[ad_1]

Nasdaq 100, Liquidity, Volatility and FOMC Rate Decision Talking Points:

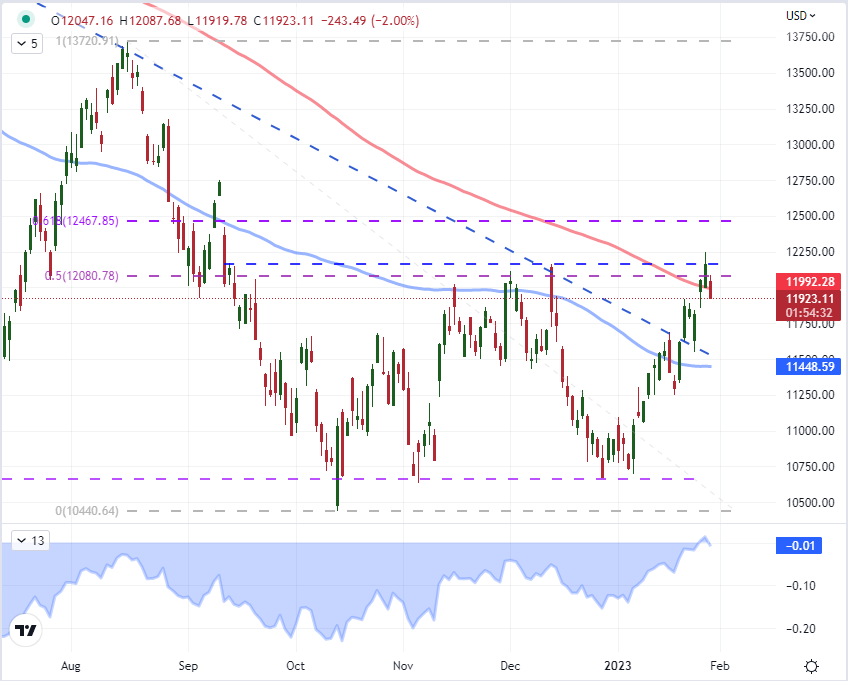

- The Market Perspective: Nasdaq 100 Bullish Above 12,300 and Bearish Below 11,500

- The Nasdaq 100 closed above the 200-day SMA for the first time in 203 trading days just this past week – ending the longest bear stretch in two decades

- With Monday trade, the NDX slipped right back below its 200-day SMA with little ceremony as markets balance risk before the Fed and other key events

Recommended by John Kicklighter

Get Your Free Equities Forecast

As the saying goes ‘talk is cheap’. When it comes to markets, forging a technical event like a breakout is ‘talk’ while the developed of a trend thereafter is the true commitment. Last week, the US indices were pushing higher and suggesting a groundswell of fundamental enthusiasm could very well override the lingering concerns behind the financial system – such as the financial pressure on the markets through monetary policy and the disproportional impact of recession risks for the future. For the Nasdaq 100 in particular, the tech index finally played catch up to its larger peers, the Dow and S&P 500. Just recently coming off of its 2022 bear trend lows, the NDX managed to close above its 200-day simple moving average (SMA) for the first time in 203 trading sessions. That brought to an end the longest bearish stretch – as measured by spot’s proximity to the SMA – since 2002. For a technically oriented trader, that is a significant event. Yet, in the context of market conditions, that is not enough to distract from the major event risk immediately ahead and its capacity to move the markets. As such, the Nasdaq 100 has dropped approximately -2 percent to start this week and reversed its hard-won break.

Recommended by John Kicklighter

Improve your trading with IG Client Sentiment Data

Chart of Nasdaq 100 with 100 and 200-Day SMAs, 200-Day Disparity Index (Daily)

Chart Created on Tradingview Platform

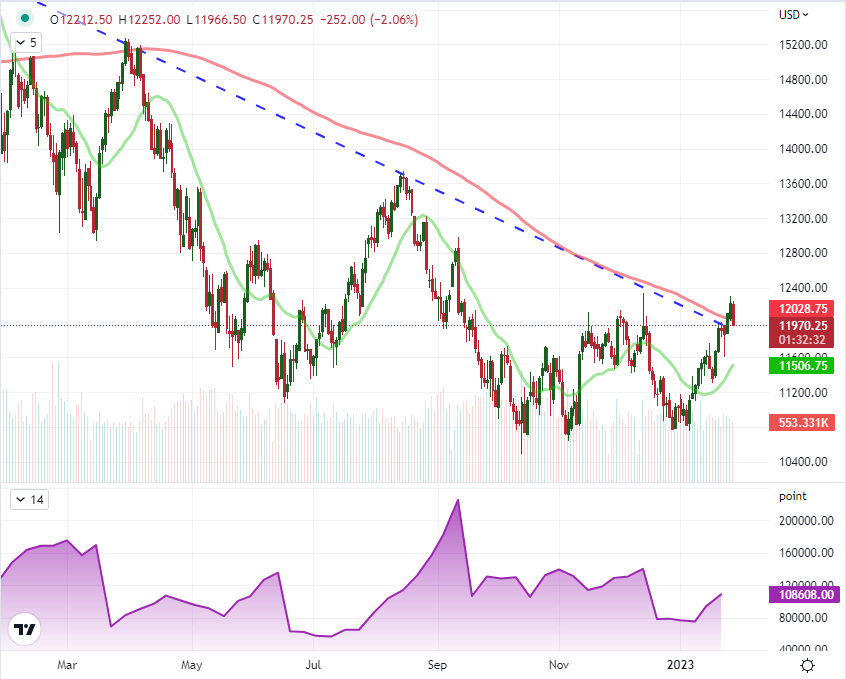

It is true that the 200-day SMA is one of the most recognizable technical measures in the entire market. It is so visible that even traditional financial papers who historically eschew the dark arts of chart analysis have included major events around those averages as well as other key events like the overtaking of ‘psychologically significant’ levels (such as big even numbers like 10,000 on the Nasdaq 100). That said, both the Dow and S&P 500 are still comfortably above their respective 200 SMAs. Further, in the hierarchy of traders’ needs, risk exposure before major event risk is far more pressing than the appetite for pre-empting a stretched trend before the major developments secure or reject the move. The upswing in 2023 – and particularly the charge this past week – puts the markets in a stretched ‘risk on’ position. What’s more, the climb in price hasn’t exactly matched the climb in participation as measured by the open interest in Nasdaq mini futures exposure below. That puts more emphasis on risk taking than clear-eyed investment intent.

Chart of the Nasdaq Composite Futures with 20 and 200-Day SMAs, Mini Futures Open Interest (Daily)

Chart Created on Tradingview Platform

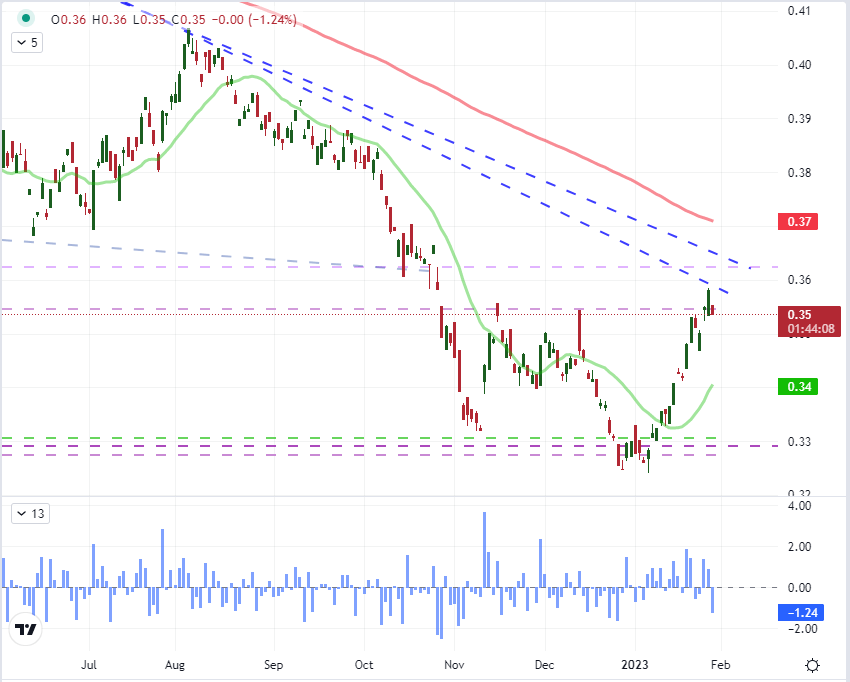

Referring back to the ‘internal’ measure of risk appetite within the US equity space, the Nasdaq 100 to Dow Jones Industrial Average ratio similarly spoke to an abrupt retrenchment in exposure. With the Nasdaq leg the ‘growth’ and the Dow representing the ‘blue chip’ or ‘value’ comparison, the relative slump for the NDX over its counterpart translated into a correction from three-month highs and the biggest drop in the comparison since December 27th. As we watching the markets respond to the major event risk this week, it will be worth it to keep an eye on this comparative measure to sort the underlying course of sentiment through the noise of volatility fostered by major event risk.

Chart of Nasdaq 100 to Dow Jones Industrial Average Ratio with 20 and 200-Day SMAs (Daily)

Chart Created on Tradingview Platform

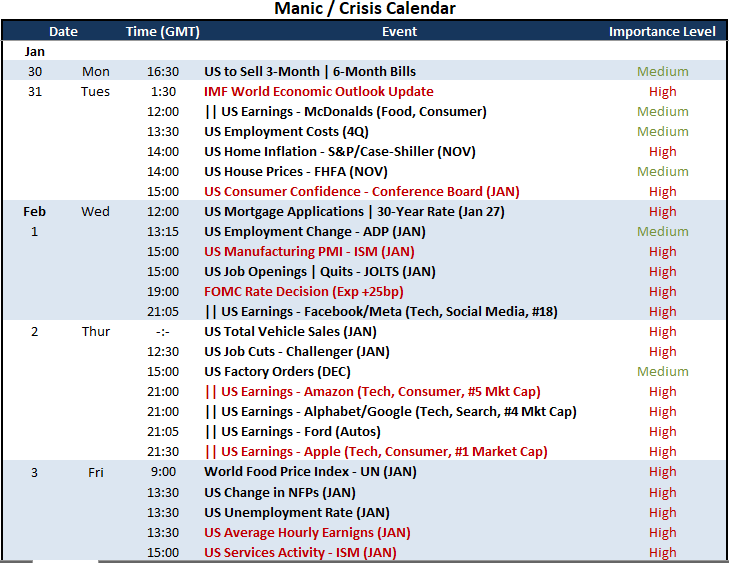

What major event risk do Nasdaq traders need to keep tabs on? The most prominent threat of sudden market movement is clearly the FOMC rate decision on Wednesday. Whether the Fed hikes 25 basis points this week or not and how much longer they intend to extend their tightening regime are critical questions for the entire financial system. That said, the central bank has not been at all reticent to share its intentions these past months; so a quick shift in focus to the subsequent trading day’s after-hours FAANG earnings (Apple, Amazon, Google), could very well create another unease curb on activity as the markets await more information. For the time being, Tuesday’s IMF WEO economic outlook update and the US consumer confidence survey from the Conference Board should be monitored as capable volatility catalysts.

Chart of Top US Based Event Risk for Next Week

Calendar Made by John Kicklighter

Discover what kind of forex trader you are

[ad_2]