[ad_1]

Japanese Yen, USD/JPY, US Dollar, Fed, Yields, BoJ, Ueda, Momentum – Talking Points

- The Japanese Yen has slipped today as markets take stock of Fed comments

- A new BoJ Governor will speak later this week with all eyes on any policy tilt

- The technical might see some sideways price action. Will USD/JPY trend resume?

Recommended by Daniel McCarthy

How to Trade USD/JPY

The Japanese Yen is slightly weaker to start the week with the US Dollar firming across the board.

The perception that the Federal Reserve might move toward 50 basis point (bp) hikes rather than 25 bp appears to be weighing on markets.

Cleveland Fed President Loretta Mester and St. Louis Fed President James Bullard both indicated that they would consider a 50 bp lift of the Fed funds target rate at the meeting in late March.

Although Treasury yields dipped slightly on Friday, they finished last week notably higher.

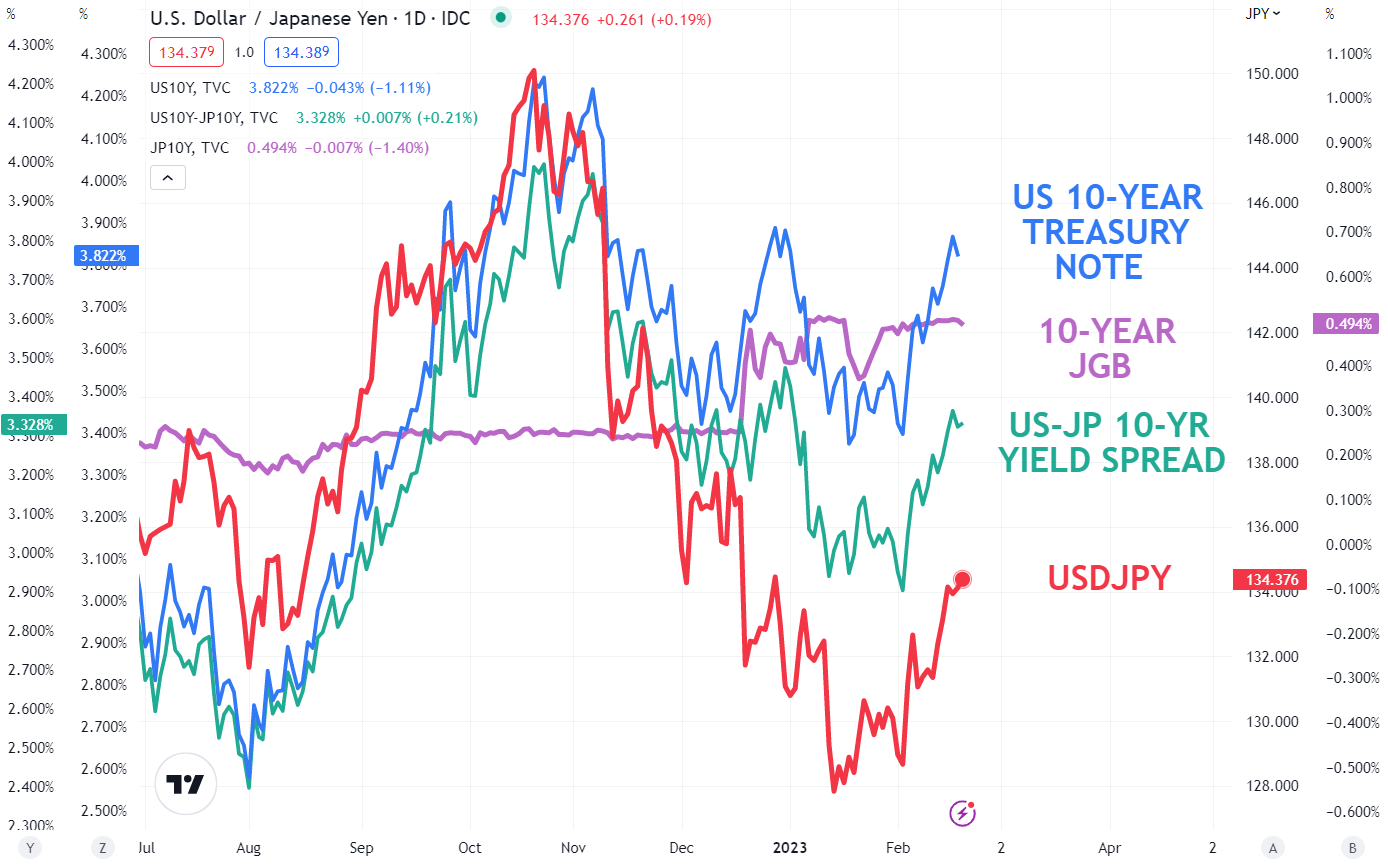

The benchmark 10-year note is trading back above 3.80% at the same time that the 10-year Japanese Government Bond (JGB) remains anchored at 0.50% due to the Bank of Japan (BoJ) exercising Yield Curve Control (YCC).

The question lingers of where the BoJ monetary policy headed after the appointment of Kazuo Ueda to be the new Governor of the Bank of Japan (BoJ). He replaces Haruhiko Kuroda, and he will appear before the Diet (Japanese government lower house) this Friday.

