[ad_1]

Japanese Yen, USD/JPY, US Dollar, USD/CAD, AUD/USD, Crude Oil, Gold – Talking Points

- The Japanese Yen trickled lower after the US Dollar resumed strengthening

- Central banks continue to tighten despite agitation of a recession looming

- Equities are feeling the pain except for China. Will USD/JPY resume rallying?

Recommended by Daniel McCarthy

Forex for Beginners

The Japanese Yen is slightly weaker so far today despite GDP there narrowly beating forecasts. Annualised GDP was -.08% for the third quarter instead of -1.1% anticipated.

Treasury yields have added a couple of basis points so far today after dipping around a dozen bps across the curve yesterday. The 2s 10s at a 40-year record inversion of -0.84%

A soft lead from Wall Street saw APAC equities go south with except for Hong Kong and mainland China. There are more reports today that China will back down from their highly restrictive zero-case Covid-19 policy.

The US Dollar is broadly stronger through the Asian session after sliding in North American trade. Fears of a recession in the US continue to swirl after commentary this week from several senior financial executives sounding the alarm for an economic slowdown in 2023.

The coordinated nature of their remarks appears to have added weight to their perspective.

The Canadian Dollar is lower again despite the Bank of Canada raising its cash rate by 50 basis points to 4.25% as anticipated overnight. USD/CAD is trading near the one-month high of 1.3700.

The Australian trade surplus for October was AUD 12.22 billion rather than AUD 12.1 billion forecast. Imports slid by 0.7% rather than accelerating by the 2% that was anticipated. The Aussie Dollar is slightly softer near 68 cents.

Crude oil is languishing near its low for the year with the WTI futures contract near US$ 76.50 bbl. Gold has held onto recent gains, trading above US$ 1,780 an ounce.

The US will see some jobs data ahead of a speech by ECB President Christine Lagarde.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade USD/JPY

USD/JPY TECHNICAL ANALYSIS

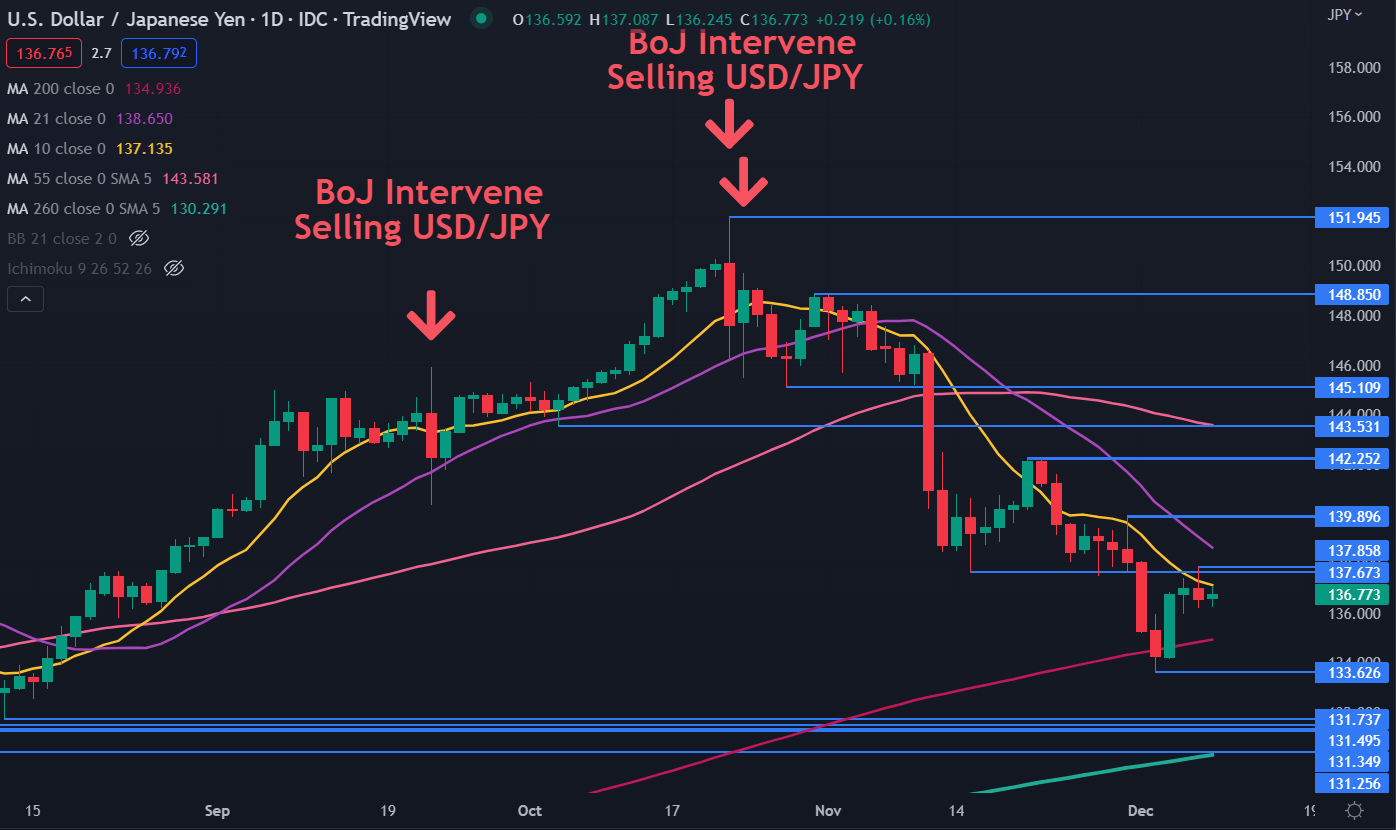

USD/JPY had a look above the breakpoint of 137.67 but was unable to sustain the rally after making a high of 137.86. These levels may continue to offer resistance.

Further up, the prior peaks of 139.90 and 142.25 may offer resistance.

On the downside, support could lie at the previous lows and breakpoints of 133.63, 131.74, 131.50, 131.35 and 131.26.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter

[ad_2]