GBP/USD – Prices, Charts, and Analysis

- UK data are supportive of the British Pound.

- FOMC minutes are released later in the session.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: British Pound (GBP) Latest – GBP/USD Slumps, a Victim of US Dollar Strength

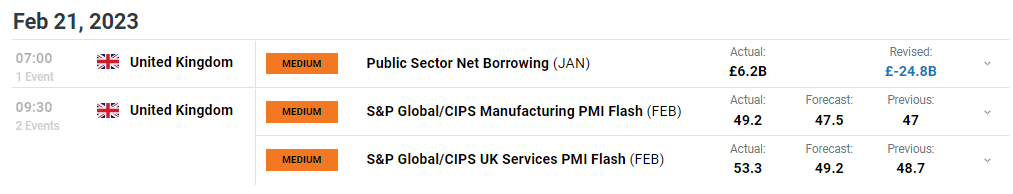

The British Pound is trading on either side of 1.2100 against the US dollar, buoyed by better-than-expected data this week. While the US dollar is also strong, supported by rising US Treasury yields, Sterling is making gains against its counterpart across the Atlantic and a wide range of other G7 currencies. The latest UK PMIs beat forecasts and showed business activity in the UK, especially in the services sector, picking up sharply in February, while the latest look at the government books showed public sector net borrowing (PSNB) boosted by better-than-expected tax receipts and in surplus in January.

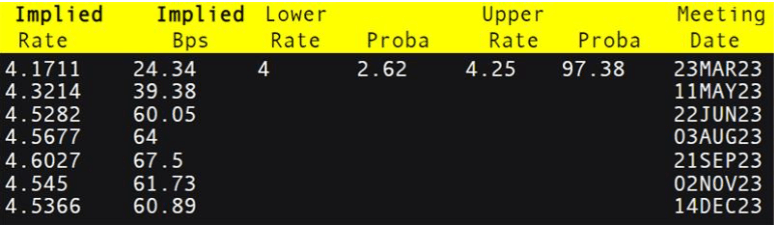

The latest data suggest that the UK economy may be improving, giving the Bank of England more wiggle room to increase interest rates. UK inflation is on the way down, but at a current level of 10.1% is sharply higher than the Bank of England’s (BoE) mandate of around 2%. Inflation is expected to fall quickly over the coming months, according to the BoE, as energy prices and the cost of imported goods fall, while the UK consumer has less disposable income to spend on goods and services. The UK central bank is seen hiking rates by 25 basis points at the March meeting to 4.25%, and by another 25 basis points in Q2. If growth continues and inflation falls in line with the BoE’s expectations, there may be a case for a UK rate cut in Q4.

