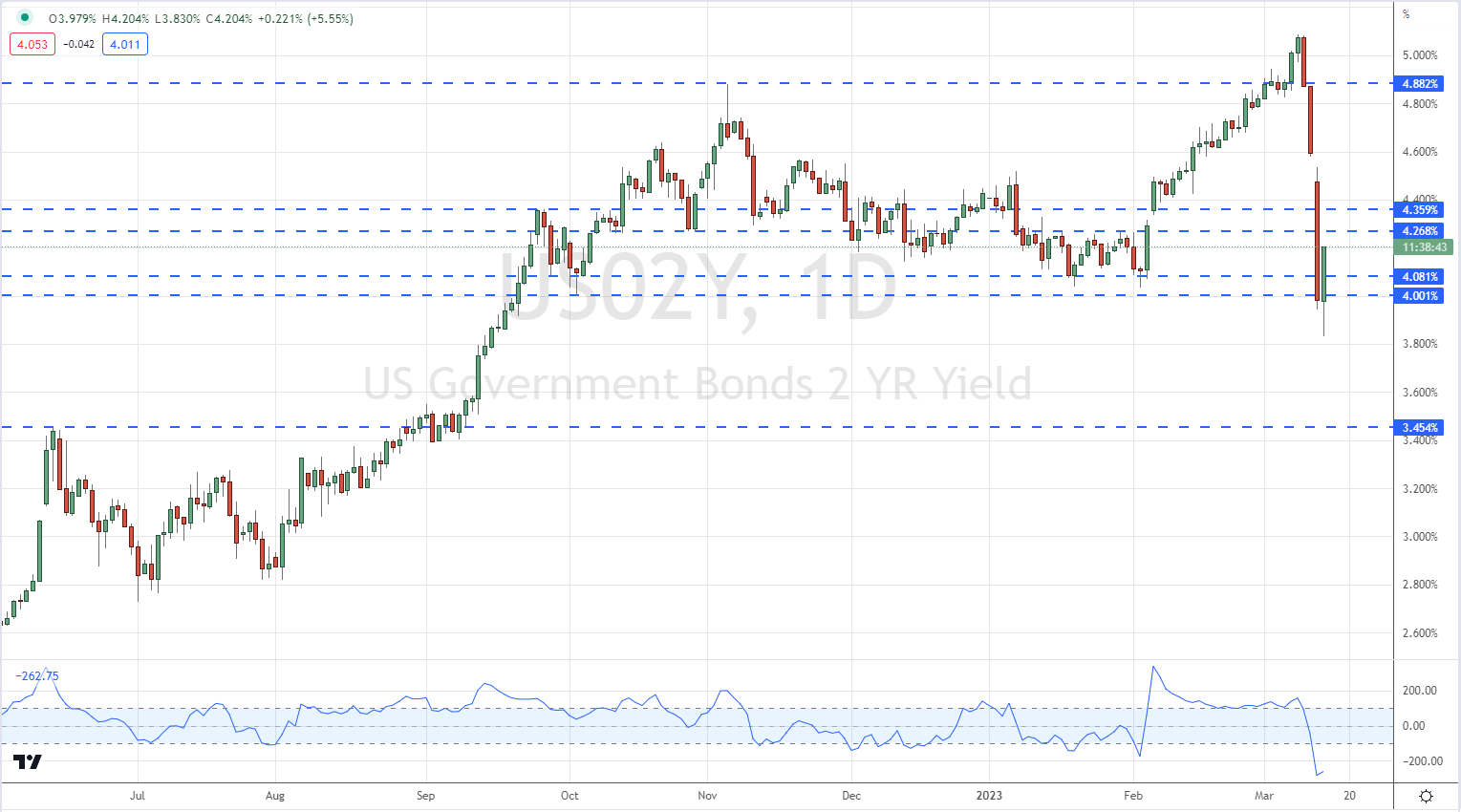

US Treasury yields have fallen sharply in the last few days as rate expectations change. The US 2-year touched a high of 5.08% last Thursday before slumping to a multi-month low of 3.83% earlier in today’s session. The yield has reversed higher in Europe but still remains vulnerable to further losses.

US 2-Year Yield

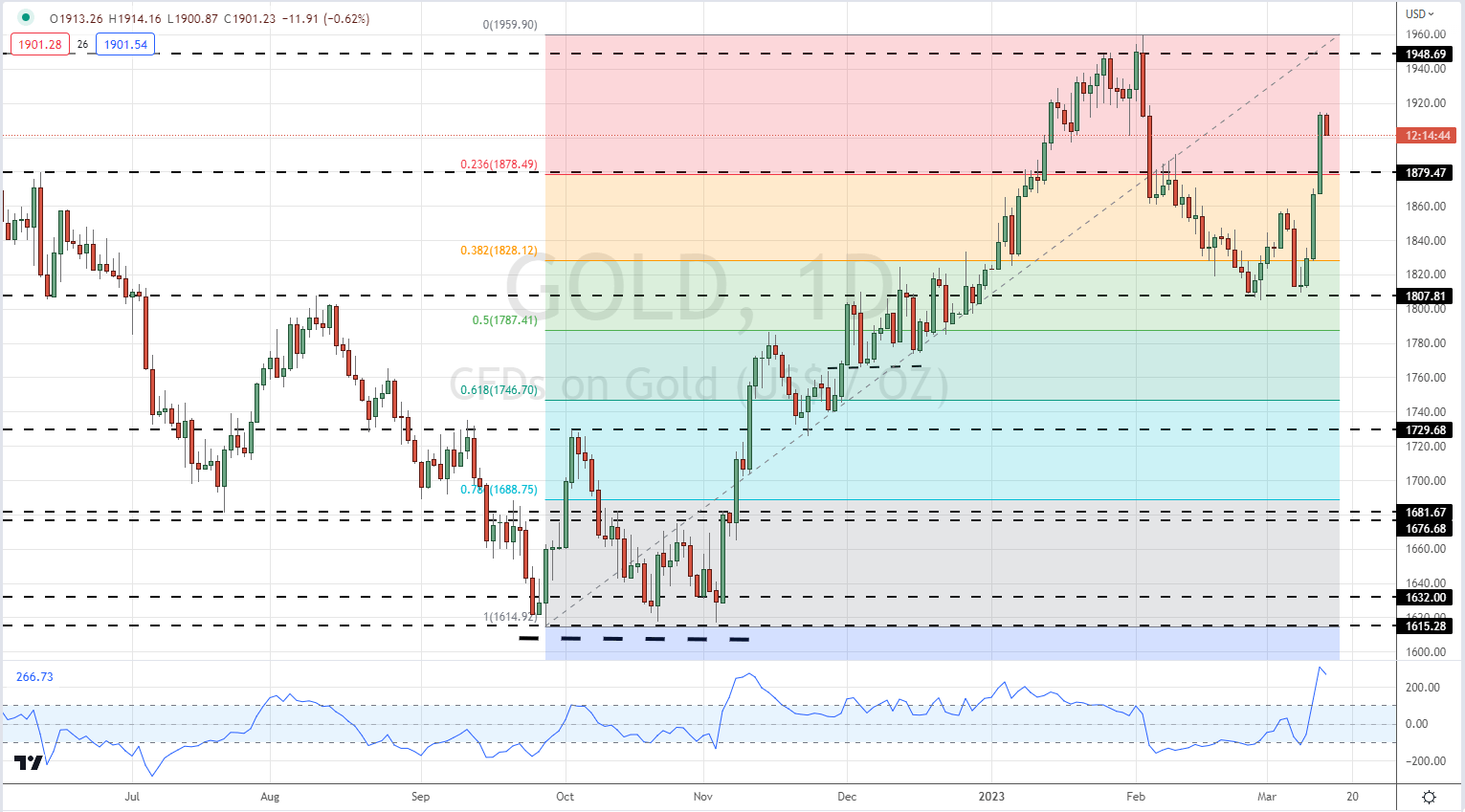

Gold has benefitted not just from the global re-pricing of rate cuts but also from its haven status. The precious metal is part of a group of goto safe-haven assets that include US Treasuries, the Japanese Yen and the Swiss Franc. The precious metal broke above $1,900/oz. on Monday as traders sought safety from possible bank contagion. Gold remains above $1,900/oz. but is likely to test this new level of support, especially if the US inflation number comes in hot. Below here $1,878/oz. comes into view and this level may hold any short-term sell off unless the interest rate background turns hawkish again.

Gold Price Daily Chart – March 14, 2023

All Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -5% | 27% | 5% |

| Weekly | -18% | 35% | -4% |

Retail Traders Boost Net-Shorts

Retail trader data show 62.57% of traders are net-long with the ratio of traders long to short at 1.67 to 1.The number of traders net-long is 3.35% lower than yesterday and 16.96% lower from last week, while the number of traders net-short is 26.32% higher than yesterday and 33.46% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]