If the policy is overhauled, it might have significant ramifications for USD/JPY with the relationship to yields being apparent in the chart below.

If Japanese yields start heading north, it could have a considerable impact on the exchange rate.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

USD/JPY, US-JAPAN 10-YEAR YIELDS

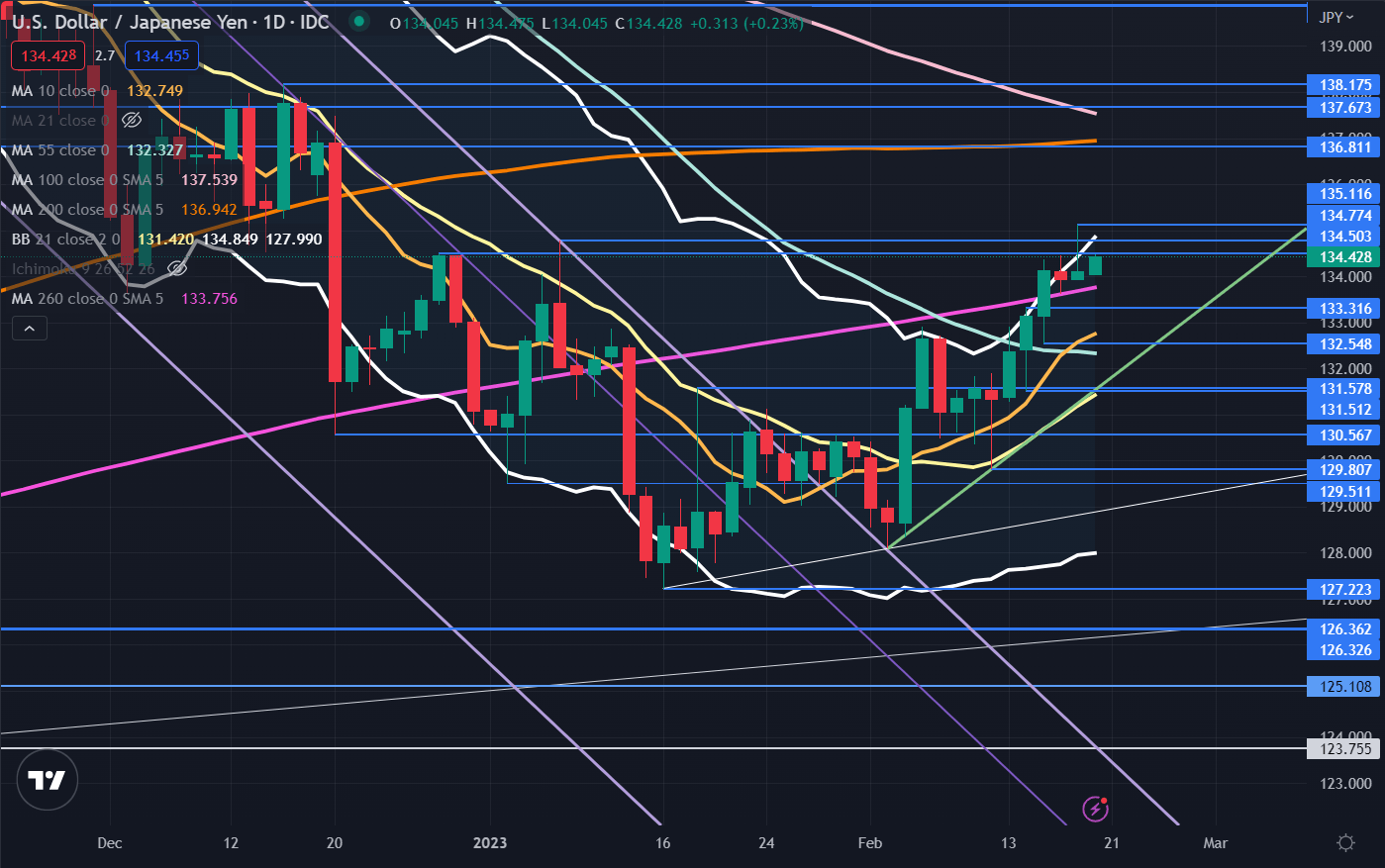

USD/JPY TECHNICAL ANALYSIS

USD/JPY traded above the upper band of the 21-day Simple Moving Average (SMA) based Bollinger Band last week and then closed back inside. This might indicate a pause in the rally or a potential reversal.

The move-up tried to break above two breakpoint resistance levels at 134.50 and 134.77 but was unable to hold the high ground after making a peak of 135.12. These levels may provide resistance.

Further up, resistance could be in the 136.80 – 137.67 area with a breakpoint, prior high and the 100- and 200-day SMAs in this zone.

There appear to be mixed momentum signals for now with the price above the 10-, 21-, 55 and 260-day SMAs but below the 100- and 200-day SMAs. This might signal a range trading environment until there is a clear break above or below all period SMAs.

On the downside, support may lie at the breakpoints and previous lows of 133.31, 132.55, 131.58, 131.51, 130.57 and 129.80.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]