Gold (XAU/USD) Price, Analysis and Charts

- Gold hesitates at $2,050/oz. but the outlook remains positive.

- Fed Chair Powell speaks later in the session.

Recommended by Nick Cawley

How to Trade Gold

DailyFX Economic Calendar

Most Read: Gold and Silver Continue to Rally as Buyers Take Charge

Gold made an early push today and came within a handful of dollars of printing a fresh 20-month high, but the move lacked conviction in an otherwise quiet market. The US dollar is little changed on the day after pushing higher on Thursday, while US bond yields, a driver of recent price action, are a fraction higher at best.

One driver of the small move higher is likely the resumption of the war in Gaza after the seven-day ceasefire between Israel and Hamas ended. According to BBC sources, the government of Qatar confirmed that renewed ceasefire talks between the two sides are ongoing.

Later in today’s session, we have US ISM Manufacturing for November with analysts forecasting a print of 47.7 compared to 46.7 in October. ISM Manufacturing fell sharply last month, after rallying from 46.0 in June. A PMI reading under 50 indicates that the manufacturing sector is in decline. Later, Fed Chair Jerome Powell will participate in a fireside chat at Spelman College at 16:00 UK before being part of a round table event at the same venue at 19:00 UK. This will be the last we hear from Federal Reserve members as they enter a blackout period ahead of the December 13 FOMC meeting. Chair Powell is unlikely to deviate from his current stance that US rates will be raised if data dictates despite the market completely pricing out any further interest rate hikes.

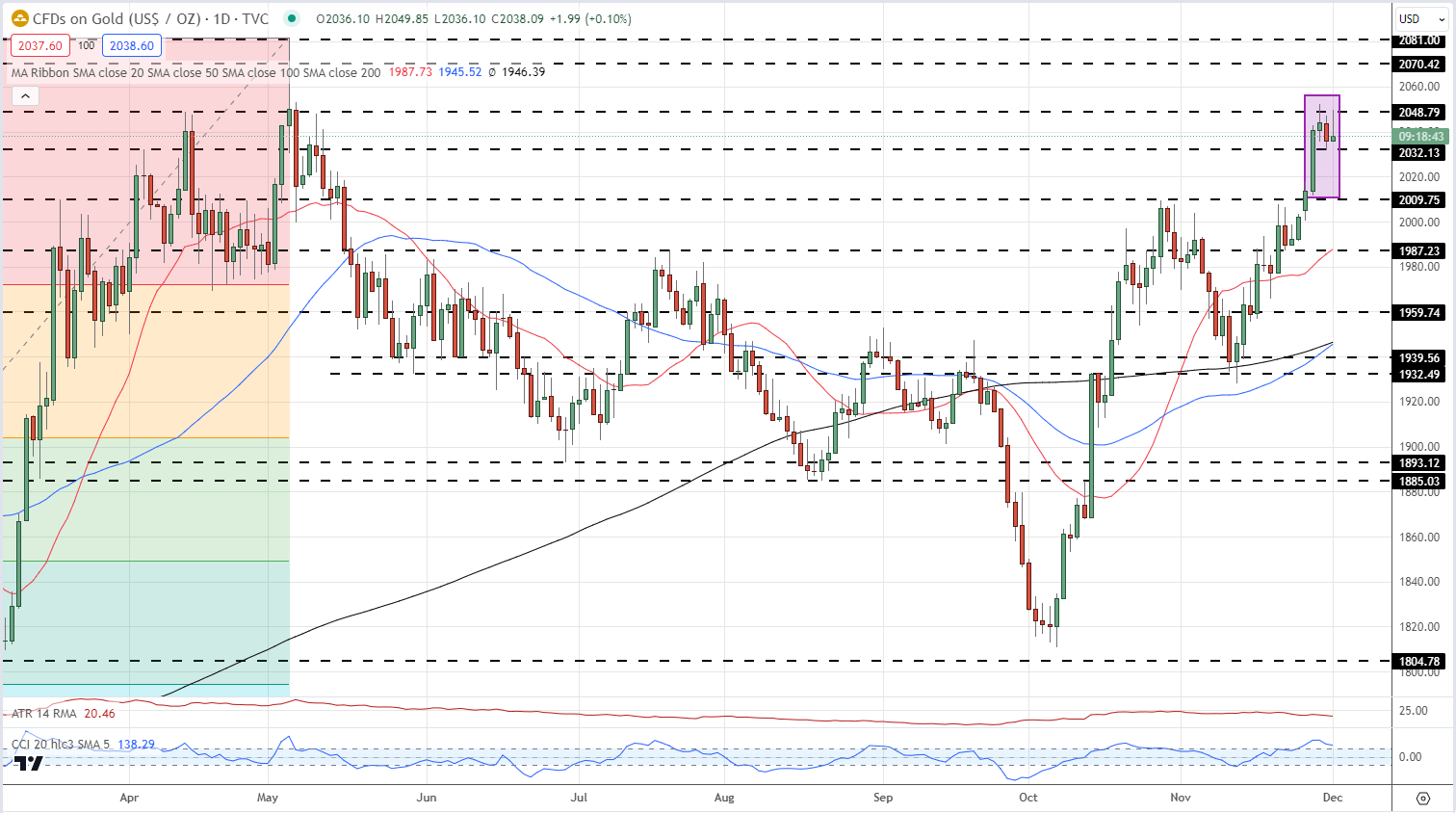

Gold currently trades around $2,038/oz. after touching a high a fraction under $2,050/oz. earlier today. The daily chart remains bullish from a technical point of view, although an overbought CCI reading may prevent the precious metal from breaking higher in the short term.

Gold Daily Price Chart – December 1, 2023

Chart via Trading View

Retail trader data shows 47.36% of traders are net-long with the ratio of traders short to long at 1.11 to 1.The number of traders net-long is 0.11% higher than yesterday and 15.02% lower than last week, while the number of traders net-short is 2.97% lower than yesterday and 31.47% higher than last week.

See how changes in IG Retail Trader data can affect price action.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -5% | -4% |

| Weekly | -17% | 28% | 2% |

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.