[ad_1]

POUND STERLING TALKING POINTS

- Services sector helps boost UK GDP numbers above pre-COVID levels.

- UK strikes limiting pound upside.

- Rising wedge break looming.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBP/USD FUNDAMENTAL BACKDROP

The British pound was muted in its reaction to the UK GDP beat this morning however, once the European session commences, there could be a more positive response. UK GDP statistics outperformed on almost all metrics (see economic calendar below) and has managed to push above the February 2020 pre-COVID level.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

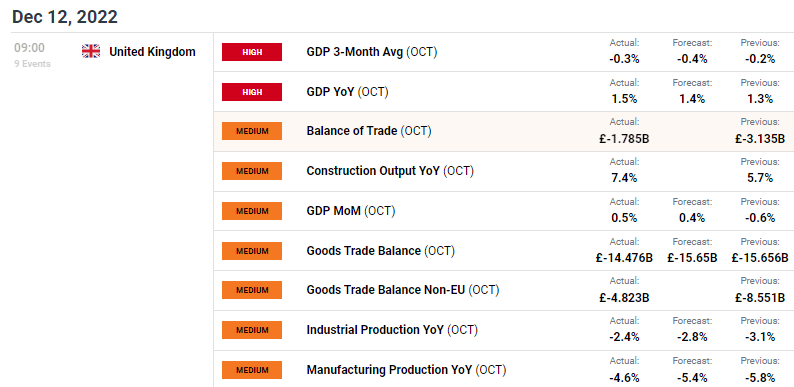

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

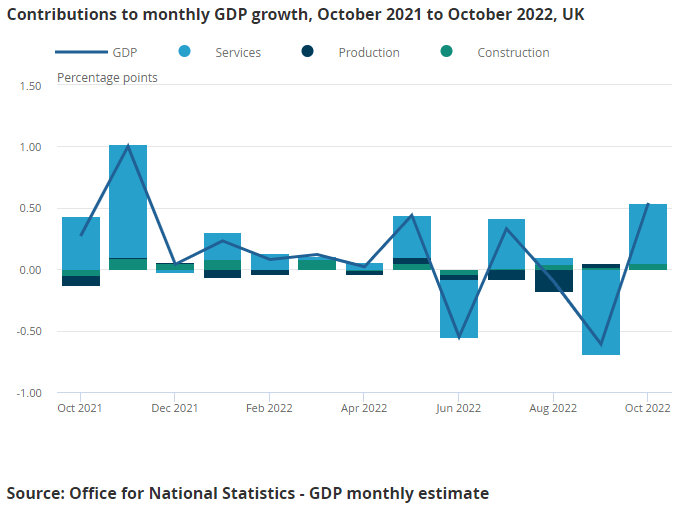

The primary contributor towards GDP for the month of October was the services sector (blue) and after a dismal month in September, the support has been most welcome. Considering the UK is principally a services economy, the release adds some positivity towards the broader UK economy.

From a production standpoint, the ONS report stated that “electricity, gas, steam and air conditioning supply was the largest negative contributor”, highlighting the declining energy crises facing the UK and Europe. Should Russia look to cut supply of gas and oil further post-G7 and their decision to implement a cap on Russian oil, this situation could compound and negatively impact future GDP number and consequently the pound.

Looking ahead, the soft GBP reaction could be attributed to concerns around strike action in both private and public sectors of the UK of which PM Rishi Sunak’s government is looking to utilize military personnel to fill the gaps.

TECHNICAL ANALYSIS

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Introduction to Technical Analysis

Candlestick Patterns

Recommended by Warren Venketas

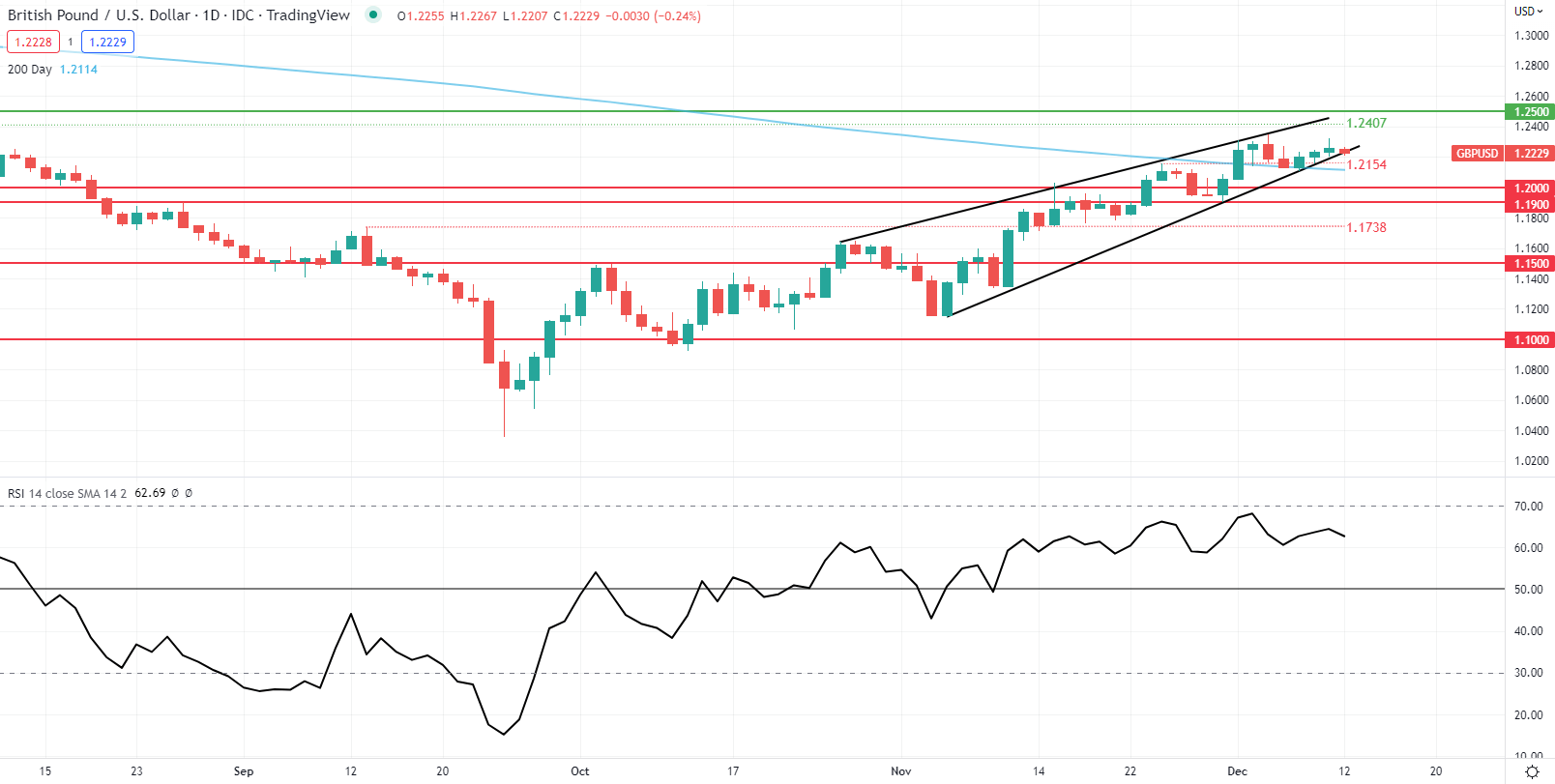

Cable looks to be testing rising wedge support (black) with a daily candle close bringing into focus the 1.2154 swing low and 200-day SMA (blue). Key economic data is critical this week and will likely be the catalyst for a downside or upside break depending on the outcomes.

Key resistance levels:

Key support levels:

- Wedge support

- 1.2154

- 200-day SMA

- 1.2000

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently SHORT on GBP/USD, with 59% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment but due to recent changes in long and short positioning, we settle on a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas

[ad_2]