[ad_1]

S&P 500 Index, SPX, Nasdaq Composite Index – Price Outlook:

- Only 18% of the members in the S&P 500 index are above their respective 20-day moving average.

- 17% of the members in the Nasdaq Composite Index are trading with 14-day RSI below 30.

- What does it mean for the trend going forward?

Recommended by Manish Jaradi

Traits of Successful Traders

Market breadth in US indices has weakened recently, with some indicators around multi-month lows. From a contrarian perspective, it could reflect oversold conditions, pointing to a minor rebound ahead of the US earnings season.

S&P 500:

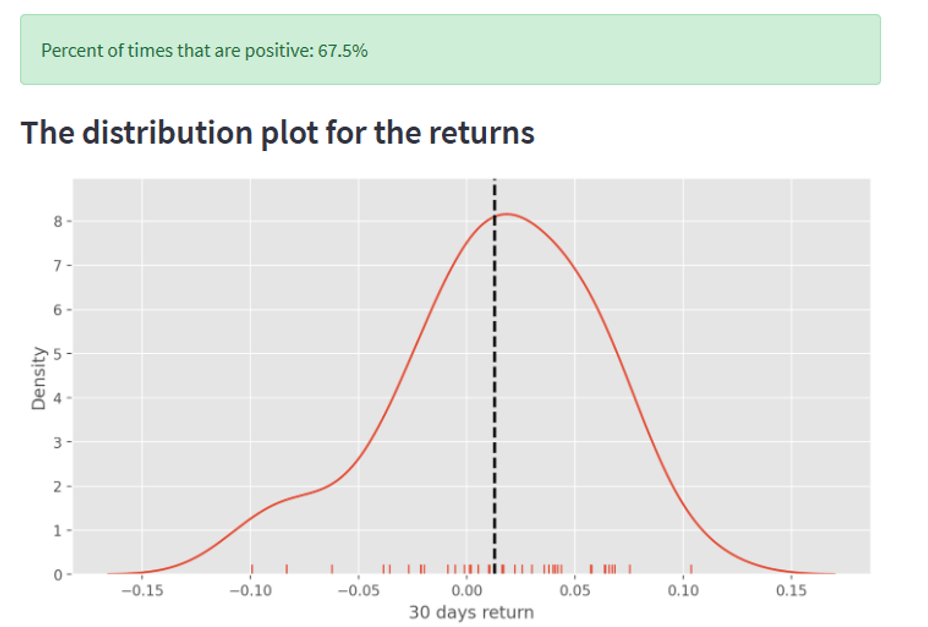

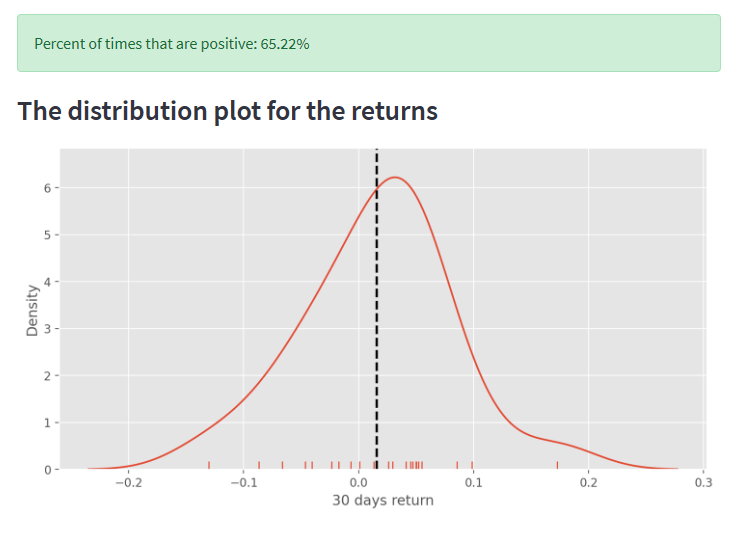

As of Friday, around 18% of the members in the S&P 500 index were above their respective 20-day moving average (DMA). Data from 1996 onwards suggests that when 17%-20% of the members were above their respective 20 DMAs, the index was up 67% of the time over the subsequent 30 days. That is, in such instances, 67% of the time the index returns have been positive over the subsequent one-month period based on historical performance (see the distribution plot).

Distribution plot of S&P 500 index returns when 17%-20% of members are above their respective 20-day moving average

Data Source: Bloomberg; Chart Created by Manish Jaradi in Python

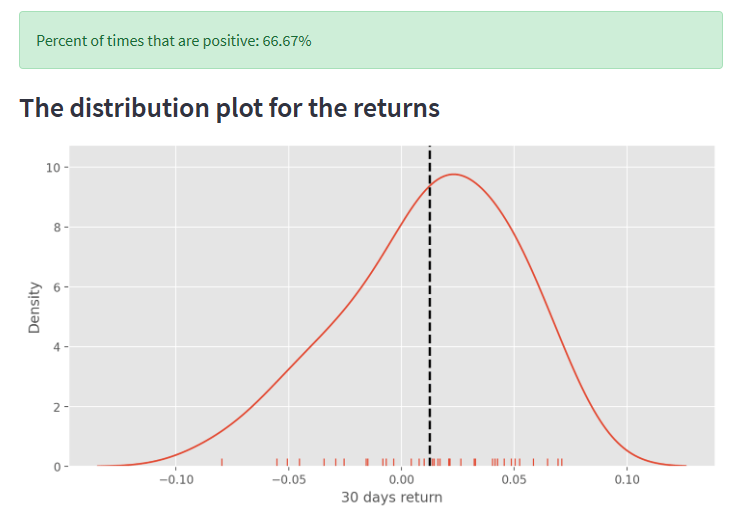

Similarly, data from 1996 onwards suggests that when 21%-24% of the members were below their respective Lower Bollinger Bands, the index was up 66% of the time over the subsequent 30 days. That is, in such instances, 66% of the time the index returns have been positive over the subsequent one-month period based on historical performance (see the distribution plot).

