[ad_1]

Hang Seng, HSI, Alibaba, HKD, Japanese Yen, AUD/USD – Talking Points

- The Hang Seng Index took off on the news a the Alibaba split up

- Tech stocks in the region benefitted as the banking crisis looks to have dissipated

- If the Chinese government are changing policy, will the HSI continue to rally?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Hang Seng Index (HSI) was up over 2.5% at one stage today on positive news for Alibaba and against a backdrop of the banking problems subsiding.

Hong Kong’s HSI posted solid gains after Alibaba announced that the business will be split into six separate business units.

The restructure saw investors reappraise their valuations for the tech behemoth. It may open the possibility of several initial public offerings (IPO) for each spin-off.

The stock closed on Tuesday at HKD 84.35 (USD 10.75) and hit a high of HKD 98.00 (USD 12.49) today. The market cap is now close to HKD 2 trillion, which is over USD 250 billion.

There is speculation that the decentralization of the group may have ticked several Chinese government regulatory boxes.

The news comes as Co-Founder Jack Ma returned to mainland China after an extended absence. It has ignited optimism in some quarters that the local government might be looking to change policy tack for the private sector to provide more favourable investment conditions.

Other APAC equity markets are generally in the green. Futures are pointing toward a positive start to the European and North American equity indices at the time of writing.

The markets appear to have found reassurance again after a US Senate hearing on the banking problems.

The regulators stated that the issues with SVB Financial were specific to internal mismanagement by the bank and were not likely to be systemic throughout the banking sector.

The Japanese Yen has been the notable underperformer in the currency space today with its perceived haven status less desirable in a ‘risk-on’ type of day. The US Dollar is generally firmer across the G-10 board.

The Aussie Dollar is a touch weaker after soft CPI data. It was 6.8% year-on-year to the end of February although it should be noted that the monthly number is less reliable than the quarterly read that will be released in late April.

Treasury yields barely changed through the Asian session after having added a few basis points overnight. Gold is steady near USD 1,670.

Crude oil has consolidated today after gaining so far this week. The WTI futures contract has been travelling above US$ 73.50 bbl while the Brent contract is eyeing US$ 79 bbl.

Looking ahead, after some European consumer confidence numbers, the UK and the US will see mortgage data.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

Traits of Successful Traders

HANG SENG INDEX TECHNICAL ANALYSIS

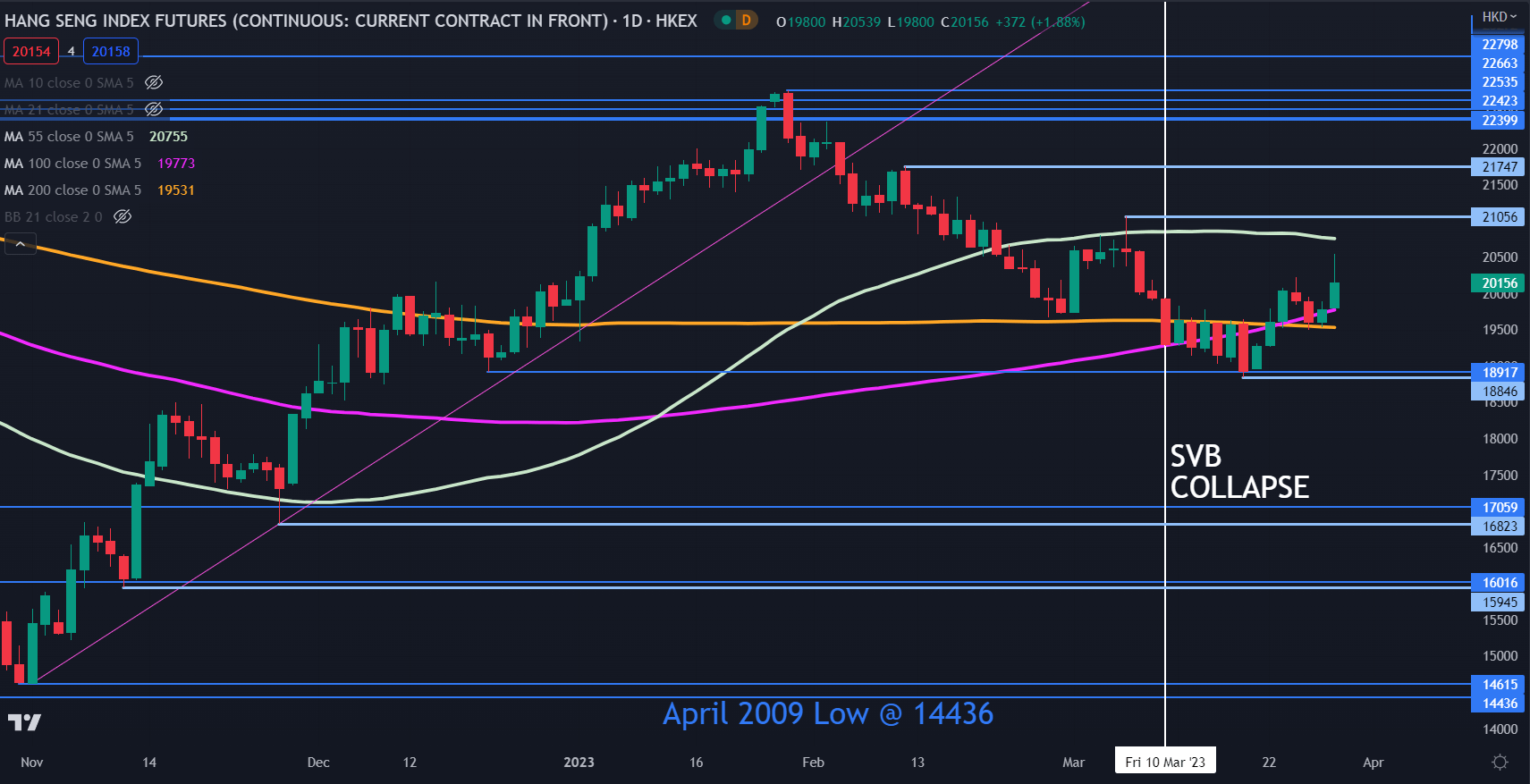

The Hang Seng Index (HSI) rally pushed it further above the 100- and 200-day simple moving averages (SMA) today.

This may indicate underlying bullish momentum could be evolving. A move above the 55-day SMA might confirm this.

Resistance might be offered at the recent peaks of 21056, 21747 and 22798. The latter has a series of historical breakpoints below that may add weight to it.

On the downside, support could lie at the prior lows of 18846, 16823 and 15945. All three levels have a breakpoint nearby.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]