[ad_1]

Gold Price (XAU/USD), Chart, and Analysis

- Gold re-tests resistance above $1,800/oz as the US dollar falls away.

- US Treasury yields push higher bringing some respite for the greenback.

Recommended by Nick Cawley

Top Trading Lessons

The Bank of Japan surprised the markets earlier today by increasing the yield curve control targets, in effect allowing Japanese Government Bond (JGBs) yields to move higher. While the move from -0.25%/+0/25% around zero to -0.50%/+0.50% may seem small, this alteration suggests that the central bank may be starting to move away from its long-standing, ultra-loose monetary.

Japanese Yen Jumps on BoJ Move, USD/JPY Crumbles to a 4-Month Low

The US dollar moved lower after the announcement although the move was relatively muted. The small sell-off in the US dollar allowed gold to push higher to an intra-day high of $1,809/oz. before the metal faded back. While the US dollar via the DXY weakened, US Treasury yields pushed higher after the announcement, adding downside pressure on gold.

Recommended by Nick Cawley

How to Trade Gold

US Treasury 10-Year Bond Yield – December 20, 2022

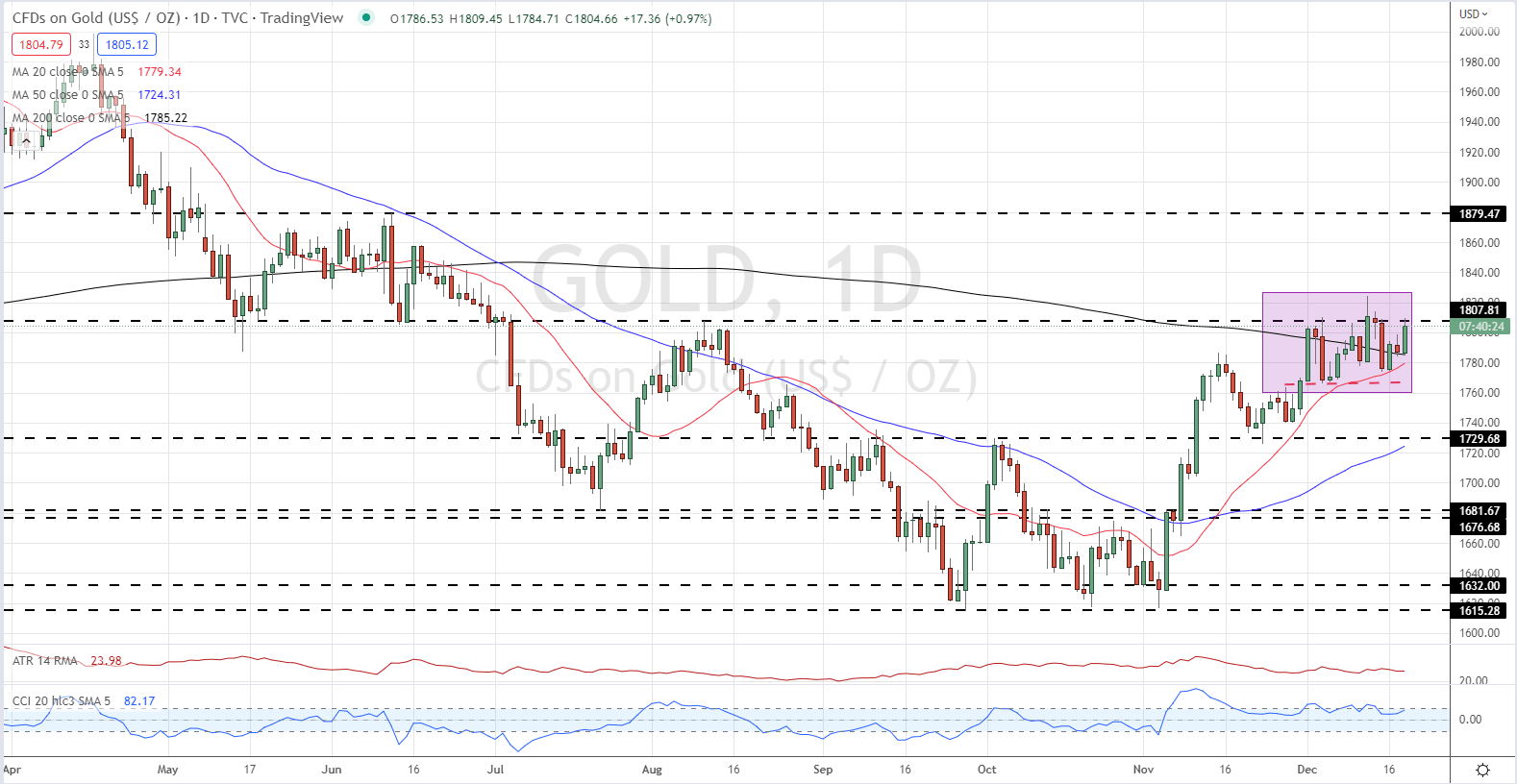

The daily gold chart shows an area of overhead resistance that has kept the precious metal in check over the last two weeks. The price of gold is currently stuck in a range and the outlook is slightly complicated by the 50- and 200-day moving averages also being in the middle of this range. The precious metal is being supported by these two moving averages, and if this continues then gold will look to press higher still. The December 13 $1,824/oz. high is the next target before $1,860/oz. and $1,880/oz. come into play. Initial support at $1,766/oz.

Gold Daily Price Chart – December 20, 2022

Charts via TradingView

{{SENTIMENT|GC}}

Retail Traders Trim Longs

Retail trader data show 68.63% of traders are net-long with the ratio of traders long to short at 2.19 to 1.The number of traders net-long is 5.02% lower than yesterday and 7.50% lower from last week, while the number of traders net-short is 3.87% higher than yesterday and 11.47% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Gold price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

[ad_2]