[ad_1]

S&P 500, Nasdaq 100, Russell 2000, Dow Jones 30, Fed,

- The S&P 500 has eased as the market appears to be listening to the Fed

- A chorus of Fed speakers all sung from the same song sheet overnight

- The tightening cycle appears to have been elongated. Will the S&P 500 go lower?

Recommended by Daniel McCarthy

How to Trade FX with Your Stock Trading Strategy

MONETARY POLICY IS A DOUBLE-EDGED SWORD FOR INVESTORS

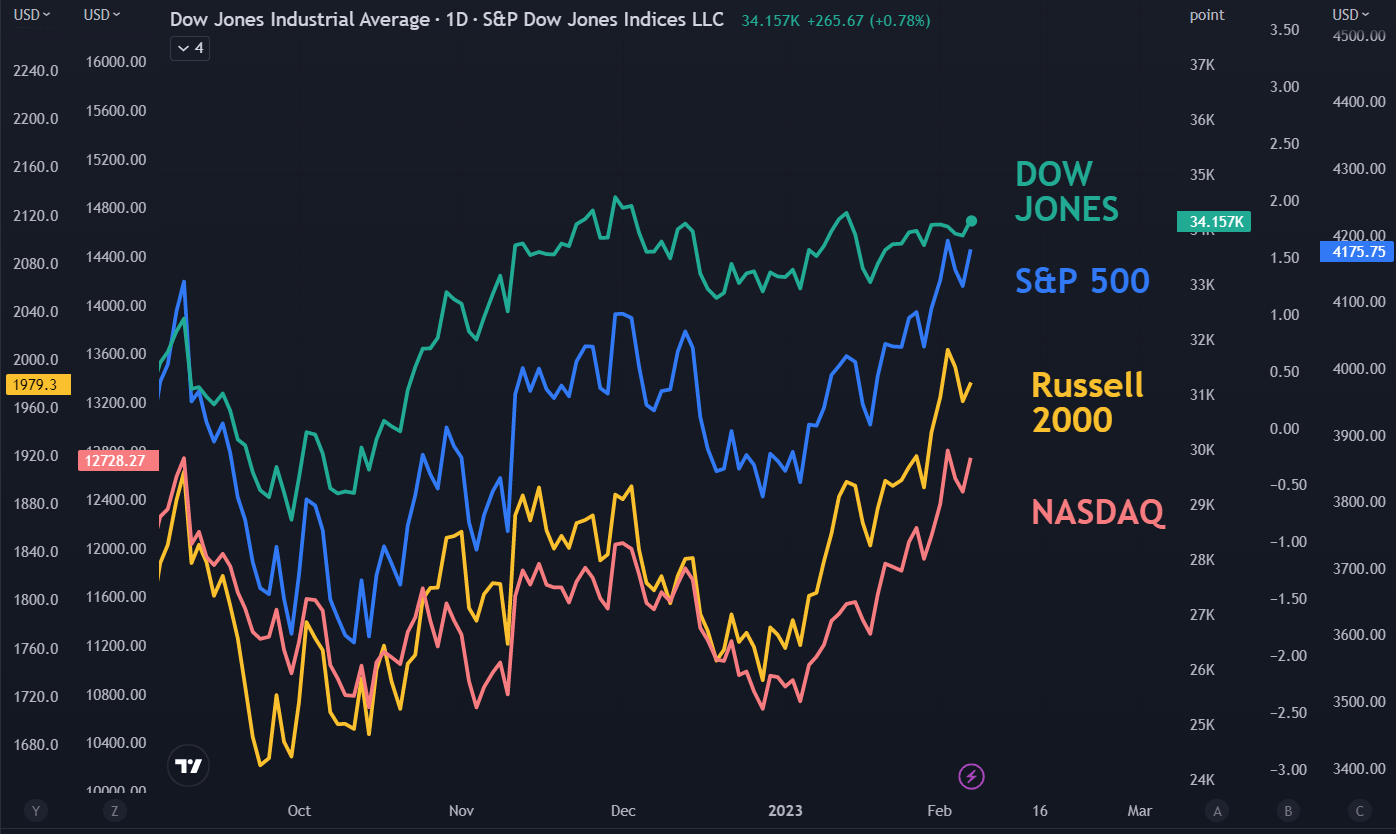

The S&P 500 took a dive overnight as more speakers from the Federal Reserve maintain the hawkish mantra. The Dow Jones, Nasdaq, Russell 2000 and S&P 500 saw declines in their cash session of -0.61% -1.11%, -1.52%, -1.68% respectively.

The magnitude of losses in each index appears to reflect the risk posed by tighter financial conditions. In an environment where the cost of capital increases, companies that rely on raising equity or issuing debt may find balance sheet management more difficult going forward

The Fed has made it clear that financial conditions need to be tightened in order to get inflation down. Overnight saw four Fed speakers take to the podium.

The broad message maintained by the central bank is that rates are going to continue to be raised and that they will need to stay there for a long period in order to stare down a 40-year high in price pressures.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

In reference to inflation, Fed Reserve Governor Christopher Waller said, “I’m not seeing signals of a quick decline in the economic data, and I am prepared for a longer fight,”

Waller was joined by comments from New York Fed President John Williams, Fed Governor Lisa Cook and Minneapolis Fed President Neel Kashkar in making hawkish remarks.

They come a day after head honcho Jerome Powell was interpreted by markets as not being hawkish enough. It seems the tune has changed for investors. The

The intonation seems to be that 25 basis point clips are appropriate, and that peak will be somewhere above 5%. Interest rate futures and swaps are now pricing in the Fed funds rate to peak above 5.10% this year, rather than below 4.90% at this time last week. Options markets have seen some trades go through with a strike at 6%.

While poor results from Alphabet dragged down the Nasdaq and the broader market, Disney reported better-than-expected earnings and a cost-reducing restructure after the bell. It has slightly buoyed Wall Street futures after the close.

S&P 500, DOW JONES, RUSSELL 2000, NASDAQ

Chart created with TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

{{RESEARCH|DNAFX}}

[ad_2]