[ad_1]

US Stocks: S&P 500, Nasdaq News and Analysis

Recommended by Richard Snow

Get Your Free Equities Forecast

SVB Solution and News of New Regional Bank Regulations to Lifts Equities

Markets appear content with the way US regulators handled the sale of distressed lender Silicon Valley Bank (SVB) to First Community Bank, stemming concerns around other potential stresses in the ‘midsized’ corner of the banking sector. In addition, reports this morning suggest that the White House is readying plans to push top banking regulators to impose stricter rules on regional banks with assets of between $100 billion and $250 billion, in the wake of the recent failures.

The legislation largely looks to reinstate prior regulations that were reversed by former President Donald Trump. The details are still being fleshed out, however, increased regulation is likely to take the form of improved stress testing and greater liquidity coverage ratios.

US Equities Expected to Open Higher: Technical Considerations

The leader of the pack, as far US indices are concerned, has certainly been the tech heavy Nasdaq. With heavyweights, Microsoft, Alphabet and Meta rising between 0.8% and 1.5% in the premarket, the index is expected to open in positive territory at 09:30 ET.

As markets factor in interest rate cuts in the US from the second half of the year, tech stocks and naturally, the Nasdaq index, have seen a marked improvement. In fact, the Nasdaq printed a new yearly high while the more diversified S&P 500 and Dow Jones indices are yet to achieve such a measure of bullish intent.

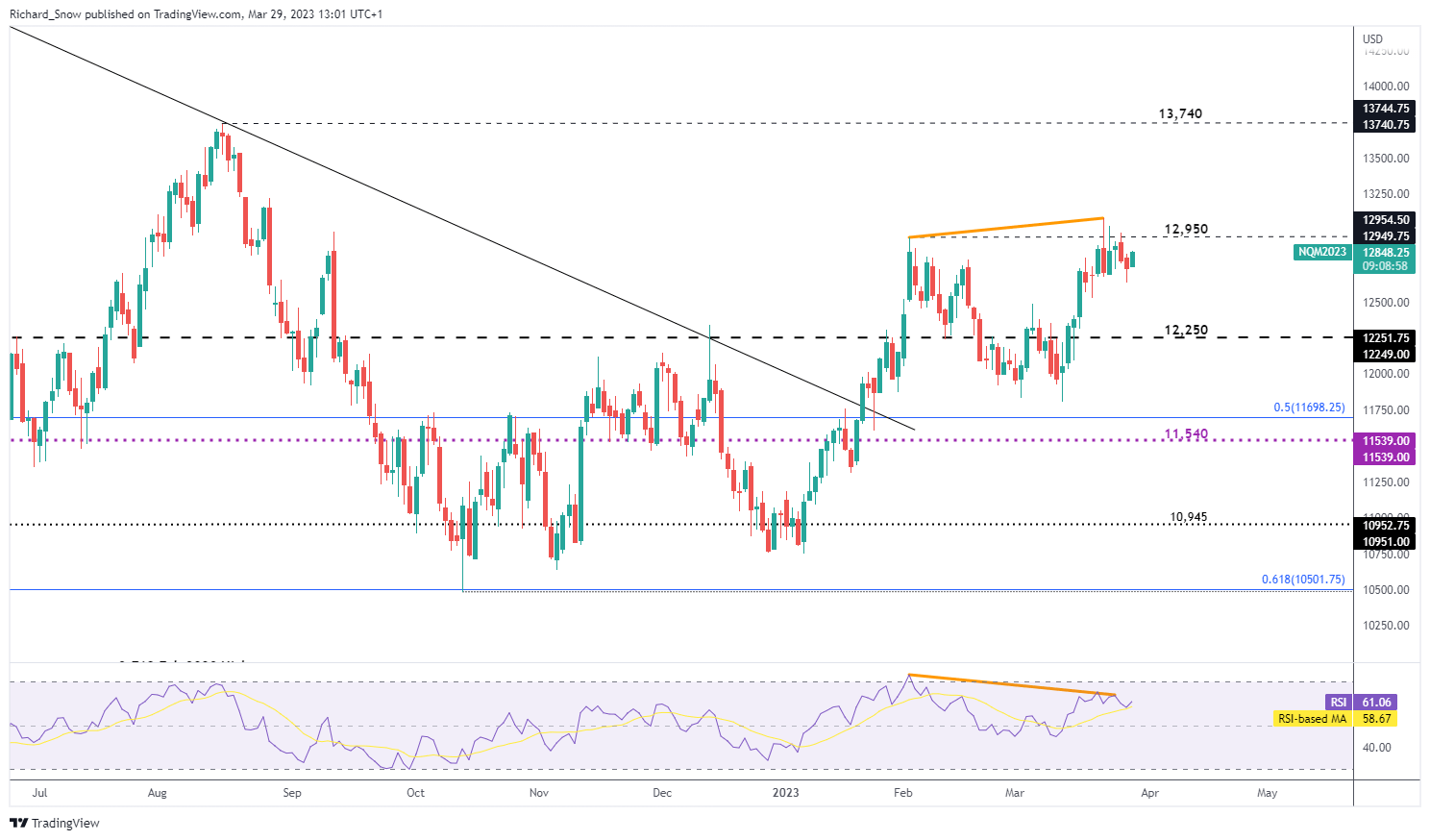

The Nasdaq – via the E-Mini Futures contract – shapes up for another test of the prior high around 12,950 and possibly even the yearly high of 13,082. However, such a move will be largely dependent on whether further news of regional bank instability makes its way onto screens this week.

