[ad_1]

S&P 500, Nasdaq 100, US Dollar, Event Risk and FOMC Rate Decision Talking Points:

- The Market Perspective: S&P 500 Eminis Bearish Below 3,900; USDJPY Bullish Above 132.00

- Risk trends shuddered to start this trading week, but the turn from the S&P 500 and the edging higher from a Dollar in a very tight range is likely misleading

- Anticipation for the FOMC rate decision Wednesday is likely forcing the market to ease excess exposure, but intent for trend likely awaits clarity from this key event

Recommended by John Kicklighter

Get Your Free Top Trading Opportunities Forecast

We are in a vortex of anticipation with plenty of fundamental ‘noise’ to generate interim volatility. The appetites of retail traders who prescribe to only technicals or believe that all event risk has equal potential could lead them into dangerous exposure. Yet, there is a hierarchy of influence when it comes to the markets, and the most prominent event generally commands the greatest potential for market movement. That is particularly true in the lead up to its release as anticipation carries with it a wide range of scenarios and possible levels of impact. We are fully absorbed in the gravity of the FOMC rate decision on Wednesday, and the activity we have seen to start this week is likely a reflection of that outlook.

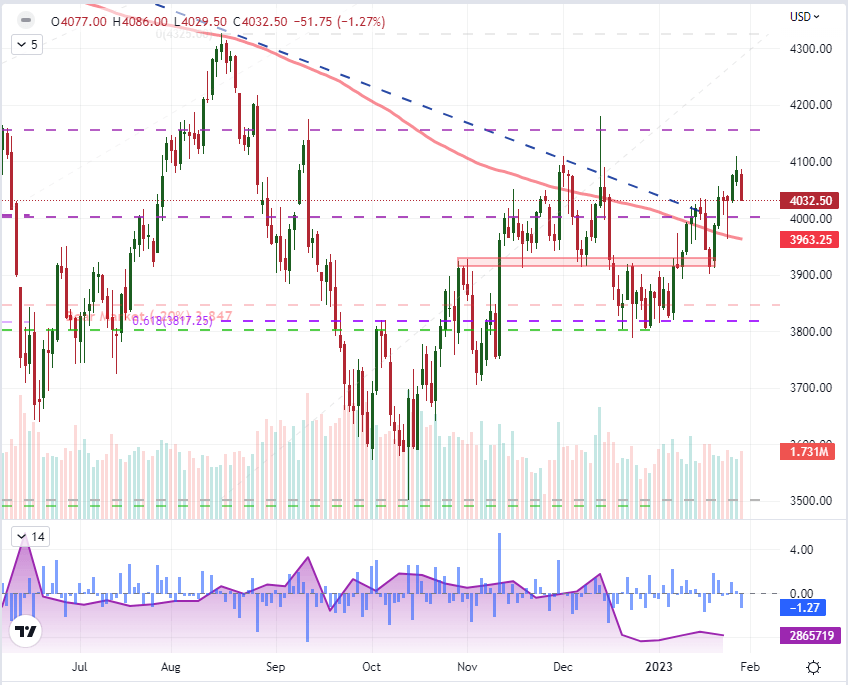

From the US indices, the charge through this past week managed to earn a significant progress on a technical basis. The Nasdaq 100 finally caught up to its larger counterparts by closing above its 200-day simple moving average (SMA) for the first time in 203 trading sessions. The index dropped back below that supposedly pivotal level Monday. For the S&P 500, the -1.3 percent was a sizable reversal that pulled the market back to the top of the previous resistance band around 4,030-4,020. What is notable to me through is that through January’s choppy (as much as 6.7 percent) advance, participation has all but flatlined. Using e-mini S&P 500 futures and options open interest as a proxy for general speculative interest, a recovery from the slump following the December FOMC decision has been conspicuously absent.

