Swedish Krona, EURSEK, Riksbank, NOK, Crude Oil, US Dollar, AUD/USD, RBA – Talking Points

- The Swedish Krona has been supported by potential hikes from Riksbank

- The US Dollar had a quiet session, but a busy US data week lies ahead

- If EUK/SEK breaks lower, will the downtrend gain momentum?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The Swedish Krona eased slightly today after having a blistering rally yesterday with EUR/SEK hitting a 2-month low.

The Riksbank monetary policy meeting minutes revealed a very hawkish tone and core CPI data was higher than anticipated for January, coming in at 0.4% m/m rather than -0.2% anticipated.

The central bank raised rates by 50 basis points at the last meeting and many economists are now taking aim at the next meeting on April 26th to be another 50 bp lift. The overnight index swap (OIS) is somewhat undecided, with around 35 bp priced in.

The move in SEK dragged the Norwegian Krone higher although to a lesser extent, with crude oil slipping before steadying in Asian trade. The WTI futures contract is near US$ 76.50 bbl while the Brent contract is a touch above US$ 83 bbl.

The US Dollar is firmer through the day so far in fairly lacklustre trade in the aftermath of the US holiday. Gold has had a small range and is sitting near US$ 1,840 an ounce.

RBA meeting minutes revealed that the board considered a 50 bp hike. Futures markets are pricing in around an 80% chance of a further 25 bp lift at the march and April meetings. AUSD/USD is slightly lower on the day, near 69 cents against the US Dollar.

APAC equities were mostly flat with Hong Kong’s Hang Seng Index (HSI) the notable exception, sliding over 15 at one stage. Futures are pointing toward a soft start for Wall Street later,

Looking ahead, European and US PMIs will be the focus alongside Canadian CPI.

Later in the week, FOMC meeting minutes will be released on Wednesday and the Fed’s preferred inflation gauge of Core PCE will be out on Thursday as well as some 4Q US GDP figures.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade EUR/USD

EURSEK TECHNICAL ANALYSIS

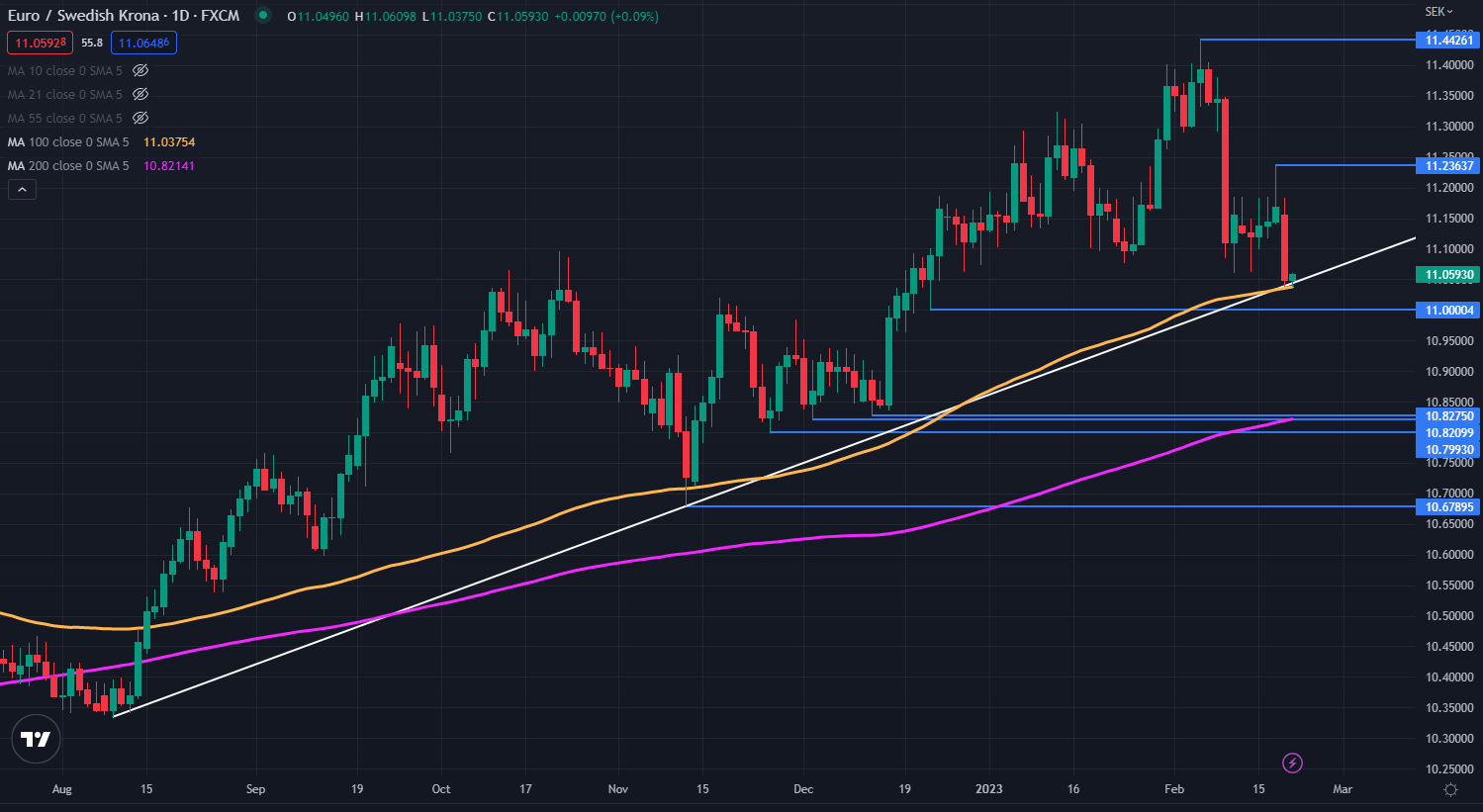

EUR/SEK is currently sitting on an ascending trend line and the 100-day simple moving average (SMA).

While they appear to be lending support at the moment, a clean break below them could see bearish momentum unfold.

Support might be at the prior lows of 11.0000, 108275, 10.8210 and 10.6790. On the topside, the 13-year high of 11.4426 might offer resistance.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter