[ad_1]

Nasdaq 100, S&P 500, Talking Points:

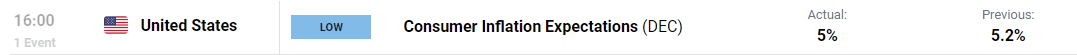

- US CPI expectations fall to 5% (from 5.9%) ahead of US CPI – has inflation peaked?

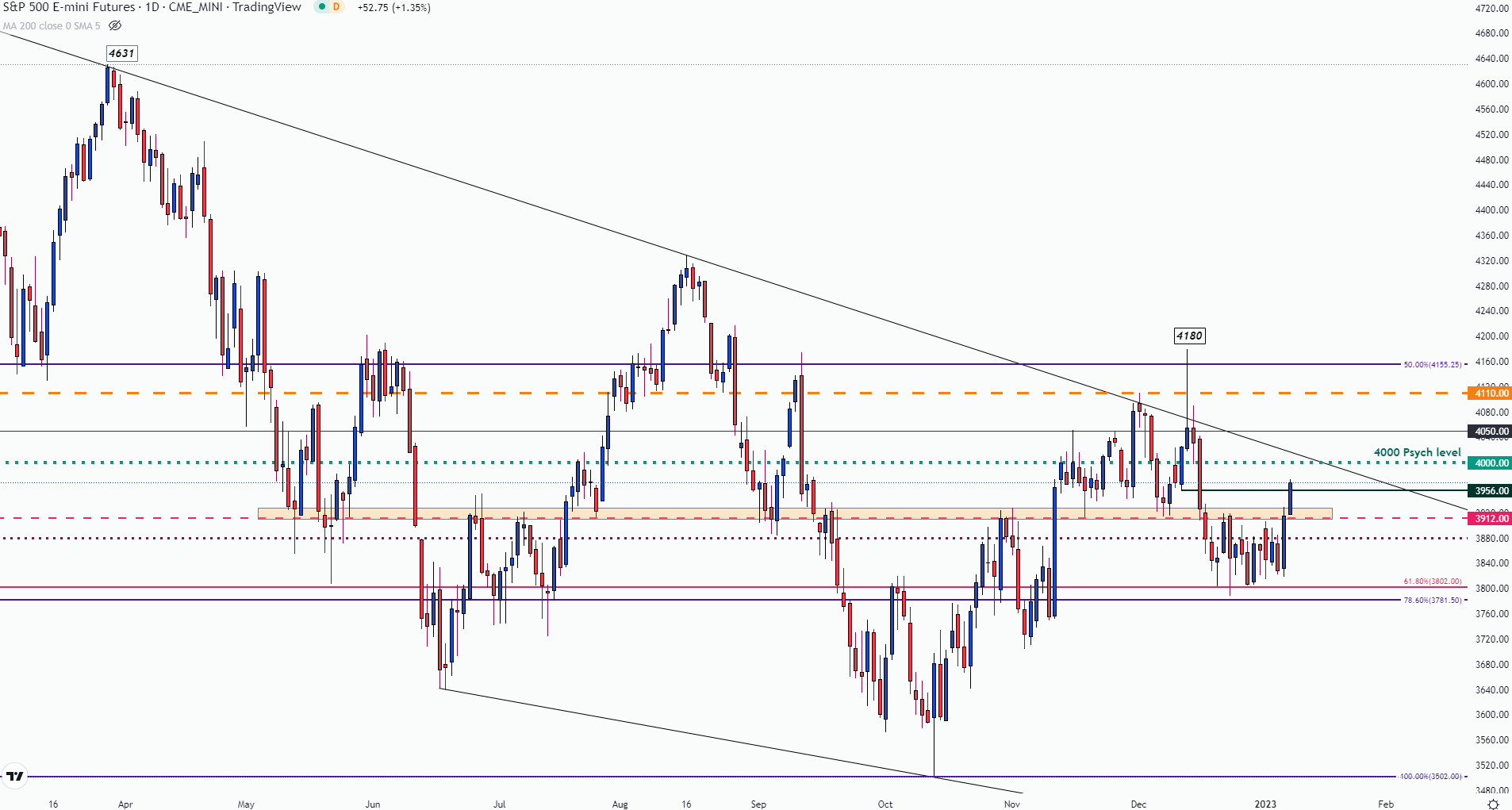

- S&P 500 futures rise above critical resistance while 4000 psychological level looms

