[ad_1]

Japanese Yen, USD/JPY, US Dollar, BoJ, YCC, PPI, CPI – Talking Points

- USD/JPY continues to test support after making fresh lows last week

- Japanese companies are facing higher costs at the factory gate

- If the BoJ tighten on Wednesday, will USD/JPY further submerge?

{{EDU_SUBMODULE|11}}

The Japanese Yen has started the week on steady footing after surging last week to a seven-month high against the US Dollar with USD/JPY trading as low as 127.46 on Friday.

Inflationary data released today might provide a headache for the Bank of Japan at their monetary policy meeting this Wednesday.

Year-on-year PPI to the end of December came in at 10.5%, above forecasts of 9.5% and 9.7% previously. The month-on-month figure for December was 0.5%, above 0.3% anticipated and 0.8% prior. The data revealed upward revisions.

From a macro perspective, a blistering PPI is problematic for corporate Japan with companies left with a dilemma around increasing input costs. They can either pass on the price rises, which will fuel CPI, or they can absorb the cost increases and face margin compression. The latter will be a negative drag on earnings.

{{GUIDE|HOW_TO_TRADE_USDJPY}}

Speculation is swirling on a possible tightening of monetary policy from the BoJ as they move away from an ultra-loose stance.

In December, the BoJ changed its yield curve control (YCC) program by targeting a band of +/- 0.50% around zero for Japanese Government Bonds (JGBs) out to 10 years. They previously targeted +/- 0.25% around zero. The 10-year note is trading around the upper boundary of +0.50%.

Another policy tilt from the BoJ on Wednesday might see further Yen appreciation.

National CPI for December is due out on Friday and a Bloomberg survey of economists is anticipating the figure to match last week’s headline Tokyo CPI read of 4% year-on-year.

USD/JPY TECHNICAL ANALYSIS

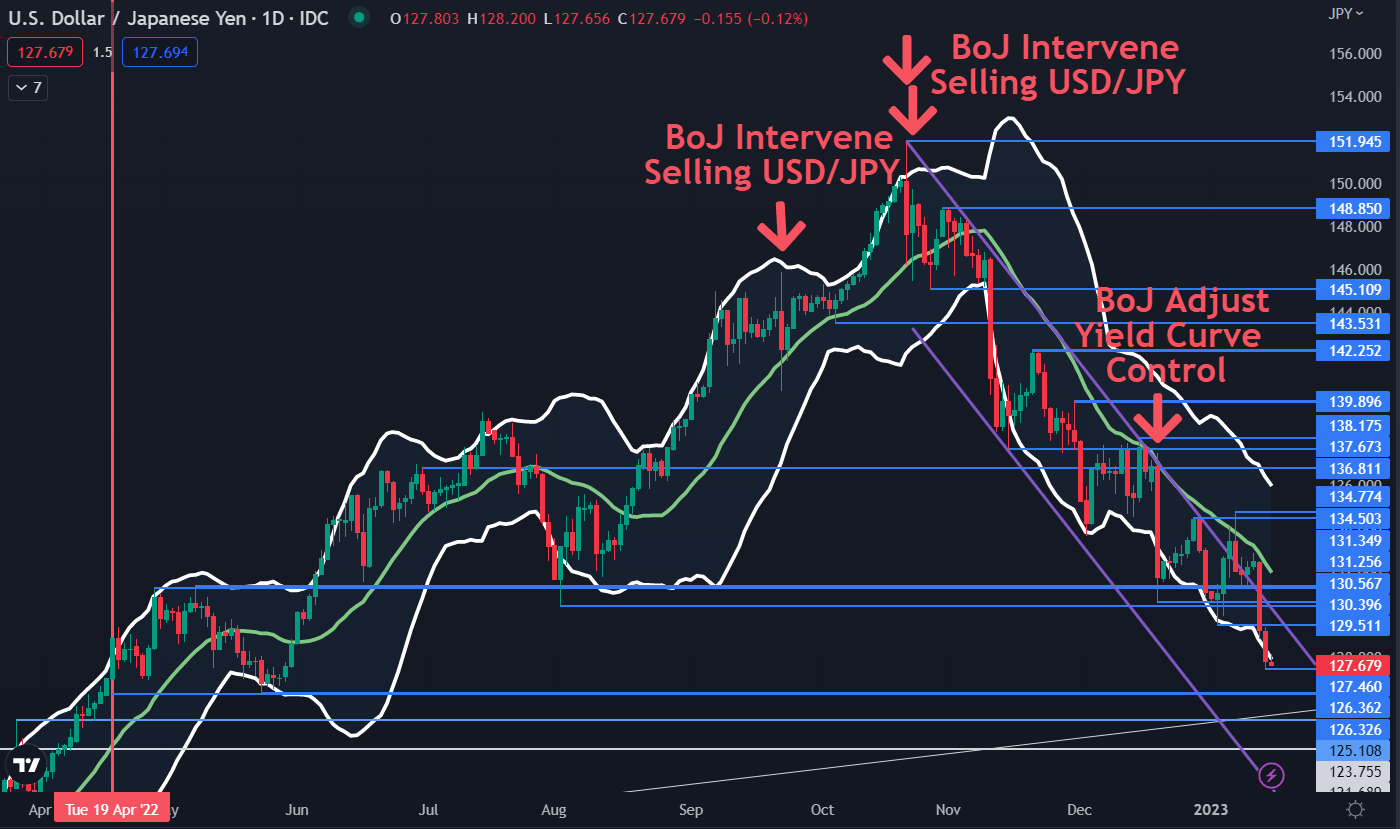

USD/JPY broke lower again last week as it remains in a descending trend channel.

The recent sell-off broke below the lower band of the 21-day simple moving average (SMA) based Bollinger Band. This may indicate that bearishness is unfolding.

A close back inside the band might signal a pause in the bearish run or a potential reversal.

Support could be at the previous lows of 127.46 and 126.36. On the topside, resistance might be at the breakpoints of 129.51, 130.40, 130.57, 131,26 and 131.35

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]