[ad_1]

Japanese Yen, USD/JPY, US Dollar, BoJ, CPI, Kyodo News – Talking Points

- USD/JPY had a look lower to start the week but has since found firmer footing

- The Japanese Government is reported to be considering a new accord with the BoJ

- If the Bank of Japan tilts toward flexibility, will USD/JPY bearish trend remain?

Recommended by Daniel McCarthy

How to Trade USD/JPY

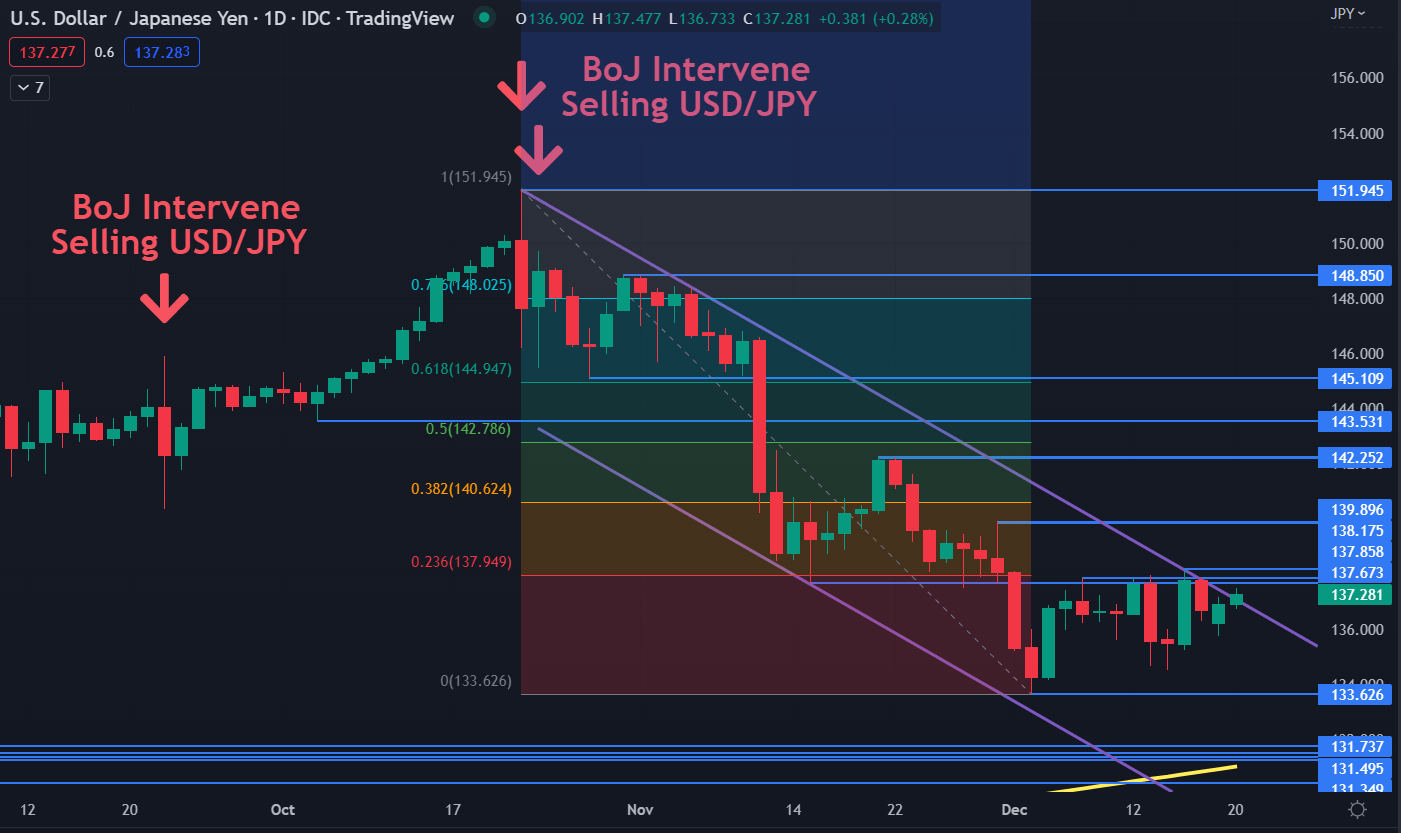

The Japanese Yen launched higher after the Bank of Japan tilted monetary policy at its meeting today.

While the bank left its policy balance rate at -0.10%, it adjusted their yield curve control (YCC) by targeting a band of +/- 0.50% around zero for Japanese Government Bonds (JGBs) out to 10-years.

YCC was previously +/- 0.25% around zero. The BoJ now holds more than 50% of all outstanding JGBs. USD/JPY collapsed from 137.50 to below 143.50 in seconds.

USD/JPY had already had a whippy start to the week after a report last Saturday from Kyodo News about the possibility of flexibility in the 2% inflation target. In an accord between the government and the central bank, price stability is at the core of the agreement.

The article over weekend cited unnamed government sources posturing that the accord could be reviewed when a new bank governor is appointed in April 2023.

Japanese national CPI is due for release this Thursday. A Bloomberg survey of economists is anticipating headline CPI to be 3.9% year-on-year to the end of November, above the 3.7% previously.

Recommended by Daniel McCarthy

The Fundamentals of Breakout Trading

USD/JPY TECHNICAL ANALYSIS

USD/JPY tried to break above the upper band of a descending trend last week but was unable to do so. It is attempting to do so again today and close notably above it might indicate that trend channel may no longer relevant.

The descending trend line could continue to offer resistance along with two breakpoints and the recent high in the 137.67 – 138.17 zone.

The trend channel is marked by the 151.95 peak in October before collapsing to the 133.63 low earlier this month. The 23.6% Fibonacci Retracement of this move is in that potential resistance zone at 137.95.

On the downside, there is a cluster of previous lows and breakpoints that may provide support at 131.74, 131.50, 131.35, 131.25 and 130.40. The 260-day SMA is in amongst those levels at 130.91.

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]