Distribution plot of S&P 500 index returns when 21%-24% of members are below their respective Lower Bollinger Band

Data Source: Bloomberg; Chart Created by Manish Jaradi in Python

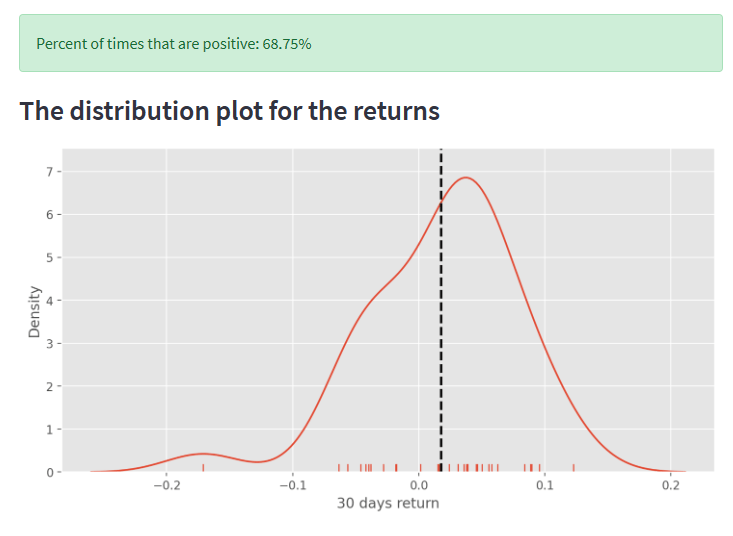

Furthermore, as of Friday, 17% of the members in the S&P 500 index had the 14-day Relative Strength Index below 30. Data from 1996 onwards suggests that when 15%-18% of the members had their 14-day RSI below 30, the index was up 68% of the time over the subsequent 30 days. That is, in such instances, 68% of the time the index returns have been positive over the subsequent one-month period based on historical performance (see the distribution plot).

Distribution plot of S&P 500 index returns when 15%-18% of members are trading with 14-day RSI below 30

Data Source: Bloomberg; Chart Created by Manish Jaradi in Python

Nasdaq Composite Index:

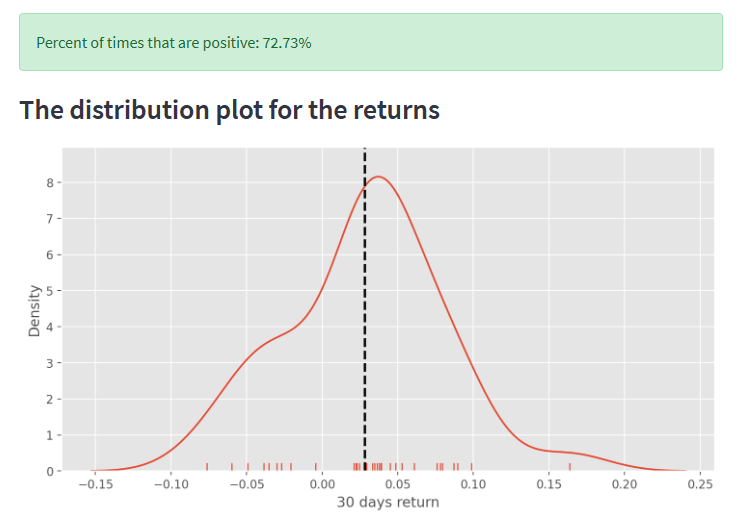

As of Friday, around 23% of the members in the Nasdaq index were above their respective 20-day moving average (DMA). Data from 2002 onwards suggests that when 22%-25% of the members were above their respective 20-DMAs, the index was up 72% of the time over the subsequent 30 days. That is, in such instances, 72% of the time the index returns have been positive over the subsequent one-month period based on historical performance (see the distribution plot).

Distribution plot of Nasdaq Composite index returns when 22%-25% of members are above their respective 20-day moving average

Data Source: Bloomberg; Chart Created by Manish Jaradi in Python

Similarly, data from 2002 onwards suggests that when 12%-15% of the members were below their respective Lower Bollinger Bands, the index was up 62% of the time over the subsequent 30 days. That is, in such instances, 62% of the time the index returns have been positive over the subsequent one-month period based on historical performance (see the distribution plot).

Distribution plot of Nasdaq Composite Index returns when 12%-15% of members are below their respective Lower Bollinger Band

Data Source: Bloomberg; Chart Created by Manish Jaradi in Python

Furthermore, as of Friday, 17% of the members in the Nasdaq index had the 14-day Relative Strength Index below 30. Data from 2002 onwards suggests that when 16%-19% of the members had their 14-day RSI below 30, the index was up 65% of the time over the subsequent 30 days. That is, in such instances, 65% of the time the index returns have been positive over the subsequent one-month period based on historical performance (see the distribution plot).

Distribution plot of Nasdaq returns when 16%-19% of members are trading with 14-day RSI below 30

Data Source: Bloomberg; Chart Created by Manish Jaradi in Python

Recommended by Manish Jaradi

Elliott Wave for Beginners

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]