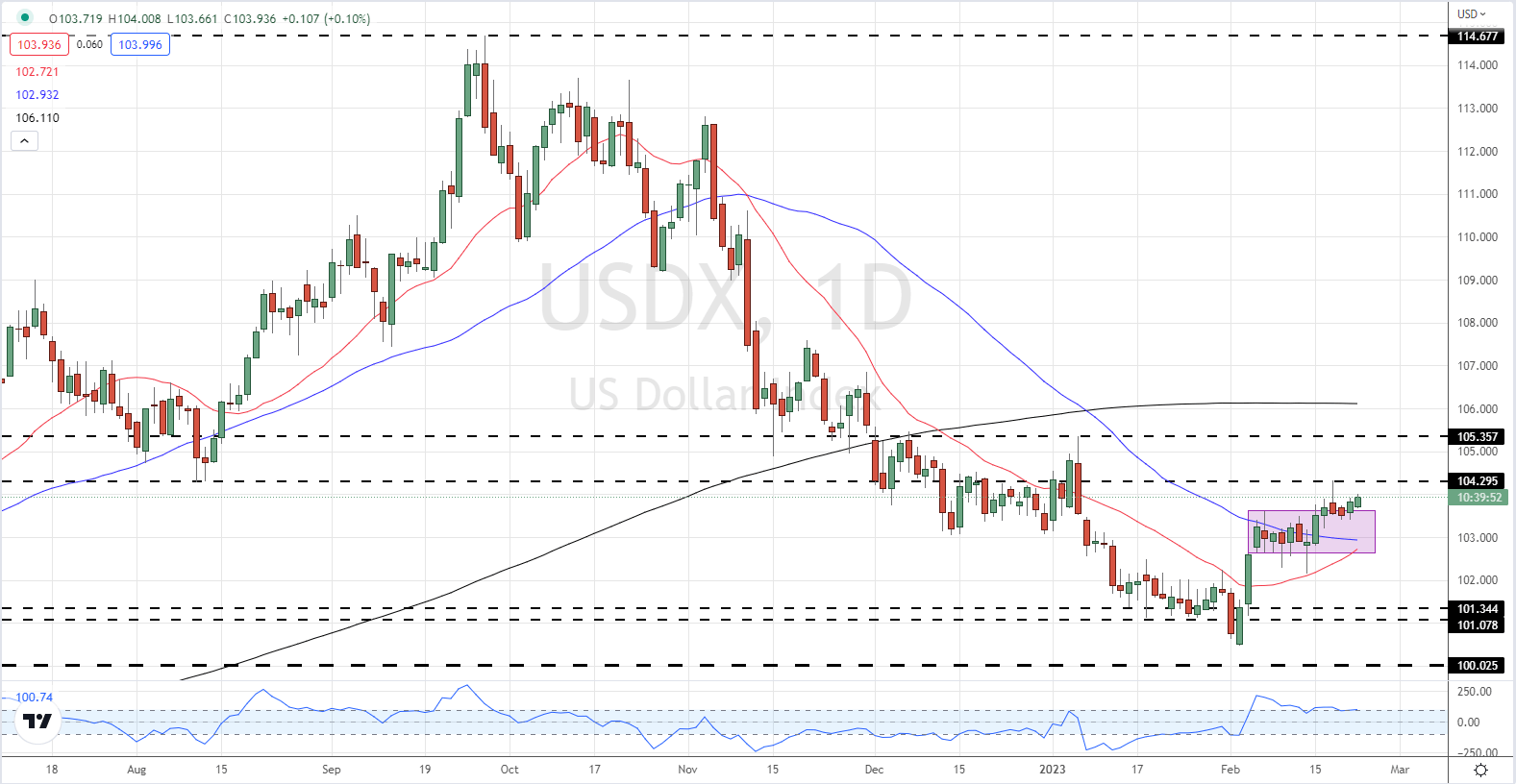

The US dollar has been the main driver of cable over the past few months as the greenback pushes higher due to a series of aggressive rate hikes in the US. The US dollar index is less than 40 pips away from making a fresh multi-week high as US yields continue their recent rally on a hawkish US central bank backdrop.

US Dollar Index (DXY) Daily Chart – February 22, 2023

Recommended by Nick Cawley

How to Trade GBP/USD

Today’s FOMC minutes, released at 19:00 GMT, will show the extent of the Fed’s hawkish outlook. Recent Fed commentary has been heavily skewed towards higher rates for longer with some participants suggesting that a 50 basis point hike was discussed at the last meeting.

For all market-moving data releases and events, see the DailyFX Economic Calendar