Chart of S&P 500 E-mini Futures with 200-day SMA, Volume, Open Interest and 1-Day ROC (Daily)

Chart Created on Tradingview Platform

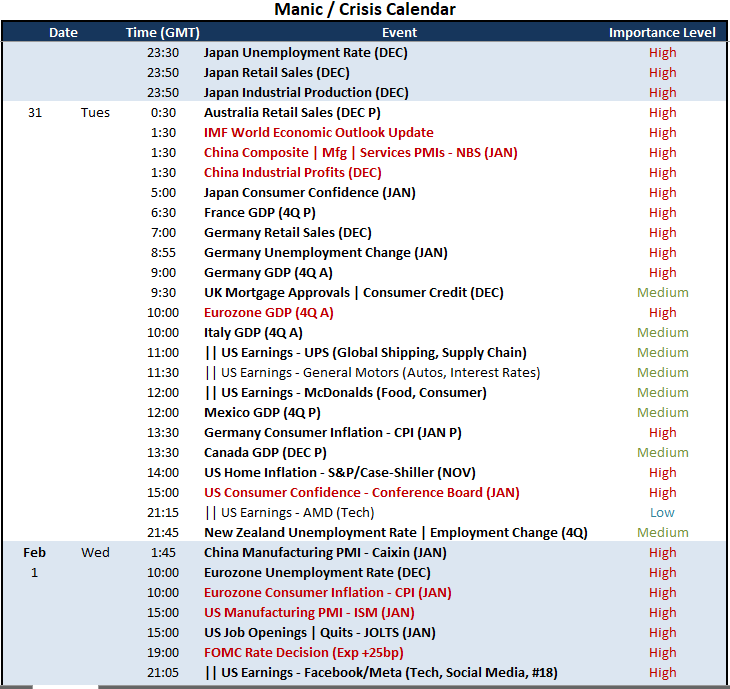

The uneven market activity that we are currently facing is a reflection of anticipation, and a brief glance at the economic docket offers up the reason for our distraction. The FOMC rate decision scheduled for 19:00 GMT Wednesday will speak to the global perspective of monetary policy. While the US central bank didn’t hike at the fastest pace amongst its peers, and may not ultimately go as far as some of its peers; it nevertheless is a leader of the current tightening regime as it was the unorthodox stimulus of the previous epoch of monetary policy. Should the authority signal it will continue to tighten to its target ‘terminal rate’ despite softening inflation, the impact will echo through the risk markets. Should they announce an unexpected pause, the impact will be just as broad but even more severe (in this case ‘risk on’). As we close await the Fed’s nod and close out the month of January, there remains significant event risk on tap.

Top Global Macro Economic Event Risk for Next Week

Calendar Created by John Kicklighter

Much of the focus through this coming session is notably on growth-oriented metrics. The first listing is a global one in the update to the IMF’s World Economic Outlook (WEO). In the past month, IMF Director Georgieva has signaled that the forecast has improved for the global economy; which seems to align to the market’s discount of late. Should that enthusiasm not show through, it is likely to weigh the markets mood – though this historically is not an update that can be relied upon to generate serious volatility. It nevertheless shapes interpretation of subsequent data and events on this same theme. The other Asia session growth update will come from China with the NBS PMIs and industrial profits expected for release. In Europe, there will be a run of advanced 4Q GDP readings from key Euro-area economies; but the Eurozone measure will project the greatest weight. In the North American session, Mexico and Canada will issue GDP readings of their own, but the US docket’s consumer confidence survey from the Conference Board will feed into the amalgam of the US fundamental picture that we will shape this week.

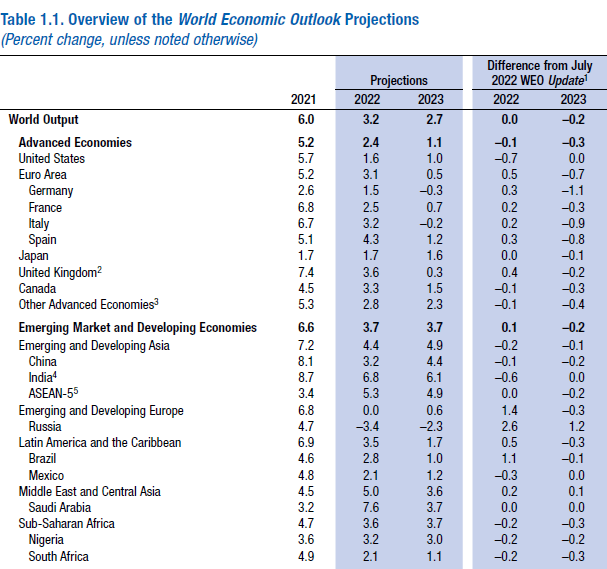

Global Growth Forecasts According to the IMF

Table from the IMF’s October 2022 World Economic Outlook

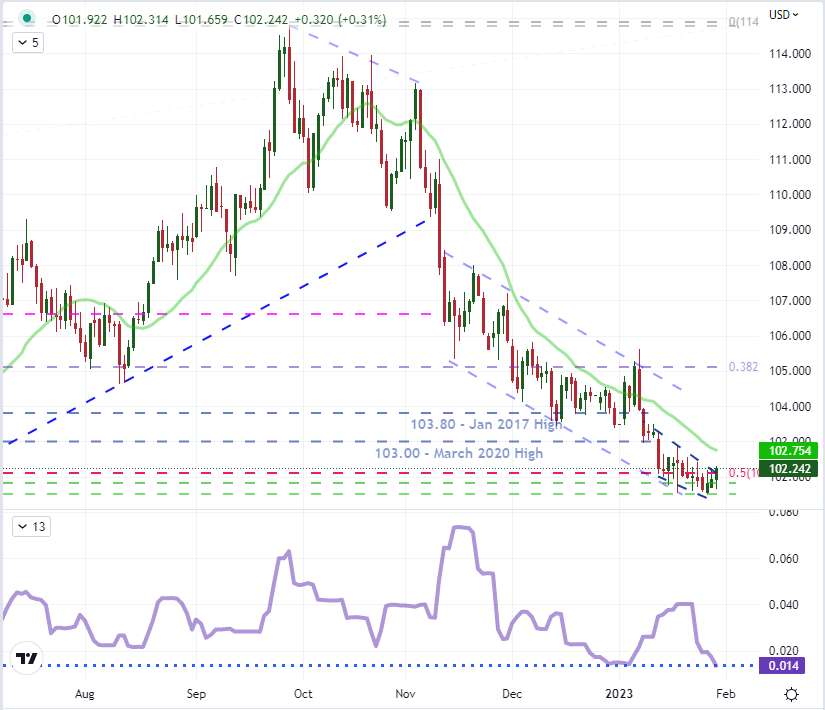

Considering the anticipation from the broader markets this week as we trade one event for another in sequential days, it is important to distinguish that the US will face a particularly overwhelming run of distractions this week. Before the FOMC decision, we have the ISM manufacturing survey and previously mentioned consumer confidence report; while after the announcement we will run through FAANG earnings, NFPs and the ISM’s service sector activity report. If you are monitoring the DXY Dollar Index for a serious break, there is likely to be a technical break from the vary tight trend channel the currency has carved these past two weeks. However, with a tentative drift higher this past session, the move won’t even broaden the extremely narrow 1.37 percent range over the past 11 trading sessions. While this is looking to the index itself, expect the same kind of struggle for the lies of EURUSD, GBPUSD and USDJPY. Further, the complications for EURUSD and GBPUSD are even greater given the ECB and BOE rate decisions on Thursday.

Chart of DXY Dollar Index with 200-Day SMA, 11-Day Historical Range (Daily)

Chart Created on Tradingview Platform

Discover what kind of forex trader you are

[ad_2]