On the other hand, Nasdaq bears will certainly be monitoring the negative divergence playing out as the index marked a higher high while the RSI failed to do so. Such an observation potentially stands in the way of a sustained move higher, aided by the relatively long upper wicks – providing a rejection of higher valuations.

Nasdaq 100 E-Mini Futures Daily Chart

Source: TradingView, prepared by Richard Snow

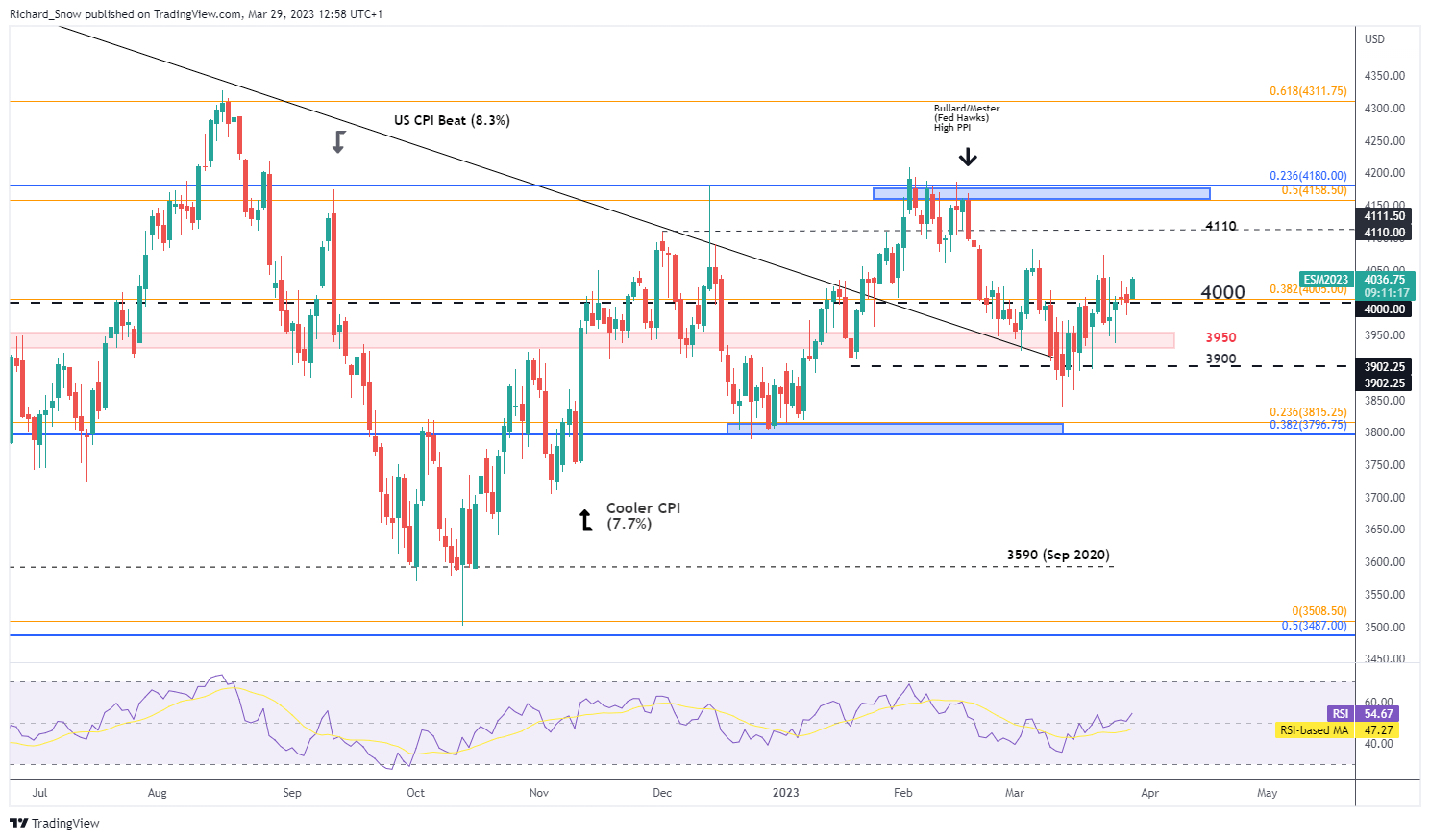

The S&P 500, via the E-Mini Futures daily chart reveals a notable move higher ahead of the open. The index has largely been oscillating around the psychologically important 4000 mark as sentiment evolves in a back and forth manner. The recent direction of travel suggests improving sentiment, while it must be noted that the possibility for increased volatility remains a threat as prior price action has shown.

Upside markers appear via the 4110 level of resistance, followed by the 4,160-4,180 zone. To the downside, 3900 emerges as a crucial level when assessing the potential for sustained selling, although, a better indication may be the zone of support around 3800.

S&P 500 (E-Mini Futures) Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]