[ad_1]

Gold Price Forecast:

Recommended by Tammy Da Costa

How to Trade Gold

Silicon Valley Bank (SVB) collapse sends Gold higher

The collapse of SVB (Silicon Valley Bank) has sent jitters through global markets, supporting safe-haven gold. After the financial institution came under scrutiny last week, fears over client’s access to deposits exacerbated concerns.

Most Read:US Dollar Slides as SVB Repercussions Stalled by the Fed and the Treasury Department

While the collapse marks the largest bank failure since 2008, higher interest rates have placed pressure on the financial system. Although the Fed, treasury and banking regulators assured investors that all clients would be granted access to their funds, risks of further contagion has boosted demand for safe-haven assets.

With the Federal Reserve reiterating their intentions to continue to hike rates more aggressively to tame rampant inflation, the bank failure could force the central bank to reconsider its hawkish stance.

The sudden shutdown and Sunday’s announcement sent yields lower, lifting gold prices.

Recommended by Tammy Da Costa

Trading Forex News: The Strategy

Gold Price Analysis

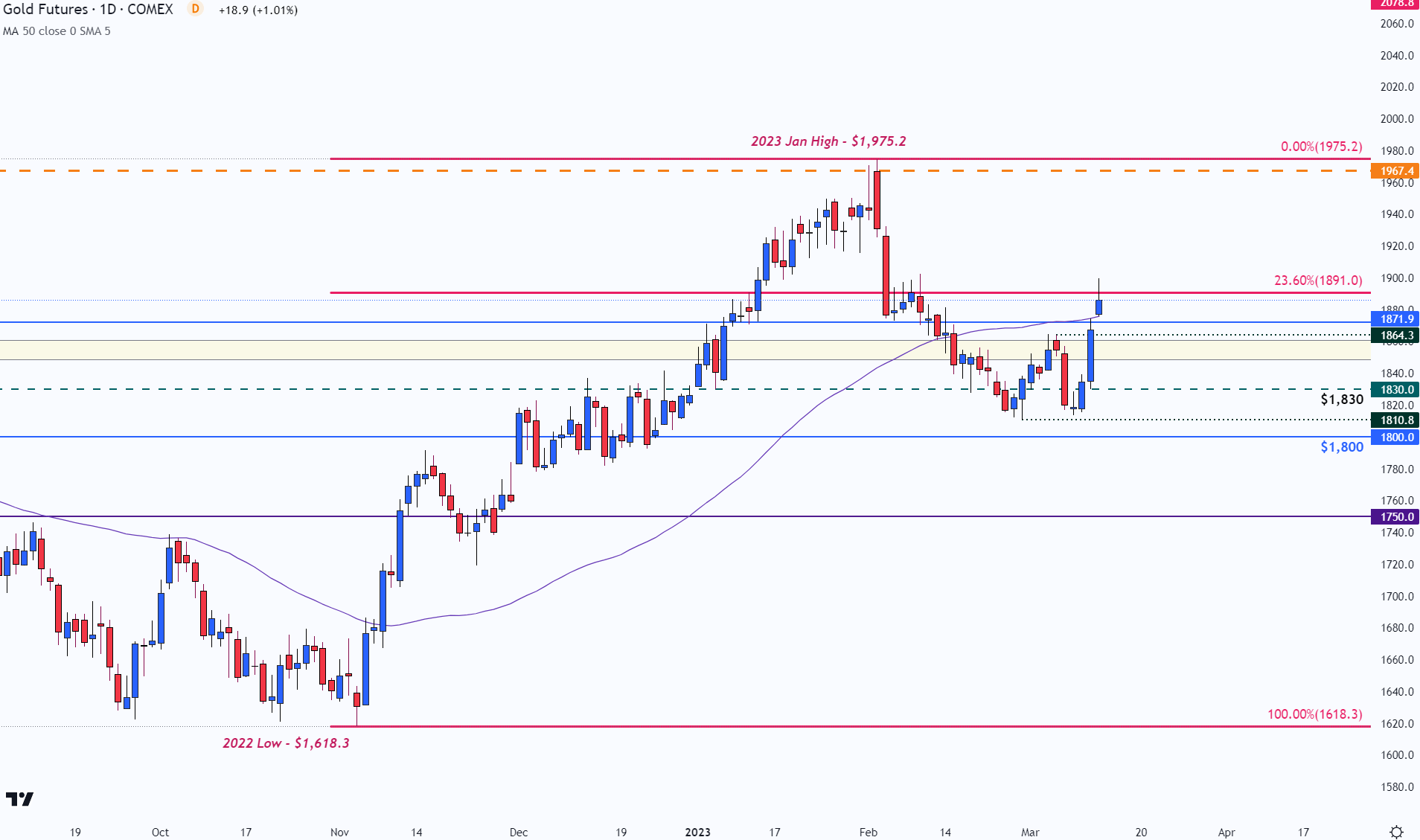

As XAU/USD rose above the 50-day MA (moving average), gold futures surged before running into a barrier of Fibonacci resistance at $1,891. With a hold above the 23.6% retracement of the 2022 – 2023 move bringing the $1,900 psychological level back into play. Above that, the $1,910 handle looms which could drive price action to $1,930.

Gold (XAU/USD) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

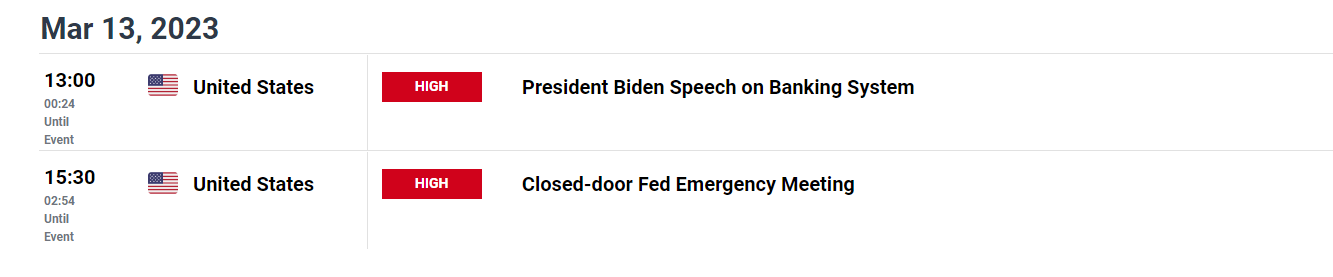

As US President Biden prepares to provide a speech on the banking system, the Fed will be hosting a closed-door Fed emergency meeting to decide how it will deal with the crisis.

DailyFX Economic Calendar

If concerns continue to rise and there’s more news about other bank failures, gold prices could continue to rise, benefiting from its safe-haven appeal.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707

[ad_2]