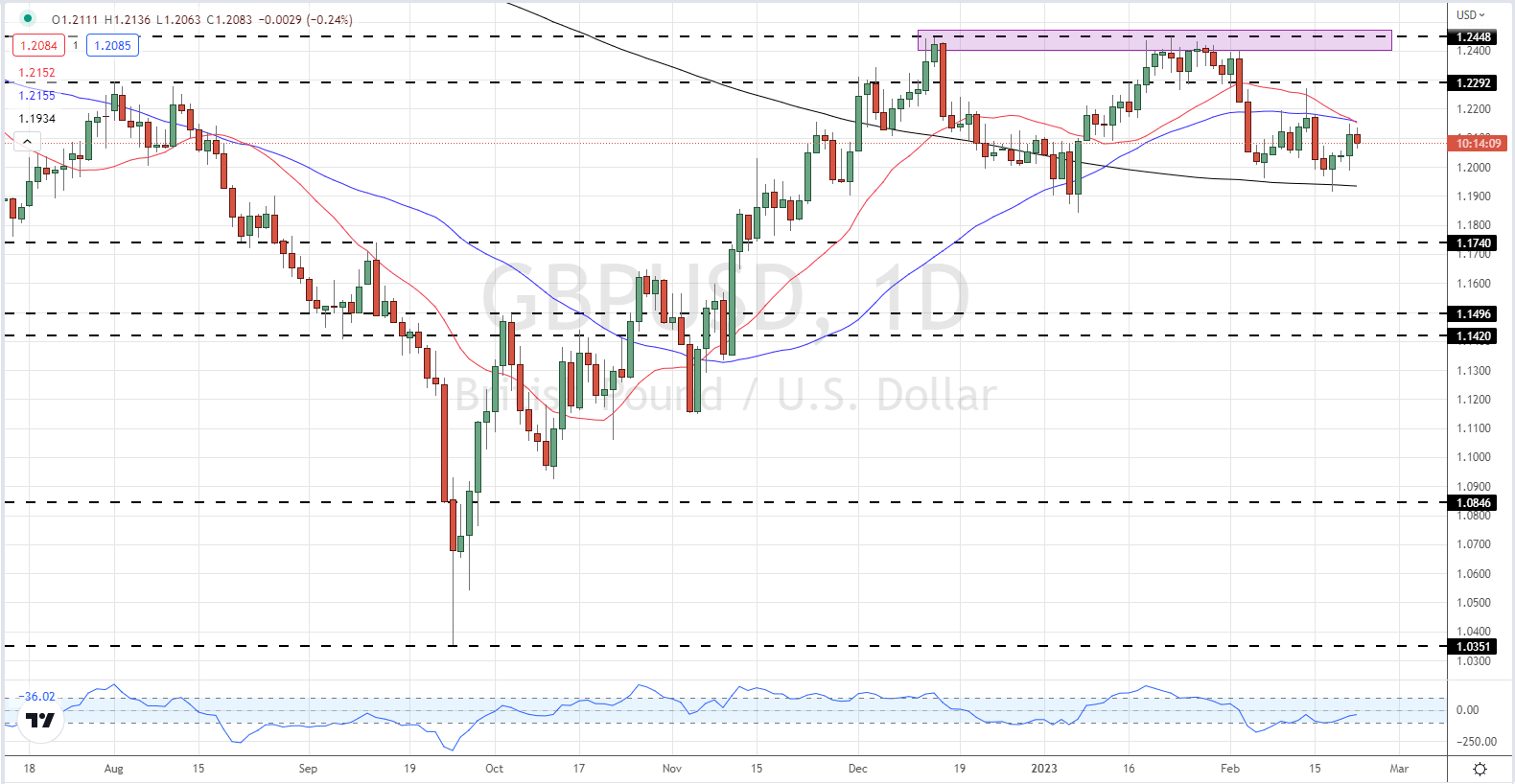

The daily GBP/USD chart shows the pair trapped between the 20-, 50-, and 200-day moving averages and in neither overbought nor oversold territory. The recent double-top around 1.2450 is unlikely to be tested in the near future with 1.2270s and 1.2290s providing resistance. The 200-dma at 1.1934 should act as a brake in the case of any sell-off.

GBP/USD Daily Price Chart – February 22, 2023

All Charts via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -2% | 1% | -1% |

| Weekly | -3% | 8% | 2% |

Retail Traders Trim Longs

Retail trader data show 49.78% of traders are net-long with the ratio of traders short to long at 1.01 to 1.The number of traders net-long is 14.74% lower than yesterday and 2.03% higher from last week, while the number of traders net-short is 7.69% higher than yesterday and 8.16% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.