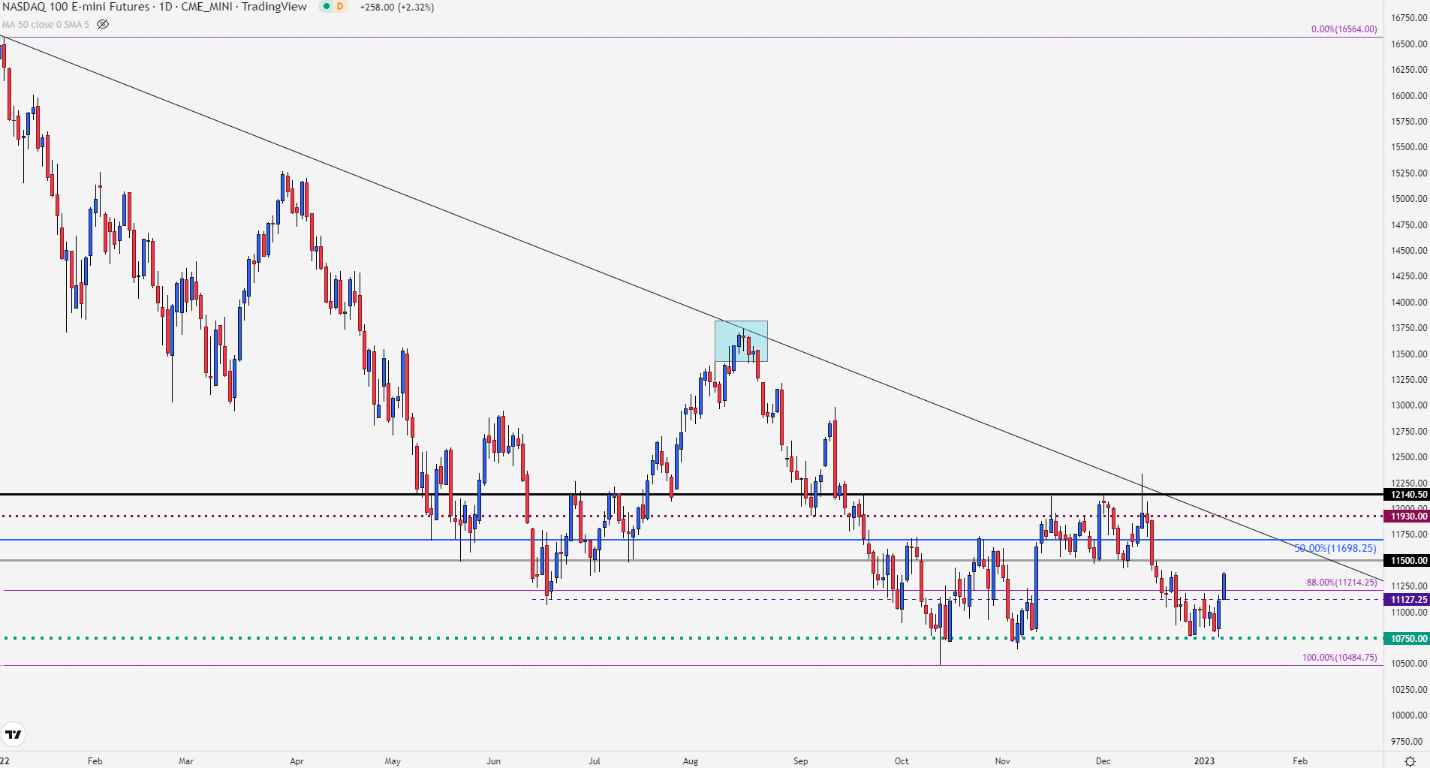

- Nasdaq 100 futures boosted by tech stocks – can prices return to 11,500?

Visit the DailyFX education section to learn more about how central banks impact forex markets

Equity futures extend gains while US consumer inflation expectations fall

Inflation, interest rates and expectations of a global recession are three topics that remain prevalent for 2023. As inflation remains well-above the Fed’s target rate of 2%, Friday’s NFP (non-farm payroll report) was met with mixed reactions.

With the unemployment rate falling to multi-decade lows at 3.5%, softer wage growth and weak ISM data indicated a slowdown in the economy suggesting that price pressures may continue to ease.

Although the growth outlook remains under pressure, renewed hopes of a Fed pivot and lower yields assisted in driving USD lower, fueling an equity rally.

S&P 500 Technical Analysis

After trading within the confines of a symmetrical wedge formation highlighted by James Stanley last week, a move above 3900 drove S&P 500 higher before peaking at 3928. As bulls continued to drive price action higher, SPX futures extended gains driving prices back above 3950.

S&P (DXY) 500 Daily Chart

Chart prepared by Tammy Da Costa using TradingView

With the next level of resistance holding at the key psychological level of 4000, a break of the descending trendline at 4110 could bring the 4150 mark back into play.

Nasdaq 100 Technical Analysis

For the tech heavy Nasdaq 100, the shift in sentiment and a move above the 88% Fibonacci of the 2022 move at 11,214 could see prices moving back towards the 50-day MA (moving average) providing resistance at 11,422.

With the next psychological barrier forming at 11,500, the economic docket could continue to drive sentiment for throughout the week.

Nasdaq 100 (NDX) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

While US consumer inflation expectations for the month of December have fallen to 5% (from 5.2% last month), Fed Chair Jerome Powell is expected to speak at 14:00 GMT tomorrow with US CPI due on Thursday.

If the Fed expresses a more dovish tone, it is possible for equities to continue higher.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]