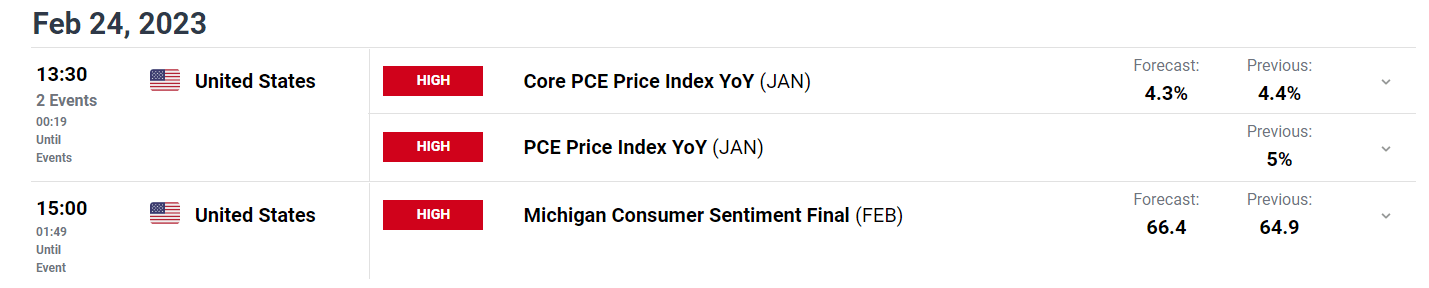

US PCE Inflation

- Core PCE (YoY) 4.7% vs 4.3% expected

- Headline PCE (YoY) 5.4% vs 5% expected

- Immediate market reaction: DXY, S&P 500, Yields (updates pouring in, refresh the article in a few minutes)

Recommended by Richard Snow

Introduction to Forex News Trading

Inflation Reveals its Ugly Head

While it must be said that the market pays more attention to the CPI version of inflation, the Fed looks to the broader PCE measure as an indication of price trends. Inflation has been declining steadily but a number of different inflation measures (CPI and PPI notable) have shown a bit of a resurgence in price pressures, printing higher than expected, but still maintaining the disinflationary trend.

Customize and filter live economic data via our DailyFX economic calendar

Today’s PCE print serves to confirm the Fed’s message that the fight against inflation is not over and that the terminal rate for interest rates appears headed for 5.5%.

Warmer weather in January and the biggest rise in social security payments helped reinvigorate consumer spending in January after a dismal December print. It appears that the increased discretionary income has contributed to a rise in the general price if goods and services in the US economy. Something the Fed remains motivated to rectify.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX