[ad_1]

Gold Price (XAU/USD), Chart, and Analysis

- Gold buoyed by lower US bond yields.

- The FOMC minutes may see the Fed reiterate its hawkish outlook.

Recommended by Nick Cawley

Download our brand new Q1 Gold forecast

Gold bulls have enjoyed a positive start to the year with the precious metal pushing back to levels last seen over six months ago. A combination of lower US government bond yields and growing fears of a global recession have pushed gold ever higher with sellers absent so far in 2023. The US dollar (DXY) is around half a point above its multi-month low, as US bond yields slip lower, while future US rate hike expectations continue to be pared back. The first test for market doves will come later today when the FOMC minutes of the December 15, 2022 meeting are released. While US inflation is starting to ease, Fed chair Jerome Powell and the committee are likely to restate that rates will go as high as the central bank needs them to as they continue their fight with sky-high inflation.

Hawkish vs Dovish: How Monetary Policy Affects FX Trading

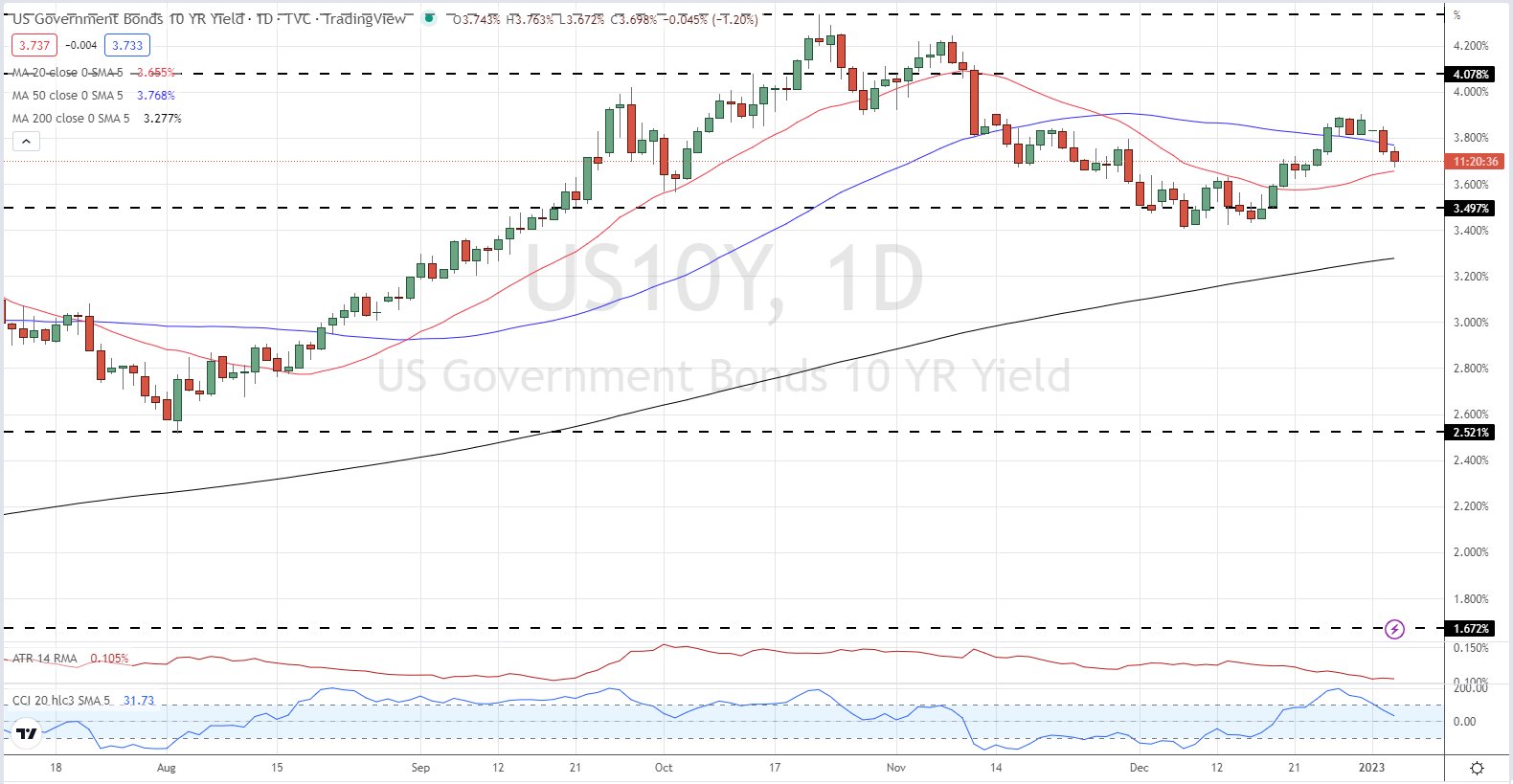

US Treasury 10-Year Bond Yield – January 4, 2023

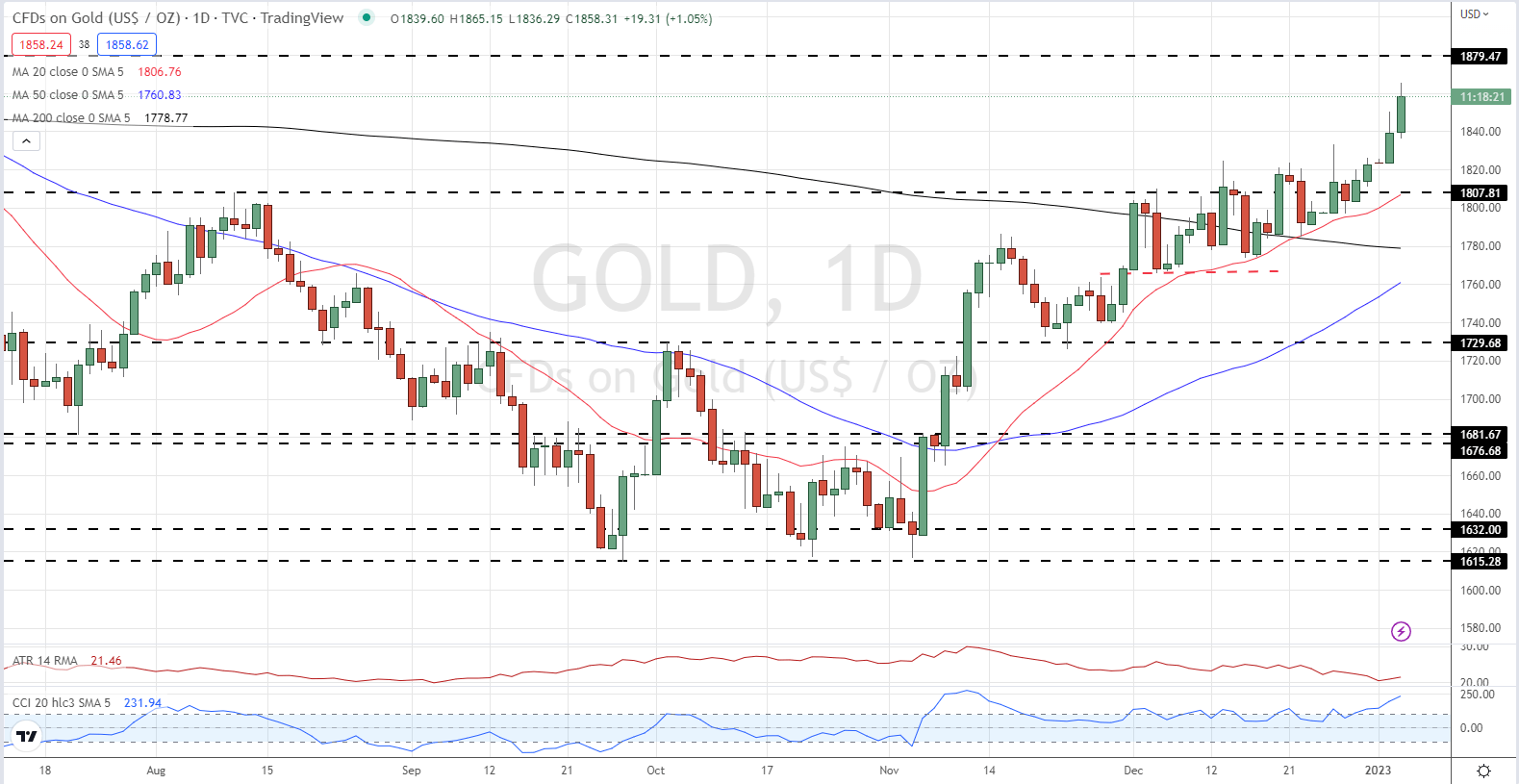

The daily chart shows the strength of the gold rally off the triple low prints made between late September and early November. The precious metal is now tracking the 20-day moving average higher, while the move was given an additional boost after gold made a confirmed break above the 200-day ma in late December. There looks to be a zone of support building between $1,825/oz. and $1,835/oz. while $1,879/oz. looks like the next, achievable, target for bulls to target. Today’s FOMC minutes will decide if these support or resistance levels are tested.

Gold Daily Price Chart – January 4, 2023

Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -2% | 13% | 3% |

| Weekly | -8% | 38% | 5% |

Retail Traders Trim Longs, Increase Shorts

Retail trader data show 63.13% of traders are net-long with the ratio of traders long to short at 1.71 to 1.The number of traders net-long is 1.23% lower than yesterday and 5.85% lower from last week, while the number of traders net-short is 13.53% higher than yesterday and 31.58% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]